E&P | NGI All News Access | Permian Basin

QEP Reaches Deal to Exit Pinedale as Focus Turns to Permian, Williston

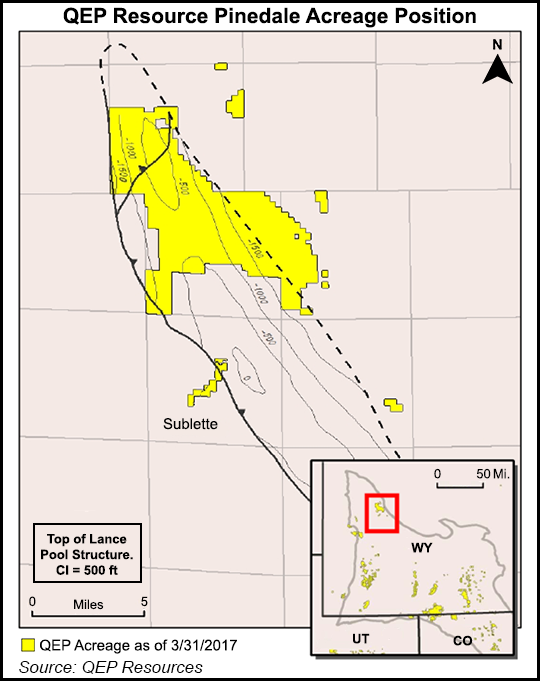

A QEP Resources Inc. subsidiary said Monday it would sell natural gas assets in Wyoming — including all of its assets in the Pinedale Anticline — through two transactions totaling $777.5 million.

In the largest of the two transactions, QEP Energy Co. said it would sell its Pinedale assets in Sublette County, WY, to Pinedale Energy Partners LLC, an affiliate of privately held Oak Ridge Natural Resources LLC, for $740 million. The assets carry an estimated 964 Bcfe of proved reserves as of year-end 2016 and produced 234 MMcfe/d (12% weighted to liquids) in the first quarter.

“Our Wyoming assets have been significant contributors to the company for many years and were critical to our early success,” QEP CEO Chuck Stanley said. “As we continue to evolve as a company, these transactions are a necessary next step in simplifying our asset portfolio and delivering significant financial proceeds that will further strengthen our balance sheet and help fund future development projects and acquisition opportunities.”

The Pinedale divestiture comes as no surprise to those that have followed QEP management’s public comments the past six months. In an April conference call, management for the Denver-based exploration and production company outlined plans to sell its Pinedale assets in order to focus capital in the Permian and Williston basins.

“We view Pinedale as a great asset; it has been the foundation of the company for a number of years and a platform for growth for us, but at this juncture, we’re running out of inventory to continue to grow production,” Stanley told analysts in April. “That is one of the primary drivers” behind the divestiture, “along with market interest” in proved developed producing assets.

Pinedale Energy parent Oak Ridge describes itself as an operator focused on acquiring and efficiently exploiting “out-of-favor” assets in the North American onshore, applying “new technologies, coupled with old-fashioned hard work, to expand the upside potential of the properties beyond their original valuation.”

The Pinedale divestment is expected to close by the end of September, subject to customary conditions.

BMO Capital Markets acted as financial adviser to QEP for the transaction, with Vinson & Elkins LLP providing legal counsel. Wells Fargo Securities LLC served as financial adviser to Pinedale Energy, with Baker Botts LLP serving as legal counsel.

Separately, QEP said it has agreed to sell non-core natural gas assets in southern Wyoming to an undisclosed buyer for $37.5 million. The assets include 15.2 Bcfe in proved reserves as of Dec. 31 and 1Q2017 net production of 4 MMcfe/d, 2% weighted to liquids.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |