NatGas Forwards Plunge As More Heat Not Expected Until July

Natural gas forward prices put up substantial declines for the period between June 16 and 22, with July prices averaging 15 cents lower during that time as markets were hit with news that they possibly will have to wait until the second week of July for more summer heat to kick in, according to NGI’s Forward Look.

The bearish weather outlook hit the market right out of the gates on Monday as weather trends over the June 17-18 weekend turned decidedly cooler for the remainder of June and first half of July. The Nymex July futures contract closed the day 14.3 cents lower and failed to gain ground throughout the week. After shifting a penny or so in either direction during the next three trading sessions, the July futures contract ultimately sustained that 14.3-cent loss to settle Thursday at $2.894.

“July natural gas prices held right along $2.90 support, which, as can be seen, has been seemingly magnetic through the week, with prices closing around it each of the last four days,” forecasters at Bespoke Weather Services said late Thursday.

New York-based Bespoke said it expected prices to remain rangebound Friday as well as easing production was being negated by lackluster weather and demand. By mid-day, the Nymex July contract had traded in a tight 4.5-cent range.

AccuWeather forecasters called for much cooler air over the weekend for parts of the northeastern United States after Tropical Storm Cindy caused torrential downpours and high humidity in the region. The rest of the country was expected to see continued heat.

“Temperatures and humidity levels will likely stay below average from later this weekend through the middle of next week,” according to AccuWeather Long-Range Meteorologist Max Vido.

In fact, there are no signs of heat returning and staying for an extended period through the first part of July. “Instead, it looks like pattern favoring back-and-forth warm and cool days with only a brief spike in heat for a day or two into the first week of July,” Vido said.

NatGasWeather forecasters agreed more sustained heat would be elusive until the middle of next month.

“The overnight weather data was a little hotter for late next week (June 26-30), but then cooler for the first several days of July. The data still maintains a hot pattern after July 5, just delaying it again by a few days. Thus, the data shows a mix of warmer and cooler trending periods, but most importantly, delaying the arrival of intimidating heat,” NatGasWeather said.

The forecaster said if prices sell off Friday, the markets will be suggesting they are annoyed more intimidating heat over the east-central U.S. has again been delayed. If prices hold up, which they appeared to be doing mid-day Friday, the markets will be saying they are okay overlooking cooler trends for the first few days of July since a hot pattern is still showing up in the weather maps after July 4-5.

Regardless, weather will be key going forward. NGI’s Patrick Rau, director of strategy and research, said if hot weather doesn’t show up soon, it will be very difficult for gas prices to recover until the winter, since that will just add to the storage overhang.

Thursday’s storage report from the U.S. Energy Information Administration was viewed as slightly bearish after 61 Bcf was reported to be injected into inventories for the week ending June 16, about 3 Bcf higher than what the market was expecting. During the same week last year, 63 Bcf was injected, and the five-year average stands at 82 Bcf. Inventories now stand at 2,770 Bcf, 324 Bcf below year-ago levels and 207 Bcf greater than the five-year average.

“We see the market as still fairly valued heading into the weekend, with the bearish EIA print matching limited weather risk,” Bespoke Weather Services said, adding that volatility has continued to fall as prices remain below the 30- and 60-day moving averages.

While weather is out of everybody’s hands, there are a few things that are more controllable that may not cause prices to rally by leaps and bounds in the short-term, but that could help limit the damage to the downside, Rau said.

One of those is coal to gas switching.

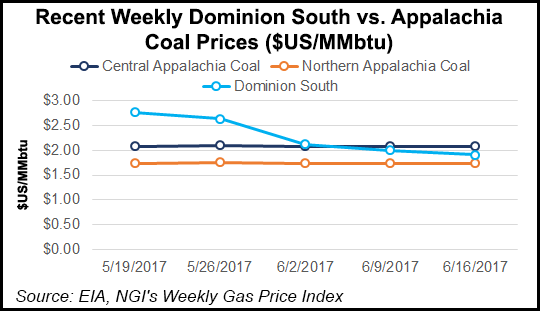

“Gas prices are starting to get to the point where some switching from coal to gas could start happening, which in turn should keep some gas from screaming into storage. Dominion South is the benchmark index for Appalachia production, and that has fallen at or below the key Appalachia coal indexes in recent weeks,” Rau said.

Indeed, Dominion July forward prices sat June 16 at $1.91, below the $2.09 price for Central Appalachian coal and just north of the $1.75 price for Northern Appalachian coal, according to NGI and EIA data. (see chart)

Dropping the number of rigs is another means to keeping the bottom from falling out from under gas prices. “Year-over-year production increases turned positive earlier this month, and given the large lead time between spudding wells and turning them on line, dropping rigs will take awhile to manifest into production losses,” he said.

Simply shutting in production would have a more immediate impact, although Rau said he did not think the market was quite at that level yet. Furthermore, it will be another month until producers start announcing any such plans via earnings conference calls, if that is indeed the plan.

“But after rising steadily over the last year, rig counts have stabilized in recent weeks, and given that drilled but uncompleted well counts outside of the Permian have decreased since May 2016, dropping rigs should translate into lower production a bit faster, everything else being equal,” Rau said.

Rau also didn’t discount the impact delays in bringing Energy Transfer’s Rover Pipeline into service could have on prices at multiple pricing locations. “The longer Rover is delayed, the longer it keeps 1-2 Bcf/d of supply off the market (the pipe is 3.25 Bcf/d, but it won’t fill right away),” he said.

While Rover’s delay may not cause prices to rally, keeping that supply off the market should help limit the downside. Delaying Rover also keeps downward pressure on basis differentials in Appalachia, which could contribute to localized rig declines, possible shut-ins and power switching in the area. “Again, nothing that would drive prices dramatically higher, but something that could help keep a floor in place, and keep some gas out of storage,” Rau said.

Meanwhile, some see ongoing weakness in the crude market as also keeping the pressure on gas prices. Despite some late-week recovery, crude oil continues to hover in the low $40s/bbl. “…If the complex is going the other way, you would get another 5 to 6 cents out of natural gas,” a New York floor trader said Wednesday.

From a technical analysis standpoint, NGI’s Rau said the July contract has tested the key $2.88 support level established by the previous reactionary low in mid-March several times this week, and has held so far.

“July remains significantly oversold at these levels, and given the slow steady grind lower this month, perhaps there will be some short-covering ahead of July going off the board next Wednesday. However, if the dam breaks, traders may chase the next key support level, which is all the way down at $2.50,” Rau said.

Looking closer at forward markets across the country, most pricing locations followed the lead of the Nymex, which saw the July futures contract shed around 14 cents between June 16 and 22 to settle at $2.894, the August futures contract slip 15 cents to $2.915, the balance of summer (August-October) shed 12 cents to $2.924 and the winter 2017-2018 strip slide nearly 10 cents to $3.17.

One exception was the Tetco M-2, 30 Receipt point, which responded to news that the Texas Eastern Transmission LP (Tetco) Lebanon Extension project would be available for service as early as Aug. 1, three months ahead of schedule. The Lebanon Extension project would provide up to 102,000 Dth/d of transport capacity from Uniontown, PA, to delivery points in Tetco’s Market Zone M2 in or near Lebanon, OH.

The early in-service of the additional capacity offered some support to forward prices at Tetco M-2, 30 Receipt on Wednesday, but prices then posted sharper declines than most other market locations on Thursday to put the weekly declines in line with the rest of the country.

For example, on Wednesday, the Tetco M-2, 30 Receipt July forward package priced at $1.79, but then fell 4 cents on Thursday to $1.75. The rest of the country mostly saw swings of a penny or two on Thursday. The August forward package on Wednesday was at $1.85, but by Thursday, had fallen to $1.80, according to Forward Look.

For the June 16-22 period, Tetco M-2, 30 Receipt July forward prices fell 14 cents to reach $1.75, while August forward prices fell 13 cents to $1.80, the balance of summer dropped 13 cents to $1.89 and the winter 2017-2018 slid 11 cents to $2.74.

A similar trend played out at Dominion, which found some support earlier in the week on lagging storage inventories but then fell harder than other markets on Thursday. Dominion currently has 135 Bcf in inventories, 39 Bcf below year-ago levels and about 34 Bcf below the five-year average. June is typically when storage facilities like Dominion see injections peak, and cooler weather forecast for the next few weeks should help inventories close the gap on historical levels.

Still, the current storage situation at Dominion appeared to temporarily soften the blow for prices along the forward curve. On Wednesday, the Dominion July forward price sat at $1.76, but then dropped 3 cents on Thursday to $1.73, according to Forward Look. August forward prices on Wednesday were at $1.82, but then dropped to $1.78 the next day.

Overall, Dominion July forwards slid 13 cents from June 16-22 to reach $1.73, August forwards dropped 11 cents to $1.78, the balance of summer (August-October) fell 12 cents to $1.86 and the prompt winter eased by 10 cents to $2.63, Forward Look data show.

Meanwhile, Waha forward prices posted more substantial declines across the curve amid ongoing drilling, and rising associated gas production, in the Permian basin. Waha July forward prices plunged 19 cents from June 16-22 to reach $2.62, August forward prices dropped 18 cents to $2.68, the balance of summer (August-October) tumbled 16 cents to $2.62 and the winter 2017-2018 slid 10 cents to $2.81, Forward Look data show.

On June 23, Baker Hughes reported the U.S. rig count rose by 8 to 941. One of those rigs was in the Permian basin, bringing the number of rigs in that basin up to 369.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |