E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Unconventional Oil, NatGas Development Carrying Global Energy Spend, Says IEA

Global oil and natural gas investments are predicted to climb this year, as U.S. onshore unconventional development spending rises, the International Energy Agency (IEA) said Tuesday.

In the annual World Energy Investment Report, the global energy watchdog forecast a 3% increase in fossil fuel development this year, a modest uptick following the longest retrenchment in spending since the oil price crash began in 2014.

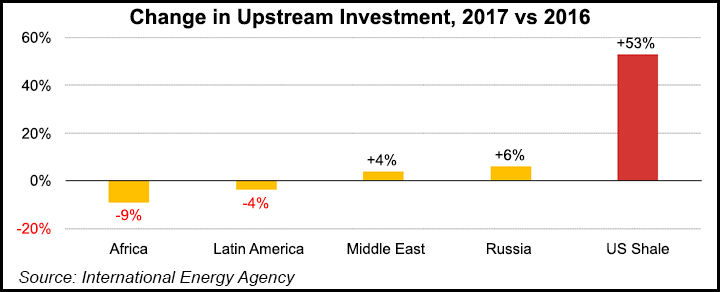

However, spend is expected to be down almost everywhere except in the United States, which is predicted to see a 53% spike from unconventional drilling. Researchers said upstream investments should begin to stabilize this year following two years of unprecedented decline.

“However, an upswing in U.S. shale spending contrasts with stagnation in the rest of the world, signaling a two-speed oil market,” said researchers. “At the same time, the oil and gas industry overall is transforming itself by delivering large cost savings and focusing more on technology development and efficient project execution.”

U.S. unconventional drilling has “benefited from a reduction in breakeven prices as a result of a combination of improvement in costs and efficiency gains,” said IEA, which delivered the report at an energy conference in Istanbul.

Instead of focusing on expensive mega-projects, the oil and gas industry has “an increased focus on activities delivering paybacks in a shorter period of time and the sanctioning of simplified and streamlined projects.”

Unconventional drilling is less expensive and delivers a much faster payback than long-term mega-projects, including those in the offshore.

Efficiencies overall have reduced costs, but the hike in domestic development should send U.S. shale costs higher this year.

“The rapid ramp up of U.S. shale activities has triggered an increase of U.S. shale costs of 16% in 2017 after having almost halved from 2014-16,” researchers said.

The relatively modest uptick in oil and gas spend this year may not be enough to prevent an oil supply shortage in the future, the watchdog’s report warned.

Investing in new reserves, rather than developing existing oil and gas fields, should contract by 7% this year after falling by half in 2014 and 2015. The decline in new spend raises “question marks about whether sufficient reserves will be available in the coming years to meet rising demand,” researchers said.

“Our analysis shows that smart investment decisions are more critical than ever for maintaining energy security and meeting environmental goals,” said IEA Executive Director Fatih Birol. “As the oil and gas industry refocuses on shorter-cycle projects, the need for policymakers to keep an eye on the long-term adequacy of supply is more important.

“Even with ambitious climate-mitigation goals, current investment activity in oil and gas will have to rise from its current slump.”

The sharp dropoff in energy investment was attributed to “the reaction of the oil and gas industry to the prolonged period of low oil prices, which was a period of harsh investment cuts, and technological progress, which is reducing investment costs in both renewable power and in oil and gas,” said IEA Chief Economist Laszlo Varro.

According to the report, total energy investment fell in 2016 for the second straight year by 12% to $1.7 trillion. Oil and gas investments were down 26% to $650 billion, off by more than 25%, while electricity generation slipped 5%.

For the first time ever, electricity investments in 2016, pinned to renewables and power grid development, surpassed total spend in oil and gas.

Renewables-based power capacity investments climbed to $297 billion in 2016 and “remained the largest area of electricity spending.”

Meanwhile, coal-fired electricity plant investments continue to decline. New coal power plant sanctions last year fell to the lowest level in nearly 15 years.

“Coal investment is coming to an end,” Varro said. “At the very least, it is coming to a pause.”

Researchers also tracked for the first time investment financing sources across the entire energy sector. More than 90% of investments are financed from the balance sheets of companies, governments and households, reinforcing the importance of sustainable industry earnings.

IEA also tracked for the first time global energy sector research and development (R&D) spending. More than $65 billion was estimated to have been spent on R&D worldwide in 2015, based on a bottom-up assessment of spending by the public and private sectors.

Energy R&D is split almost evenly between private money and public funding, but when it comes to low-carbon technologies the public sector takes a higher share.

“While the clean energy transition hinges on scaling up innovation, overall energy R&D expenditure has not risen in the past four years, nor has the clean energy component in particular,” researchers said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |