Bakken Shale | E&P | Markets | NGI All News Access | NGI The Weekly Gas Market Report

Bakken ‘Steady As She Goes’ in North Dakota; DAPL Fails to Reduce WTI Differential

Production in North Dakota’s Bakken Shale remained unchanged in May from April, but that doesn’t mean the prolific sweet crude oil and natural gas area has peaked, the state’s chief oil and gas regulator said last week.

There are more rigs working and drilling wells faster, but many of the wells are not being hydraulically fractured (fracked) and/or completed because of low prices, said Lynn Helms, director of the Department of Mineral Resources (DMR). “We’re seeing a higher rig count than we can frack,” and the backlog of drilled-but-uncompleted wells (DUC) is growing.

“It continues to cause a lot of frustration because operators cannot frack them as fast as they can drill the wells,” said Helms. One of the Bakken’s largest operators, which he did not name, had committed to clearing its DUC backlog this year, only to find it growing at mid-year. “They’re very actively trying to recruit hydraulic fracturing crews.

“But I don’t think at all that the Bakken has peaked, and with better prices we’ll see that activity pushed up higher.”

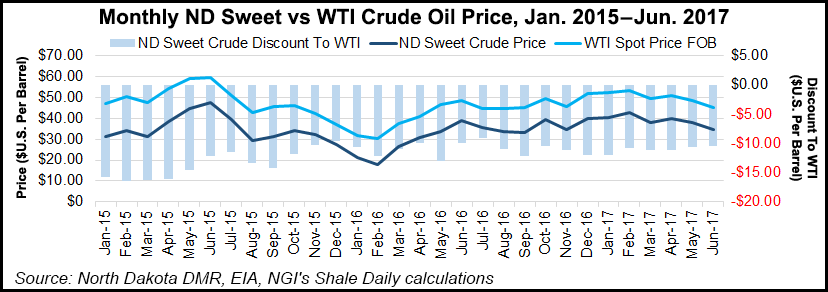

According to Helms, the only real surprise in the latest statistics was related to the Dakota Access Pipeline (DAPL), which is moving crude to a hub in Illinois and on to the Gulf Coast. The initial startup did not narrow the price differential between Bakken supplies and West Texas Intermediate (WTI) prices. The differential remained at about $11/bbl in May, while state officials had expected a $6-7/bbl differential.

“We’re going to have to do some more research on this because that differential should shrink,” Helms said. He expected DAPL’s competitive transportation costs to drive up the prices Bakken crude can fetch.

Longer term, if prices for North Dakota sweet crude don’t get above $40/bbl and stay there, production could “languish,” said Helms, whose latest report predicts weak oil prices nationally for at least the rest of this year.

After averaging nearly $40/bbl in April, North Dakota oil prices have gone down, hitting $37.85 in May, $34.72 in June and $35.25 last Friday.

According NGI markets analyst Nathan Harrison, the differential “has actually been narrowing and even tightened almost 2% month/month” from May to June “as the pipeline officially went into service on June 1. The differential has tightened 6.6% since Energy Transfer Partners LP first began filling the pipe back in March.

“I suspect the narrowing has been minimal for a variety of reasons including the fact that DAPL may not reach full 470,000 b/d capacity until 2018,” Harrison said. According to a recent report by ESAI Energy LLC, he noted that “DAPL may only reach 75% of its stated capacity by the end of 2017.”

North Dakota’s oil production remained nearly flat in May at 32.2 million bbl (1.04 million b/d), compared to 31.5 million bbl (1.05 million b/d) in April. Natural gas production also climbed slightly to 57.4 Bcf (1.85 Bcf/d) in May from April’s 55.08 Bcf (1.83 Bcf/d).

The number of producing wells reached an all-time high in April at 13,876, with about 11,819 wells (85%) considered unconventional Bakken wells. The rig count remained flat at 50 in April-May before moving to 55 in June and hitting 58 last Friday, Helms said.

The amount of gas captured also stayed steady at the 90% level statewide, although on part of the Fort Berthold Reservation it lagged at 82%. Slumping prices and demand have made natural gas and natural gas liquids (NGL) unprofitable, Helms said.

“Gas and NGLs are pretty much a break-even scenario for the producers right now,” he said. “They are not investing any more money than they have to in gas capture as a result.”

Demand and drilling have to increase before there are comparable increases on the gas capture side. For now there is no “catching up” taking place in terms of finishing the backlog of drilled but uncompleted (DUC) wells.

State energy officials for the past year have reiterated that Bakken gas and NGLs would get more attention as commodity prices turn upward, but the turnaround has faltered.

While operators in keeping with national trends have been “losing ground” in cutting into the DUC backlog, North Dakota should maintain its 1 million b/d production for the rest of this year, Helms said.

“We may stumble a little bit in coming months, but it is still quite realistic to stay above the 1 million b/d level. A lot, of course, depends on what happens to oil prices.”

Even with the current unfavorable economics for Bakken gas and NGLs, Helms said he thinks gas production is going to continue to increase.

“I wouldn’t be surprised to see it continue to increase since the areas where the rigs are running now have high gas content. Operators are pushing infrastructure to the max, so I wouldn’t be surprised to see natural gas and NGL production increase, even if crude oil production dropped 20,000 b/d.”

When the Bakken first was being developed a lot of the drilling was outside the core area, which is gassier than the periphery. Most of the current activity is taking place where the gas volume per crude barrels are two or three times larger.

“We’ve been asking operators if they are seeing a lot of well interference, and that is maybe driving the high gas-to-oil ratio and they continue to say no,” Helms said. Nevertheless, some of the experiments with distances between wells has shown that at distances of 300-400 feet, there is well interference, but that’s not how operators are drilling wells.

“Drilling currently is in the deepest, hottest and gassiest part of the reservoir,” he said. Well interference, aka frack hits, refers to putting two well bores close causing the fracks to intersect one another.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |