Markets | NGI All News Access | NGI Data

Forecast Energy Demand Lifts Eastern NatGas; Expired July Futures Out On Firm Note

Physical natural gas trading for Thursday delivery was mostly a mixed affair, and in the big picture prices moved little. Strength in the Northeast and Appalachia was barely able to offset soft pricing in California and mostly flat pricing in the Midcontinent and Texas. The NGI National Spot Gas Average rose 6 cents to $2.73.

Ahead of the holiday weekend futures trading was equally uninspired, but the expired July contract did manage to hold onto its perch above $3, adding 3.0 cents to $3.067. August rose 3.0 cents to $3.094.

Eastern next-day gas gained as surging energy demand and higher next-day power quotes gave buyers plenty of incentive to make incremental purchases for power generation. ISO New England forecast that peak power Wednesday of 16,150 MW would rise to 16,850 MW Thursday and jump to 20,30 MW by Friday. The New York ISO predicted peak load Wednesday of 20,665 MW would escalate to 22,560 MW Thursday and reach 25,720 MW Friday. PJM Interconnection expects peak load Wednesday of 37,446 MW to jump to 45,307 MW Thursday and climb to 49,251 MW Friday.

Gas at the Algonquin Citygate rose a stout 41 cents to $2.71 and deliveries to Iroquois Waddington added 44 cents to $2.94. Gas on Tennessee Zone 6 200 L gained 37 cents to $2.65.

Marcellus quotes were strong as well. Gas on Dominion South was quoted 14 cents higher at $1.94 and packages on Tennessee Zone 4 Marcellus came in 21 cents higher at $1.92. Deliveries to Transco Leidy rose 27 cents to $1.95.

Next-day power also rose. Intercontinental Exchange reported that on-peak Thursday power at the Indiana Hub gained $4.50 to $31.50/MWh and power Thursday at the ISO New England’s Massachusetts Hub rose $4.43 to $29.54/MWh. Thursday deliveries of on-peak power at the PJM West terminal added $5.30 to $31.10/MWh.

Other market points were mostly flat. Gas at the Chicago Citygate was up a cent to $2.84, and deliveries to the Henry Hub changed hands 3 cents higher at $3.01. Gas on El Paso Permian added a penny to $2.64 and gas priced on Panhandle Eastern was up a cent at $2.64.

Deliveries to Opal were quoted a penny higher at $2.63 and gas priced at the SoCal Citygate was down a cent at $3.08.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

The expired July contract opened and settled 3 cents higher as traders honed in on new weather data reinforcing warmer trends. Overnight oil markets weakened.

Overnight weather models turned a touch warmer. “The six- to 10-day forecast is generally warmer than yesterday’s forecast, favoring the northern half of the continental United States,” said forecaster WSI Corp. in a morning report to clients. Continental United States population-weighted cooling degree days (CDD) “are up 1.3 to 60.1, which are 9.5 above average.”

WSI cautioned that “model spread and rain risks offer risks in either direction over parts of the lower Midwest into the eastern US. The interior West, Plains and Midwest could run warmer late in the period.”

Near term forecasts of cooling load show a warmer New England and cooler Mid-Atlantic and Midwest. The National Weather Service (NWS) for the week ended July 1 estimated that New England would see 39 cooling degree days (CDD) or 12 greater than normal, and New York, New Jersey and Pennsylvania would experience 37 CDD or 4 less than its average. The greater Midwest from Ohio to Wisconsin was anticipated to endure 31 CDD or 14 less than its seasonal norm.

“I don’t think we will get under recent lows unless there is a drastic change in the weather forecasts,” said Steve Blair, vice president at Rafferty Technical Research in New York.

“Summer is truly here, and I think we’ve set the bottom of the market for the time being. What will be interesting is the CFTC reports on Friday on the managed money sector. The report from last week, I believe, showed the Nymex and ICE natural gas managed money had gotten very long.” Blair admitted that if large managed money accounts all bailed at the same time, it could cause a sharp drop in price, “but they have to have a reason to do so.”

Others see warm summer weather as having been in the market for several months and anticipate seasonal headwinds for the bulls. “The seasonal pattern says don’t fall in love with the upside here,” Walter Zimmermann of United ICAP told NGI.

“The seasonal risk is lower, and what’s behind that is going from the winter into the spring people are buying up the market in anticipation of summer demand. You get the winter to spring pre-season rally, like we had this time around from $2.52 to $3.43, and then the market sold off a little bit.

“The bulls are now looking for heat waves and hurricanes, but the problem with that is that is what the pre-season rally has already done. The bulls get disappointed and are forced to liquidate their length as the summer unfolds. Bulls end up buying into a market that has already discounted summer demand.

“If the market could break $3.20, that would break the pattern, but if you get to $3.21 all you have done is break the ongoing .618 retracement pattern. We could have a little upside correction, but this is not the time to fall in love with the upside,” said Zimmermann.

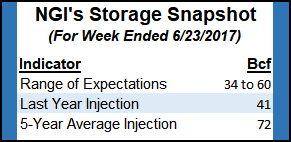

The ability of the market to hold $3 is likely to get a stress test Thursday with the release of Energy Information Administration (EIA) storage figures. Last year 41 Bcf was injected and the five-year pace stands at 72 Bcf. Citi Futures Perspective is looking for a 54 Bcf increase and IAF Advisors in Houston calculates a 51 Bcf injection. A Reuters survey of 22 traders and analysts showed an average 52 Bcf with a range of +40 Bcf to +60 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |