Heatwave Pushes NatGas Forward Prices Higher, But Will it Last?

With heat indexes soaring above 100 degrees over much of the United States and forecasts indicating more hot weather on the way, natural gas forward prices for August rose an average 9 cents from July 7 to 13, according to NGI’s Forward Look.

The sweltering conditions and projections for the strongest demand of the summer lifted gas markets from the start of the week, when Nymex August futures rose 6.5 cents. A dip in production also contributed to Monday’s gain.

Tuesday brought about an even more pronounced rally as the front of the curve put up an impressive increase of nearly 12 cents to lift the August futures contract back above $3 — to $3.047. But alas, some profit-taking on Wednesday and cooler trends that began showing up in some weather models led to a 8.6-cent decline in August futures over the next two sessions, leaving the prompt-month contract back under $3 by Thursday, at $2.961.

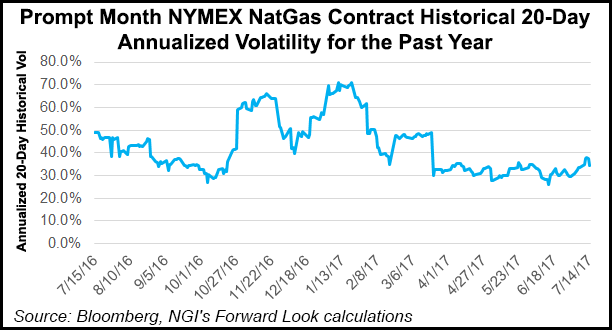

Even with a modest flurry of activity so far in July, annualized historical price volatility for the prompt month Nymex futures contract still remains close to its trailing one-year low, which suggests the market is looking for direction all the more.

“Slightly milder weather overnight spurred the initial decline, and weaker spot prices added additional pressure,” Mobius Risk Group analysts said Thursday. Interestingly, they said, the loss in cooling degree days (CDD) “was primarily from lower gas intensity regions, and thus, overall demand may not suffer much. Over the next two weeks, temperatures are still expected to be materially warmer than normal, and of particular importance is a stretch of noteworthy heat in the southeastern U.S.”

Indeed, forecasters at NatGasWeather said a hot ridge is expected to regain ground and strengthen over the northern and east-central United States, where highs of upper 80s to 100s are expected to be widespread across the country to drive strong national demand.

Genscape Inc.’s team said the return of warmer weather is expected to boost natural gas demand “modestly,” as the data and analytics company projects CDDs to climb toward a high of 159 by Thursday, about 27 CDDs above normal for this time of year.

The bulk of the increases are expected to come from higher-population markets in the Northeast, Midwest and West Coast. Accordingly, Genscape is forecasting total Lower 48 demand averaging 63 Bcf/d during the workweek, reaching a forecast high of 64.1 Bcf/d on July 20. Power burns are forecast to crest 35 Bcf/d, but remain well shy of the season-to-date high of 39.3 Bcf/d established July 13.

Modest cooling is likely to return over the northeastern part of the country late in the week to ease national demand somewhat, and weather data continues to flip-flop on whether cooling can continue to spill across the northern United States, according to NatGasWeather.

“At issue is the weather data has been flip-flopping between hotter and cooler patterns over the northern and eastern U.S. for the last week of July, with the latest round trending back a little hotter,” NatGasWeather said Friday.

Still, the fact that earlier production losses have since recovered above 72 Bcf/d also could have been behind Thursday’s price decline and could continue to weigh on prices Friday. After opening slightly lower, Nymex futures traded a few pennies higher by midday and ended up closing Friday’s regular session at $2.980, up 1.9 cents from Thursday.

This past week’s erratic swings in the futures/forwards markets may offer a glimpse into market behavior in the coming weeks as weather models for the last week of July and beyond are muddled at best. Everything from hot ridges to the cool troughs to hurricanes are showing up in the data, but what’s most likely is minor cooling across portions of the northern part of the country and very warm to hot everywhere else, NatGasWeather said.

“The data can quickly trend hotter or cooler, and we will be watching it closely before the weekend break,” the forecaster said.

Meanwhile, the market will also continue to keep a close eye on gas storage levels, as the latest storage report from the U.S. Energy Information Administration was slightly bullish to expectations.

The EIA reported a 57 Bcf build into inventories for the week ending July 7, just below market consensus of 59 Bcf. Inventories now stand at 2,945 Bcf and are 289 Bcf less than last year and 172 Bcf greater than the five-year average.

The surplus versus the five-year average has fallen by 132 Bcf over the past 10 weeks, reflecting nearly 2 Bcf/d of undersupply in the natural gas market, according to Wells Fargo Securities LLC analysts. And, with hot weather forecast for the next two weeks across most of the continental U.S., the bank expects the pace of storage injections to slow even further.

“Based on current weather forecasts, as well as elevated power burn levels thus far in July (34.1 Bcf/d month-to-date versus 33.7 Bcf/d month-to-date in July 2016), our model projects a 76 Bcf cumulative storage build over the next three weeks,” said Wells Fargo analysts Thursday. “This would be substantially below the five-year average of 143 Bcf and would reduce the storage surplus to just 108 Bcf by the end of July.”

For its part, NatGasWeather expects the surplus over the five-year average to shrink from current levels of 172 Bcf to around +120-125 Bcf after the next two EIA reports.

And while pipeline exports to Mexico and liquefied natural gas exports continue to offer structural support to the market at more than 4 Bcf/d and 2 Bcf/d, respectively, weather should continue to be the key driver for the markets going forward.

Looking more closely at the futures and forward markets, solid gains in the futures curve were seen through 2018. The Nymex August futures contract climbed 9.5 cents from July 7 to 13 to reach $2.96, while September and the balance of summer (September-October) each rose 9 cents to $2.95 and $2.97, respectively. The prompt-winter futures strip posted a double-digit increase of 10 cents to settle at $3.22, while even the calendar year 2018 strip was up an impressive 8 cents to $2.99. Earlier in the week, it settled above $3 the first time since June 28. By comparison, the calendar 2019 strip edged up just 3 cents for the week, and the calendar year 2020 was up just a penny.

Elsewhere around the country, the blazing heat that has blanketed the West for much of the summer season appears to be having little impact on forward markets. Southern California Border forward prices for August climbed just 5 cents from July 7 to 13 to reach $2.81 (compared to the national average of 9 cents), while September rose 8 cents to $2.764 and the balance of summer (September-October) picked up 8 cents to reach $2.73, according to Forward Look.

The softer gains at the front of the curve come even as California demand reached 6.21 Bcf/d on July 10, far above the 5.88 Bcf/d average over the previous seven days. Demand is expected to remain strong for the remainder of the month, averaging 6.106 Bcf/d between July 17 and 21 and 6.182/Bcfd between July 24 and 28, according to Genscape.

The modest gains for August prices in California come amid a near-record hydro year across California and the Pacific Northwest and increased renewables generation, particularly solar. Since last summer, the California Independent System Operator, the state’s electric grid operator, added about 3,090 MW of new resources, including about 2,302 MW of solar, 699 MW of natural gas and 80 MW of battery energy storage.

Meanwhile, forward prices in the Midcontinent also put up comparatively small increases at the front of the curve as demand is expected to wane after reaching some of the highest levels of the summer. Genscape shows demand averaging 2.958 Bcf/d from July 17-21, well below the 3.19 Bcf/d average over the last seven days. Demand is expected to fall even further, to an average 2.796 Bcf/d for the last week of July.

Oneok Gas Transmission August forward prices rose 4.6 cents from July 7 to 13 to reach $2.491, while September and the balance of summer (September-October) each climbed 5 cents to $2.463 and $2.48, respectively. Gains for the upcoming winter were more on par with the rest of the country, with the winter 2017-2018 strip gaining 9 cents to hit $2.84, Forward Look data shows.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |