U.S. Rig Count Holds Flat Amid Stagnant Prices; Canada Gains After Last Week’s Losses

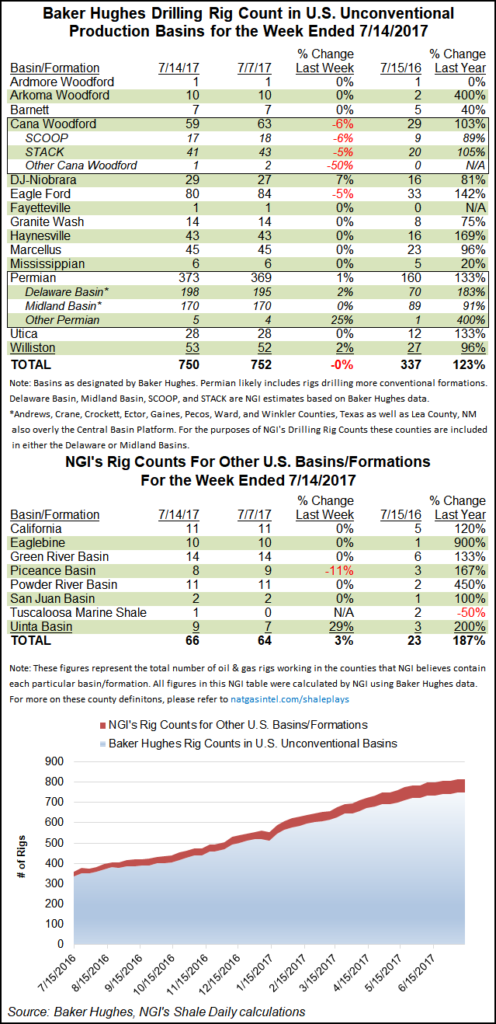

The U.S. oil and natural gas rig count held steady for the week ended July 14, while Canada gained back what it lost the week before and then some, according to data released Friday by Baker Hughes Inc.

The United States added two oil rigs for the week, while two natural gas-directed rigs left the patch. Canada, meanwhile, brought back 15 gas-directed rigs and one oil-directed, more than making up for the 14 rigs that dropped out the week before.

That left the total North American rig count at 1,143 as of July 14, up 16 week/week and more than double the year-ago tally of 542, according to Baker Hughes, which now is a unit of General Electric.

Among plays, the Cana Woodford in the Midcontinent shed four rigs for the week to finish at 59, while the Eagle Ford Shale in South Texas also dropped four to end at 80.

After dropping one rig last week, the mighty Permian Basin got back to growth, adding four rigs for the week ended July 14 to finish at 373, more than double the 160 rigs running in the play a year ago. In total, Texas added three rigs for the week, while Oklahoma dropped two.

Rounding out the other notable changes for the week, the Denver Julesburg Basin-Niobrara formation added two rigs, and the Williston Basin added one.

The Federal Reserve Bank of Kansas City, covering the Tenth District, released a survey Friday showing the district’s energy activity expanded at a slower pace during the second quarter.

The Tenth Federal Reserve District includes western Missouri, Nebraska, Kansas, Oklahoma, Wyoming, Colorado and Northern New Mexico.

“The rig count pace of growth is going to slow significantly and probably flatline,” one district energy firm responding to the survey said. “The industry has a significant number of drilled but uncompleted wells and this inventory is growing every day.”

Another observed that “public companies overpaid for Permian assets and must show reserve and production growth, so drilling will continue to escalate for several months in the Permian, no matter the price. Other basins may counter that a bit when prices are uneconomic.”

Crude oil futures rebounded somewhat during the week ended July 14, with the Nymex August contract recovering from recent lows to trade around $46/bbl as Friday’s close approached. That’s still a significant drop from prices north of $50/bbl earlier this year.

Natural gas, meanwhile, continued its struggle to climb above $3/MMBtu, with some general warming in the forecast and a nearly on-target weekly Energy Information Administration storage report not enough to excite the bulls. The August Nymex contract was trading up about 2 cents Friday at $2.982 as the close approached.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |