Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin | Utica Shale

A Tale of Two Basins as Market Resets and Permian, Appalachian NatGas Volumes Rise

Oil-directed drilling in the Permian Basin is creating yet another natural gas glut that could keep prices lower for longer and threaten industry growth across the country.

At the same time, Appalachian Basin basis is expected to improve over the next year with more takeaway capacity coming online. Resurgent producers in the Rockies, the Haynesville and Fayetteville shales and the Midcontinent are adding to the dynamic as the market resets, necessitating what will need to be a close eye on the supply and demand picture going forward.

“The Permian guys won’t stop drilling,” Williams Capital Group LP analyst Gabriele Sorbara told NGI’s Shale Daily. “The tier one Appalachia guys won’t stop producing,” he said. He pointed to Northeast production powerhouses Range Resources Corp., Cabot Oil & Gas Corp., EQT Corp. and Antero Resources Corp. as “the guys with the core premium acreage; those guys won’t stop drilling. They’re the lower cost producers. The guys that get pushed out are the tier two type guys.”

Rarely do producers drill exclusively for natural gas in the Permian, but despite the recent slump in oil prices, the play remains economic at $40/bbl, which is likely to keep gas production surging across West Texas and southeastern New Mexico, especially as more pipeline capacity is built, said NGI’s Patrick Rau, director of Strategy & Research.

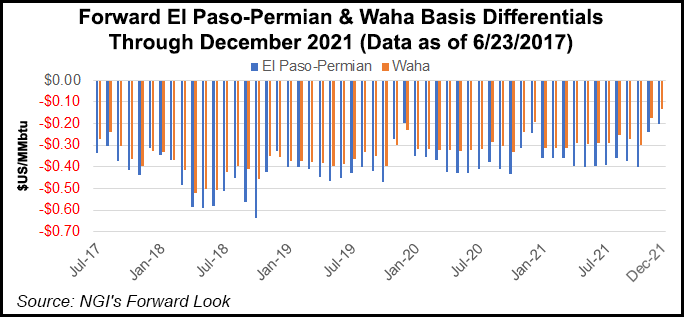

“The forward curve has flattened a bit,” Sorbara said. “There’s a lot of things that bother me about gas. You have takeaway coming online in Appalachia, associated gas coming out of the Permian and Anadarko Basin. Those are going to be two drivers where you have issues with the pricing front. You’re seeing that with Waha and El Paso gas pricing blowing out,” he said of the West Texas trading hubs.

“For both commodities, pricing is a concern, there’s no question. The market is resetting and that’s why these stocks are coming in lower and price decks are falling.”

Basis differentials at El Paso-Permian and Waha have widened through the first six months of 2017, especially when compared with the same time last year as the industry continued to wrestle through the downturn. The spread is expected to keep widening this year, with production in the Permian at about 8.3 Bcf/d and rising, Rau said.

To be sure, the differences between Appalachia and the Permian are stark. Along with Oklahoma’s stacked reservoirs, the Permian is expected to surpass all onshore areas for oil drilling and activity this year. As of Friday, rigs in the play have skyrocketed, going from 150 at the same time last year to 369, according to Baker Hughes Inc. data.

Permian oil production has increased to 2.4 million b/d in June from 1.5 million b/d in June 2014, which was the beginning of the downturn, widely surpassing oil production from the other six shale resource plays tracked by the Energy Information Administration. Permian gas production has risen significantly along with oil over the same time period from 5.6 Bcf/d in June 2014.

In the Marcellus and Utica, there were 73 rigs running on Friday compared with 35 at the same time last year. The Marcellus and Utica together are currently producing 23.6 Bcf/d of natural gas.

“The Permian growth is significant,” East Daley Capital’s Justin Carlson, managing director of research, said in an interview earlier this month. “And I doubt — as Appalachian producers were projecting and looking toward growth through the expansion of pipelines and also the productivity of their resource base — they anticipated that a 90-year-old basin would reemerge as a major gas player. So, as the Permian grows, it naturally means that it’s more difficult, or it limits the stack, in terms of availability for other supply sources to grow. The U.S. is pretty diverse with respect to the Rockies and the Gulf. I think the Marcellus grows, as does the Permian, but it does limit the opportunity for others basins and potentially limits the gross trajectory of the Marcellus.”

Carlson said producer guidance in the Northeast suggests gas output will grow by 14.5 Bcf/d by 2019. But as Appalachia adjusts to surging associated gas production from the Permian and elsewhere, the Northeast may have to slash its growth expectations to 11 Bcf/d.

“We’re going to have plenty of interconnectivity across the U.S. in the coming years,” said BTU Analytics LLC senior analyst Matthew Hoza. “As the Permian grows, as your associated gas grows and your demand pie stays the same, they’re going to grow at the expense of someone else, unless you see 90% or 100% utilization out of liquefied natural gas terminals, but we’re not really expecting that.”

For now, demand constraints are the primary concern for Appalachian and Permian gas. The Southeast and parts of the Gulf Coast are relatively insulated from growth in the Northeast, Hoza said. Rau said West Texas basis differentials should improve in a year or so as interstate pipeline systems are expanded and more lines are added to get volumes to the Agua Dulce Hub in South Texas to open Permian gas to more markets.

“What we’re seeing now is that gas move westward,” Hoza said of the Permian. “Rockies gas once moved south” to the El Paso Natural Gas pipeline system. “Now what’s happening is that gas is being displaced by the Permian. More Permian gas is moving west to serve California demand and that means less Rockies gas can move onto El Paso.

“There’s not too much connectivity to move gas north out of the Rockies, so really your choice is to move east,” via the Rockies Express Pipeline (REX). “But as you move east on REX, you have increasing Appalachian gas moving west. This is sort of like a domino effect that will continue to propagate down as Permian production grows.”

As markets across the country grow more interconnected, the broader concern is that Henry Hub gets dragged into the mix, forcing benchmark prices down.

“Henry Hub is still the sole focal point of the U.S. gas market…for Permian producers to get as close as possible and for Marcellus producers to get as close as possible,” Carlson said. “It’s an important competitive landscape for everyone to participate in. Otherwise, you’re still subjected to having basis discounts, which can put you at a disadvantage to the rest of the market.”

Whether a battle is shaping up between the Permian and Appalachia, or which volumes get squeezed first — if any at all — is for now a matter of opinion. But “it looks like Mexico may be able to help with that,” said NGI Markets Analyst Nathan Harrison.

From January 2010 to March, monthly pipeline exports to Mexico increased from about 23 Bcf to roughly 130 Bcf, according to the Energy Information Administration and NGI’s Shale Daily calculations. During that time, Mexican exports increased as a percentage of Permian natural gas demand from 17% to 53%.

“Basically, Mexico alone could currently eat over half of the Permian’s natural gas production,” Harrison said. “I’d be willing to bet that exports to Mexico increase much faster over the next few years than associated gas production, especially in a $40/bbl of oil environment.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |