E&P | Markets | NGI All News Access

Without (Unlikely) Black Swan Event, BMO Sees Lower Oil, NatGas Prices Sticking Around

The collapse in crude oil prices that began in mid-2014 shows no signs of abating soon, and in fact oil — and natural gas — prices could remain relatively weak for a couple more years, BMO Capital Markets analysts said Monday.

Market fundamentals don’t always set the price, analysts said. In the last four decades the direction and level of crude oil prices have been altered by unexpected “black swan” events. However, oil prices also follow cycles that are driven by multi-year supply and demand trends.

“We believe that the current downcycle is largely a product of the high price cycle that preceded it,” said the BMO team. “High oil prices encouraged the development of new sources of supply and at the same time slowed demand growth.

“The challenge is that once unlocked, new sources of supply can take time to consume.”

For example, they noted that the emergence of supply in the North Sea and Alaska’s North Slope in the 1980s took more than a decade to absorb.

“The most recent new source of supply (U.S. shale oil) is still many years away from being fully absorbed and so will influence the direction and level of crude oil prices for several more years, in our opinion,” analysts said.

Without support by the Organization of the Petroleum Exporting Countries, which has agreed voluntarily to limit some output until next March, “crude oil prices would be roughly $10/bbl lower,” the BMO team said.

“The top end of the trading range for oil prices is determined by the ability of U.S. producers to grow production. Based on the industry’s current cost structure, crude oil prices above $50/bbl could result in too much growth in U.S. production and, concomitantly, weaker crude oil prices.”

Likewise, oil prices under $40/bbl would reduce the rate of growth sharply.

BMO’s updated production model following 1Q2017 reporting puts U.S. crude oil production on path to be relatively flat year/year in 2017. However, analysts see U.S. oil output increasing by more than 1.4 million b/d in 2018 to 10.5 million b/d, and potentially 11.5 million b/d in 2019 assuming a relatively flat rig count.

The United States also won’t be the only source of oil growth in North America.

“Canadian oil production is expected to grow steadily through 2020 as new oilsands and offshore east coast projects currently under construction come online,” said analysts. “We expect Canadian oil production to grow from 4.4 million b/d in 2017 to 4.8 million b/d in 2018 and 5.1 million b/d in 2019.

In total, BMO is forecasting North American oil production will increase by 2.2 million b/d in 2018, and a further 1.2 million b/d in 2019, based on the current U.S. rig count and new projects coming online in Canada.

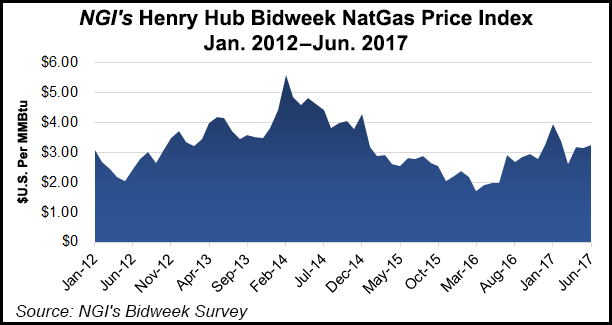

For domestic natural gas, supply growth should exceed demand in 2018 and 2019, keeping Henry Hub prices rangebound in 2018 and potentially weak in 2019. U.S. gas prices generally have traded in a $2.50-4.00/Mcf band over the past five years, with exceptions mostly driven by the weather, analysts said. Meanwhile, Canada AECO prices in general have traded even lower, around $1.50-3.50, in part because of intra-Alberta infrastructure constraints.

“We believe that natural gas prices will remain in these established trading ranges into 2018,” said the BMO team. “We believe that Henry Hub prices could trade lower in 2019 as U.S. production grows faster than demand and see the possibility for weaker AECO prices in mid-2017 with seasonal maintenance and through 2018 as the aggregate growth plans of Canadian producers exceeds available infrastructure capacity.”

U.S. gas production declined 1.8 Bcf/d year/year in 2016, attributed in part to less associated gas from oil drilling activity, as well as infrastructure constraints that led to a pause in Marcellus/Utica shale drilling.

As U.S. shale oil drilling expands this year, associated gas output should expand as well, particularly from the most active region, the Permian Basin.

“We expect Permian natural gas production to grow from 6.7 Bcf/d in 2016 to 7.7 Bcf/d in 2017, and 10.6 Bcf/d in 2018 based on the current rig count,” analysts said.

In addition, gas infrastructure bottlenecks are poised to ease in the Northeast, potentially accelerating more drilling activity.

“We expect Marcellus and Utica production to grow from 21.8 Bcf/d in 2016 to 23.7 Bcf/d in 2017, and 26.8 Bcf/d in 2018,” analysts said. “It is worth noting that this growth appears set at the current rig count.”

Working gas in storage this year is tracking around the five-year average, assuming normal weather. BMO’s model indicates total working gas in storage to exit the summer injection season at roughly 3.8 Tcf.

Next year, U.S. gas demand should increase by 2.8 Bcf/d, with 2019 demand rising another 1.8 Bcf/d, again assuming normal weather conditions, according to BMO.

“Based on the current level of rig activity and our aggregate company forecast, we expect the growth in U.S. supply to exceed the growth in demand in 2018 and 2019. This should keep natural gas prices range-bound in 2018 and points to potential weakness in 2019 as available supply would exceed storage capacity.”

The Energy Information Administration expects Henry spot prices to increase from an average of $3.16/MMBtu this year to $3.41/MMBtu in 2018, based on its latest Short-Term Energy Outlook.

Meanwhile, Western Canadian gas prices periodically have decoupled from U.S. prices because of infrastructure and other local conditions, including weather. Plans for substantial maintenance activities this year could impact Western Canadian gas prices, especially at the Station 2 pricing point on the Spectra system, analysts said.

The spread between Henry Hub and AECO is expected to remain above $1/Mcf into 2018 on the combination of maintenance outages and ongoing growth in the Montney Shale “that will test pipeline capacity,” the BMO team said. “We expect the price spread between AECO and Station 2 to increase over the coming months as pipeline maintenance gets underway. We expect spreads to remain relatively wide through 2019.”

Western Canadian gas production is forecast to increase from 16.2 Bcf/d in 2017 to 17.5 Bcf/d in 2018, and 18.5 Bcf/d in 2019 based on BMO’s corporate models.

“Over the same period, we expect intra-Western Canada demand to increase by roughly 200 MMcf/d each year while exports increase by 300 MMcf/d by 2019.” That structural imbalance between supply growth and demand growth likely will put downward pressure on Canada gas prices relative to Henry Hub.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |