E&P | Markets | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Questions Precede OFS, E&P Quarterly Earnings on Stagnant Prices, Rising DUC Inventories

Natural gas and oil operators have begun dishing their second quarter results, and energy experts cite cautious optimism that the industry’s recovery will not be waylaid by stagnant commodity prices and lack of demand.

Kinder Morgan Inc. officially kicked off the season on Wednesday. On Friday oilfield services (OFS) bellwethers Schlumberger Ltd. and General Electric’s Baker Hughes Inc. are scheduled to issue their results, along with North American exploration and production (E&P) giant Encana Corp.

Baker Hughes and Schlumberger, the world’s largest OFS, should provide early indicators of the oil and gas industry’s overall health, which relies on the temperature of the E&P sector.

Sanford C. Bernstein Ltd. recently downgraded its oil price outlook. Analysts Colin Davies and Laura Tao expect lower oil prices to stall U.S. rig count growth and defer any offshore recovery.

“After a positive tone on activity last quarter, we will be looking for any adjustment to plans or change of tone for the second half,” the duo said.

Some “structural issues” may change E&P positioning in the second half of 2017 (2H2017) and into 2018, said the Bernstein analysts. Regarding the U.S. land rig count growth trajectory, they will be looking for evidence of slowing growth and what would happen if rigs begin falling in the coming months.

“Are the leading indicators of rig inquiries and tenders telling us something?” asked the Bernstein duo. “The impact on pumping will be lagged — so tone may still be positive — but are participants reactivating into a potential period of slower growth?”

Evercore ISI’s James West examined the E&P implications for the OFS sector. Even though prices have recovered slightly, OFS stocks “continue to reflect doomsday scenarios as the majority of investors remain resolute in their expectation that the rig count will roll over in 2018 and that the current cycle is set to peak over the next three quarters.”

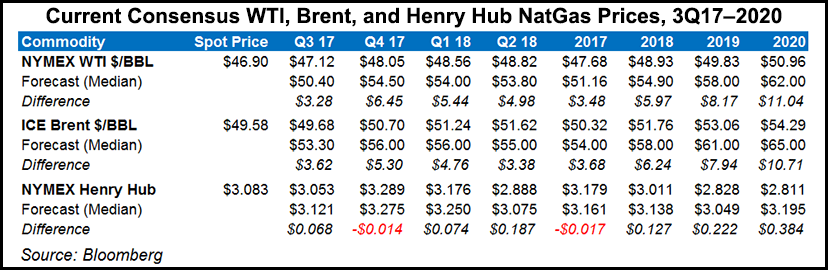

Evercore remains bullish on oil prices, with a forecast of $60/bbl by 4Q2017. “Nevertheless, we believe consensus expectations point to at least a 20% decline in the rig count at $45/bbl West Texas Intermediate (WTI) in 2018,” West said. Utilization of high-tech alternating current rigs should remain “relatively steady at that price point,” but pricing traction may falter.

“Cynics would be quick to point out that similar rig declines in 2015 and 2016 failed to stimulate commensurate production declines, but legacy production declines have accelerated, and more importantly production per rig has peaked and has begun to decline,” he said.

“Production per rig has now declined for 12 consecutive months in the Permian, eight consecutive months in the Eagle Ford, and three consecutive months in the Bakken. Looking back at our historic models, this was the biggest source of error with respect to predicting production.”

Tudor, Pickering, Holt & Co. (TPH) analysts plan to listen to the “DUC tales,” to comprehend the impact of a growing onshore backlog of drilled but uncompleted wells.

“Over the last few months we have had a number of questions regarding the growing number of backlog wells that have been built up as Permian operators have accelerated the rig count,” said the TPH team. “While the magnitude of the gain has indeed been impressive, the direction of the move is in-line with corporate business plans in-basin.”

Following a review of the “completions cadence” for their covered E&Ps, TPH analysts determined that “while rigs are likely to start leveling out, companies are stepping on the accelerator with respect to completions, with production to follow.”

Jefferies LLC’s Zach Parham expects much of the focus in E&P conference calls to be on the ability to maintain budgets/growth targets.

“We expect that most E&Ps will maintain previously announced 2017 capital budgets and production growth guidance, citing hedges that are already in place, relative proximity to year-end 2017, and break-evens below current front-month West Texas Intermediate (WTI) oil prices,” Parham said.

“However, expectations for 2018 activity levels will be a key question for E&Ps this quarter, and producers have a much lower level of production hedged in 2018 versus 2017.”

Jefferies E&P coverage indicates that 12% of total oil production is hedged for 2018 versus 35% hedged for the remainder of 2017.

“While we expect little in the way of formal guidance for 2018-plus, E&Ps may comment on flexibility, while maintaining a focus on spending within cash flow and continuing to capture efficiencies at the well level,” Parham said.

Well productivity also has improved using enhanced completions — shorter stage spacing, higher proppant loads, etc.

“We believe operators are likely nearing the end of productivity gains from larger completions and the emphasis will soon shift to optimizing versus enhancing, as the focus is less on increasing the size of the fracture and more on finding the best ”recipe’ of inputs for each section of rock,” said Parham. “Through the reporting season, we expect additional well results and updates on previously released well performance of enhanced completions.”

Look for updates on the pressure pumping market as well, he said, as some operators reported tightness during 1Q2017 calls because crews were not available.

Jefferies “still sees the market as continuing to tighten and expects pricing to rise through the back half of the year. Larger E&Ps with more stable development programs will likely be more insulated from price increases than smaller E&Ps with more volatile, shorter-term plans.”

NGI’s Patrick Rau, who directs strategy and research, has a litany of questions going into the earnings season.

For example, the Permian, which is setting the pace across the onshore, has a growing buildup of DUCs. The buildup has “slowed the rig count there, but when do completion companies start to get worried” by lower crude prices and the buildup? That’s key, as the Permian activity is “holding everything up” on a positive basis for the U.S. energy sector.

The Permian’s future takeaway capacity also is on Rau’s mind, “both on the crude and natural gas side…Everybody wants to know about that.”

Gas takeaway updates in the Appalachian Basin also are priorities, including the status of Energy Transfer Partners LP’s Rover Pipeline, which now is targeting a late summer start.

Like other analysts, Rau is looking for insight into whether E&P capital expenditure plans have changed for 2H2017. “Are folks buying into the rebound in crude, or do they expect sub-$50 WTI to prevail?”

The balance sheets of North America’s E&Ps, and their debt loads, still are a concern.

“How many are still in trouble?” Rau asked. “How many companies will continue to ramp production, even in the face of lower economics, in order to service their debt?”

E&P consolidation also will be on his mind, following the proposed tie-up last month of Appalachian heavyweights Rice Energy Inc. and EQT Corp.

“Will this accelerate consolidation in the area?” Rau asked. “Is this a tacit acknowledgement that efficiency gains from longer, single-well laterals and better fracture recipes are starting to slow?”

Other basin activity, including renewed activity in the Eagle Ford, should gain attention too.

“It seems to me that the Eagle Ford is the current incremental region with respect to drilling economics,” said Rau. “Comments there might serve as broader overall expectations for the industry.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |