Markets | NGI All News Access | NGI The Weekly Gas Market Report

U.S. NatGas Power Burn Sets 2017 High, But Down Overall Year/Year, EIA Says

Natural gas power burn recently reached its highest level so far in 2017, surpassing 41 Bcf/d on July 20, but gas has fallen year/year in terms of its overall share of the power stack, according to Energy Information Administration (EIA).

Power burn normally peaks in late July or early August due to high cooling demand, EIA said Thursday, with the record daily high occurring last August when it surpassed 42 Bcf.

Citing data from PointLogic Energy, EIA said power burn has been lower in 2017 compared to 2016, though still above the five-year average. From April 1 to July 25, power burn averaged 27.1 Bcf/d, down 7% year/year, the agency said.

Higher natural gas prices have contributed to the year/year declines, removing some of the competitive advantage over coal, according to EIA.

“The Henry Hub natural gas spot price averaged $2.27/MMBtu from April 1, 2016, through July 25, 2016, compared with $3.03/MMBtu during the same period in 2017,” EIA said. “Average natural gas prices at power plants were $1.02/MMBtu higher in the first half of 2017 compared with the first half of 2016, while coal prices were about the same in the first half of both years.”

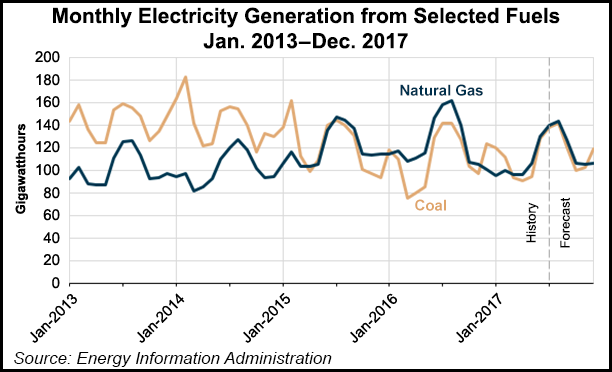

Natural gas surpassed coal for total share of U.S. electric generation on an annual basis for the first time ever last year, with gas at 34% to coal’s 30%. EIA said its most recent monthly data on the electric market shows coal accounted for 30% of U.S. electric generation for the first four months of 2017, compared to 28% from gas.

EIA in its latest Short-Term Energy Outlook forecasts natural gas and coal to each fuel about 31% of U.S. electric generation for full-year 2017. The full-year 2017 power burn is expected to average 25.9 Bcf/d, down 2.5 Bcf/d (9%) from 2016.

“Overall electric generation is expected to be slightly lower than the 2016 level, and natural gas’s share declines because of larger shares from renewable sources (particularly hydropower) and coal-fired generation,” EIA said.

Thus far this summer, natural gas cooling demand has disappointed overall, and the Henry Hub New York Mercantile Exchange prompt month contract has tumbled aftertesting $3.20 earlier in the year.

The August contractgot a jolt Thursday from a bullish 17 Bcf storage injection in EIA’s weekly inventory report.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |