Infrastructure | E&P | NGI All News Access

Rigs Finish June at a Steady Clip; All Eyes on Permian

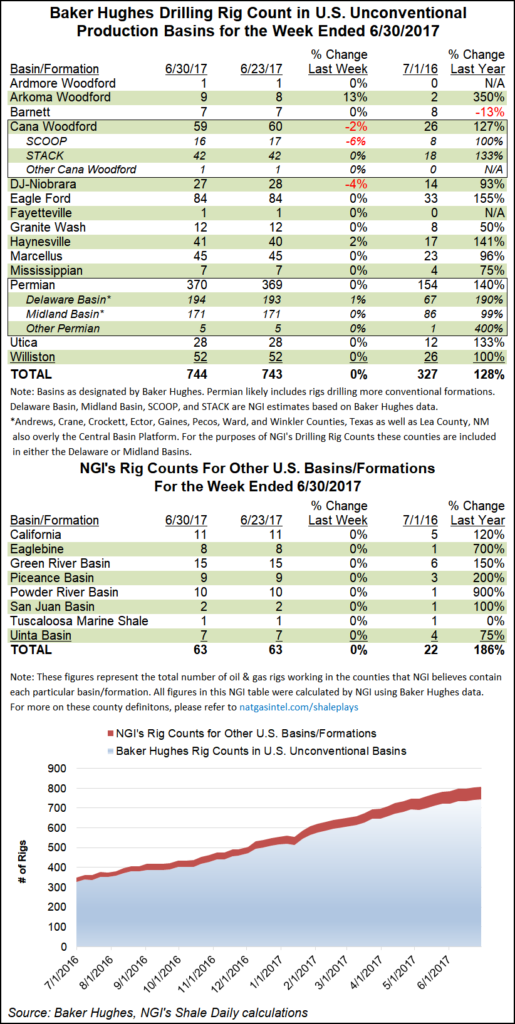

U.S. oil and gas rig activity remained pretty steady during the last week of June as those in search of oil declined by two to 756, while those drilling for natural gas added one to 184, according to data from Baker Hughes Inc.

Taking a deeper dive into the data for the week ending June 30, it is clear that the slump of the last few years is over. For example, the 756 oil rigs in service during the week represents a 122% increase over the 341 rigs in operation one year ago. Likewise, the 184 natural gas rigs is a 107% increase over last year’s number of 89 rigs.

Economics are still favoring plays with strong oil returns, especially the Permian Basin and its various sub-basins. For the week ending June 30, the Permian Basin only added one rig to reach 370 in the play. While the increase was small, the 370 rigs in operation represent a 140% increase over last year’s level of 154 rigs.

The Permian Basin and its Delaware sub-basin were in the news repeatedly during the week, with some marketwatchers referring to the flood of exploration and production activity in the area as gold rush-like.

New Mexico reported during the week that its June oil and natural gas lease sale collected $654,448, which pushed fiscal year 2017 earnings from monthly sales to more than $65 million, nearly doubling the previous year’s proceeds of $36 million. The state attributed the increase to interest in the Delaware sub-basin of the Permian Basin in southeast New Mexico.

Also last week, Houston-based Carrizo Oil & Gas Inc. agreed to nearly double its West Texas Permian Basin portfolio in a $648 million deal with private equity-backed Exl Petroleum Management LLC. The Quantum Energy Partners portfolio company agreed to sell Carrizo 23,656 gross (16,488 net) acres in Reeves and Ward counties, considered to be the heart of current exploration and development within the Bone Spring and Wolfcamp formations.

“Over the past couple of years, we have evaluated numerous deals in the Delaware Basin, and these properties rank amongst the best we have evaluated, meeting all of our acquisition criteria,” said Carrizo CEO Chip Johnson. “The assets are located in the core of the Delaware Basin, offering the potential for decades of high-return drilling locations across multiple horizontal zones. Additionally, the properties have a significant amount of well control, not just across the acreage, but also within the various target zones, dramatically reducing the future operational risk.”

On Thursday ConocoPhillips continued its turn away from natural gas and to more oil-weighted projects after snagging $305 million from an affiliate of Miller Thomson & Partners LLC for its legacy gas-rich Barnett Shale portfolio. During the second quarter, the No. 1 independent in the world concentrated most of its Lower 48 dollars to the Eagle Ford and Bakken shales, as well as the Permian Basin. Production in the Lower 48 overall averaged 221,000 b/d in 2Q2017, with output from the Eagle Ford around 133,000, the Bakken at 59,000 and the Permian at 17,000 b/d.

The results of the increased rig force over the last several months is starting to pay off as crude production continues to tick higher. The Energy Information Administration said last Tuesday that crude production has continued to increase through the first five months of 2017. Crude production peaked at about 9.5 million b/d in 2015 to reach its highest point in decades, but slipped by 6% last year to below 9 million b/d as the downturn persisted. Volumes are currently at about 9.4 million b/d as activity has bounced back in the Midcontinent and other places like the Permian Basin.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |