Infrastructure | E&P | NGI All News Access

Four Land Rigs Pack Up in U.S. as Industry Awaits 2Q2017 Results

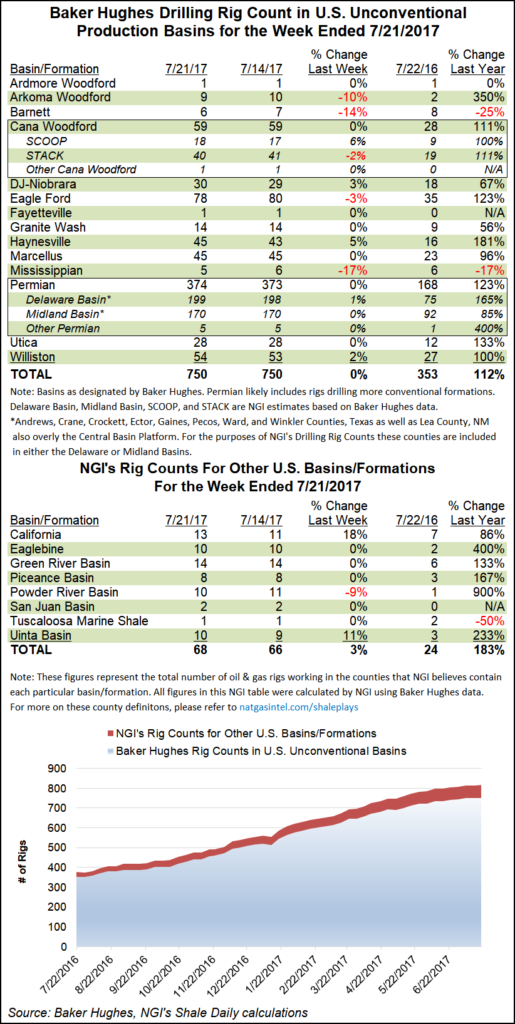

Four land rigs packed up while two offshore rigs returned in the United States during the week ended July 21, according to data released Friday by Baker Hughes Inc. (BHI).

The oilfield services (OFS) giant’s weekly rig data suggests a holding pattern for U.S. drilling activity coming off the growth observed earlier this year. The latest figures come as the industry prepares to digest 2Q2017 results, and questions remain amid stagnant commodity prices and rising inventories of drilled but uncompleted wells (DUCs).

The United States saw one oil-directed rig and one natural gas-directed rig leave the patch for the week, finishing down two at 950 rigs, more than double the year-ago tally, according to BHI. Canada, meanwhile, added 15 rigs during the week — 12 oil-directed, three in search of gas — to end at 206 (up from 102 a year ago).

The total North American rig count finished the week at 1,156, a gain of 13 and well above the 564 rigs running a year ago.

The biggest gainers among states were Louisiana (up four rigs to 71) and California (up two to 13).

Oklahoma and Texas each saw three rigs leave during the week, while New Mexico saw two pack up, BHI said.

Among plays, the Permian Basin in West Texas and eastern New Mexico added a rig to end at 374 (up from 206 a year-ago), while the Haynesville Shale in Louisiana and parts of East Texas added two rigs to end at 45 (up from 29 a year ago).

The Eagle Ford (minus two) and Barnett (minus one) shales in Texas each dropped rigs, while the Appalachian Basin remained flat, with the Marcellus (45 rigs) and Utica (28 rigs) shales unchanged week/week.

In North Dakota’s Williston Basin, where production remains steady, according to state officials, one rig returned to work during the week.

Economists are seeing positive signs from the activity in the Permian. The Federal Reserve Bank of Dallas, in its 2Q2017 Dallas Fed Energy Survey, observed a decline in the Permian’s unemployment rate during the second quarter, from 4.4% to 4.1%. The district’s company outlook index, though lower than the first quarter, remains positive, according to the Fed.

With oil prices falling from the plus-$50/bbl levels seen earlier in the year, the market will be looking to see how OFS and exploration and production (E&P) companies will respond, and the upcoming slate of 2Q2017 earnings calls is expected to offer some clues.

Sanford C. Bernstein Ltd. recently downgraded its oil price outlook. Analysts Colin Davies and Laura Tao expect lower oil prices to stall U.S. rig count growth and defer any offshore recovery.

“After a positive tone on activity last quarter, we will be looking for any adjustment to plans or change of tone for the second half,” the duo said.

Schlumberger Ltd. on Friday reported an 18% increase in North American revenues during the quarter, including 42% sequential growth in U.S. land revenue. The growth in U.S. land revenue was “almost double that of the 23% growth in the U.S. land rig count, driven primarily by hydraulic fracturing revenue that grew 68% as completion activity intensified and pricing continued to improve,” according to CEO Paal Kibsgaard.

Kicking off 2Q2017 earnings season late Wednesday, Kinder Morgan Inc. reported quarterly growth in natural gas transport volumes bolstered by continued demand pull from exports to Mexico and liquefied natural gas terminals along the Gulf Coast.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |