E&P | Mexico | NGI All News Access | NGI Mexico GPI | NGI The Weekly Gas Market Report | Regulatory

With Mexico Upstream Bids Awarded, ‘Now Comes the Hard Part,’ Talos CEO Says

Producers that have been awarded blocks in Mexico’s historic oil and natural gas upstream auctions should not rest on their laurels, said Talos Energy LLC CEO Tim Duncan.

“Now comes the hard part,” he said Tuesday at the fourth Mexico Oil & Gas Summit in Mexico City.

After winning an auction, companies have to obtain a range of specialist services that might not be readily available in Mexico, Duncan said during a panel discussion titled “The Road to First Oil for Mexico’s New Offshore Operators.”

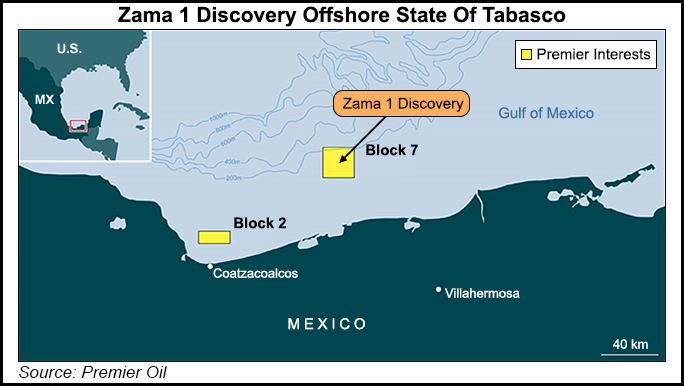

Talos and its partners earlier this month announced the Zama 1 discovery in the southern state of Tabasco, the first private-sector offshore oil find since Mexico’s 2013 energy reform. Zama 1 has a potential 1-2 billion bbls of light crude. Talos, which owns a 35% stake, drilled the well with Sierra Oil and Gas S. de R.L de C.V. (40%) and Premier Oil plc (24%).

Houston-based Talos, which has experience working the U.S. Gulf of Mexico’s shallow waters, is now expanding its reach to the south. While Houston is the world’s oil industry capital replete with oilfield services (OFS) and equipment, almost 80 years of a state monopoly have left the shelves close to bare among Mexican suppliers.

Yet oil companies that operate in Mexico have to observe minimum national levels in their contracts. The answer is to develop the growth of suppliers and providers of services. “Collaboration has to be the watchword,” said Murphy Oil Corp. Vice President Gregory Hebertson.

Carlos Morales, who was the Petroleos Mexicanos exploration and production chief for more than a decade, is now CEO of Petrobal, a start-up controlled by Alberto Bailleres, the Mexican tycoon whose Industrias Penoles is the world’s leading silver producer.

Morales, who knows Houston and Mexico well, advises that it will take time to achieve the full potential of the Mexican services industry. Meanwhile, he said operators have to keep costs under control, particularly in a oil market currently stuck at $40-50/bbl.

The shortage of OFS in Mexico will only expand as development ramps up. Earlier this month, auction Rounds 2.2 and 2.3 of Mexico’s energy reform were held, which saw competitive and even fierce bidding for blocks. Round 2.2 included nine blocks offering licenses in the Burgos Basin across the Texas border and long Mexico’s leading producer of non-associated natural gas. A 10th block in round 2.2 offered extra-light crude and gas in southeastern Mexico.

Round 2.3 featured 14 licenses: four in Burgos; five in the southeast, including one in the Chiapas foldbelt; and four in the southern Gulf state of Veracruz, including in the Tampico-Misantla Basin. The Tampico-Misantla Basin, which extends across east-central Mexico into the shallow waters of the Gulf of Mexico, may be one of 24 global onshore “super basins,” much like the Permian Basin with its myriad reservoirs and multiple source rocks, according to a recent report by IHS Markit.

The blocks in Veracruz feature wet and dry natural gas and oil, according to the National Hydrocarbons Commission.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |