E&Ps Trained on Value Creation, Efficiencies Heading Out of Downturn, Says Wood Mackenzie

Oil and natural gas exploration companies plan to keep the focus on low-cost opportunities this year, with an emphasis on creating value, capital efficiency and returns on investments, according to Wood Mackenzie Ltd.

In a survey of 200 senior exploration and production (E&P) professionals, the consultant wanted to determine if a true recovery in the industry is emerging.

“It comes as no surprise to hear that companies will continue to explore low-cost opportunities in 2017,” said Wood Mackenzie researchers. National oil companies plan to “put more emphasis on growth and higher exploration impact, while value creation, capital efficiency and returns on investment are all high on the priority list.”

The “top resource capture options” worldwide continue to be conventional exploration and increased recovery from existing assets, with value creation considered the most important metric to demonstrate performance.

The short-term focus “remains in mature basins for high-margin, low-cost and near-field prospects” and away from deepwater and frontier basins.

“Budget constraint” remains the top issue, with “opportunity availability and portfolio strength beginning to increase in importance.”

For operators working in unconventional exploration, today almost entirely in North America, most executives surveyed think it needs more price support.

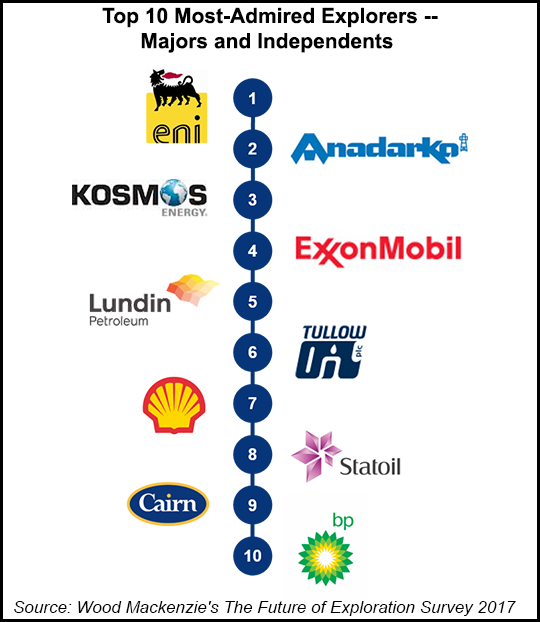

Wood Mackenzie also quizzed executives about the E&Ps they most admired. Leading the list is supermajor Eni SpA, which is headquartered in Italy. Second on the list is U.S. super-independent Anadarko Petroleum Corp., based near Houston in The Woodlands. Anadarko has onshore and offshore expertise, with operations weighted to the U.S. onshore and deepwater Gulf of Mexico. Its exploration philosophy today centers around the “three Ds” — defined as the deepwater, Denver-Julesburg Basin of Colorado and the Permian Basin’s Delaware sub-basin.

The third most admired explorer is Dallas-based Kosmos Energy Ltd., which concentrates its efforts overseas. The fourth most admired is ExxonMobil Corp., followed by Norway’s Lundin Petroleum AB, African independent Tullow Oil plc, Anglo-Dutch Royal Dutch Shell plc, Norway’s Statoil SA, UK-based Cairn Energy plc and UK’s BP plc.

Executives rated the operators based on several factors including consistent track record/success rate; risk appetite/play opener; technical knowledge/ability; portfolio strategy; commitment to exploration; and value creation/intelligent monetization.

The production leaders also were ranked by management and organization; timing/first mover; focus on capabilities/key strengths; and high impact/large volume discoveries.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |