Markets | NGI All News Access | NGI Data

NatGas Cash Eases, Bears Unfazed by EIA Storage Data; August Drops 2 Cents

Natural gas for delivery Friday retreated from gains made earlier in the week as firm pricing in the Midwest, Midcontinent, Texas, and Louisiana was crushed by a weak next-day power market in the Northeast and Marcellus-focused issues in Appalachia. The NGI National Spot Gas Average came in 3 cents lower at $2.92.

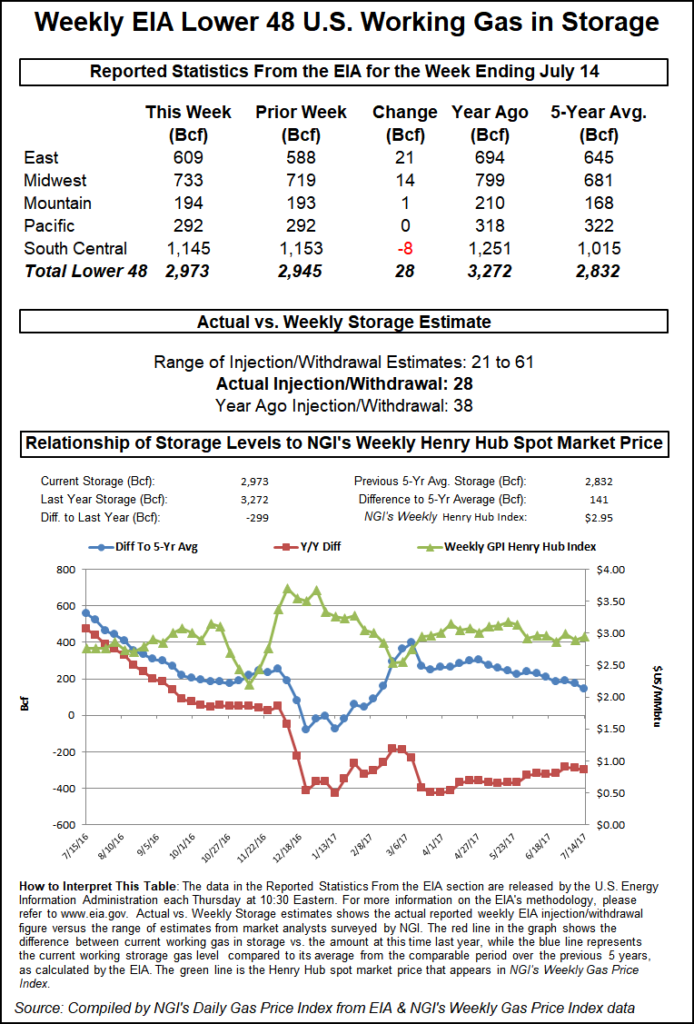

The Energy Information Administration (EIA) reported a storage build of 28 Bcf for the week ending July 14, about 4 Bcf short of expectations, but traders were circumspect about any near-term market impact. At the close August had fallen 2.3 cents to $3.043, and September had retreated 2.2 cents to $3.033. The expired August crude oil settled at $46.79/bbl, down 33 cents.

Natural gas bulls felt a glimmer of hope once the storage numbers clanged through the market. August futures gained ground following the report. When the lower-than-expected injection figure hit trading desks August futures rose to $3.114, but by 10:45 a.m. August was trading at $3.091, up 2.5 cents from Wednesday’s settlement.

Before the report traders were looking for a storage build higher than the actual figures. Last year 38 Bcf was injected and the five-year average stands at 59 Bcf. Ritterbusch and Associates expected a 47 Bcf build. A Reuters survey of 23 traders and analysts showed an average 32 Bcf with a range of +21 Bcf to +47 Bcf.

“The market really isn’t making a stab to get into the high ‘teens and just seems to be hovering in a range,” said a New York floor trader. “I don’t think the number had much of an impact at all.”

Tim Evans of Citi Futures Perspective called the report a “clear bullish surprise. The data also suggests some tightening of the background supply/demand balance implying ongoing support for prices.”

The Wells Fargo Securities LLC analytical team called the report bullish and said it reflects a market undersupplied by at least 2 Bcf/d.

“Based on current weather forecasts as well as elevated power burn levels thus far in July (35.2 Bcf/d month-to-date (mtd) versus 34.9 Bcf/d mtd in July 2016), our model projects a 46 Bcf cumulative storage build over the next two weeks,” said Wells Fargo analysts. “This would be substantially below the five-year average of 86 Bcf and would reduce the storage surplus to just 106 Bcf by the end of July.”

Inventories now stand at 2,973 Bcf and are 299 Bcf less than last year and 141 Bcf greater than the five-year average. In the East Region 21 Bcf was injected, and the Midwest Region saw inventories rise by 14 Bcf. Stocks in the Mountain Region were up by 1 Bcf and the Pacific Region was unchanged. The South Central Region fell by 8 Bcf.

Weather forecasts did not change much overnight as near-term temperatures are expected cool in New England and warm over the West. “No significant changes are made to the forecast in this period, which continues to feature a round of below normal temperatures accompanying high pressure into the East early and lingering along the New England coast into mid-period,” said MDA Weather Services in its morning six- to 10-day forecast for clients.

“While much of the Midwest is also on the cool side of normal at the onset, a round of slight aboves are forecast in the mid-period out ahead of a frontal boundary. Above normal temperatures look to be most steadily focused in the Interior West and California, with even the Southwest seeing those warmer anomalies late as ridging further builds near the region.”

In physical market trading weak next-day power prices in the Northeast made incremental purchases for power generation less attractive. Intercontinental Exchange reported that on-peak Friday power at the ISO New England’s Massachusetts Hub fell $9.37 to $48.53/MWh and peak power at the PJM West terminal skidded $7.84 to $45.21/MWh.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

Gas at the Algonquin Citygate shed 62 cents to $3.30 and deliveries to Tennessee Zone 6 200 L dropped 52 cents to $3.28. Gas on Tetco M-3 Delivery shed 14 cents to $2.23, and gas bound for New York City on Transco Zone 6 was quoted 9 cents lower at $3.14.

Marcellus basis was hammered once again as the industry continues to try to wrap its head around the regulatory issues andpotential delays to Energy Transfer Partners LP’s Rover Pipeline. Henry Hub quotes were unchanged at $3.10, but gas on Dominion South tumbled 12 cents to $2.12 and deliveries to Tennessee Zone 4 Marcellus shed 8 cents to $2.10.

Other market points were mostly higher. Gas at the Chicago Citygate rose a penny to $3.02 and deliveries to the NGPL Midcontinent Pool changed hands 3 cents higher. Gas on El Paso Permian added 6 cents to $2.75.

Kern River was quoted at $2.76, higher by 6 cents and Transwestern San Juan rose 7 cents to $2.78. El Paso S Mainline came in at $2.94, up 6 cents, and gas priced at the PG&E Citygate was unchanged at $3.37.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |