Infrastructure | E&P | NGI All News Access

North America Down Three NatGas Rigs, Up 11 for Oil Despite Bearish Crude Headwinds

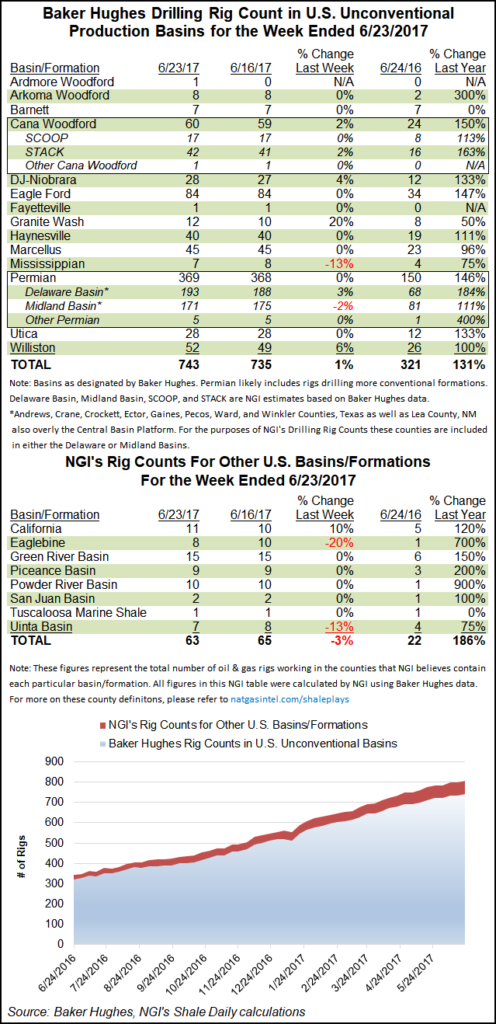

North American drillers were undeterred by bearish shifts in crude oil prices for the week ended June 23, as 11 U.S. oil-directed rigs returned to the patch, according to Baker Hughes Inc. (BHI) rig count data released Friday.

Three U.S. natural gas rigs packed up for the week. That left the United States to finish at 941 rigs total (758 oil, 183 gas), up eight for the week and 520 above the year-ago tally, BHI said. Canada added 11 rigs for the week, seven oil and four gas.

The total North American count gained 19 to 1,111 rigs for the week, up 614 from 497 rigs a year ago.

Oklahoma, home to various stacked formations, was the biggest gainer among states, adding five rigs to finish at 132, well above its year-ago count of 54. The Ardmore Basin’s Woodford and Cana Woodford formations each added a rig, while the Granite Wash added two, according to BHI.

North Dakota’s Williston Basin carried over its momentum from last week, adding another three rigs to finish at 52, double where the play stood a year ago.

Meanwhile, the Permian Basin added one net rig during the week; the Midland sub-basin lost four rigs, though they may have simply switched over to the neighboring Delaware sub-basin, which added five.

Alaska proved the biggest loser among states, giving up two rigs to fall to five, down from nine a year ago. Utah and New Mexico each saw one rig leave.

The enthusiasm among drillers reflected in the week’s oil rig gains came amid mounting concerns over declining crude prices.

The New York Mercantile Brent August contract has been trading on a steady downward trajectory the past few weeks, from recent highs in the mid- to lower-$50s/bbl to around $45/bbl as Friday’s close approached.

“The talk from Iranian Oil Minister Bijan Namdar Zanganeh regarding possible further” cuts from the Organization of Petroleum Exporting Countries (OPEC) “may be a reminder that a falling oil price does increase the pressure and odds of a further adjustment on the part of OPEC suppliers, although the near-term emphasis may be on how ‘difficult’ it will be to reach a consensus,” Citi Futures analyst Tim Evans said in a mid-week note to clients. “In similar fashion, further price weakness may also take the edge off U.S. production growth prospects.

“Crude oil supplies may be price inelastic over the near-term, but over the intermediate- to longer-term, adjustments will be made.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |