Broad Natgas Gains No Match For California, Northeast Weakness; July Drops A Penny

Physical natural gas prices for Thursday delivery did something of a flip-flop in Wednesday trading as spot prices in the Northeast and California weakened and points in Louisiana, Texas, and the Midcontinent firmed. The NGI National Spot Gas Average fell 2 cents to $2.72.

Futures trading was lackluster with traders trying to balance the expected moderation in temperatures with supportive storage figures expected Thursday. At the close July had eased 1.4 cents $2.893 and August was off 1.5 cents to $2.915. August crude oil continued its downward spiral losing 98 cents to $42.53/bbl.

Forecast high temperatures for the desert Southwest kept California prices elevated although prices eased slightly as traders expected high pressure to move on out by the weekend and take the high temperatures with it. AccuWeather.com predicted Wednesday’s 87 high in Los Angeles would ease to 84 by Thursday and by Friday reach 81, just one degree above normal. Las Vegas’ Wednesday max of 116 was seen sliding to 115 Thursday and 114 Friday, 14 degrees above normal. Phoenix’ peak of 117 Wednesday was forecast to dip to 114 Thursday and 112 by Friday, 6 degrees above normal.

A Denver trader said that if the high pressure moves out and temperatures moderate “you would think prices would ease, but if everyone else is pricing that in it could just keep prices from going higher. You would think you would see a little bit of a pop on the Nymex based on the heat in the West. I know the 6- to 10 is going to be cool over the central US, but this time of year you are taking it from 77 or 80 degrees down to 72. It’s not as though there’s a lot of load out there.”

Gas on Malin was flat at $2.68 and deliveries to the PG&E Citygate rose a nickel to $3.19. Gas at the SoCal Citygate shed 16 cents to $3.99 and gas priced at the SoCal Border Average dropped 14 cents to $3.40.

“The most extreme heat wave in recent years will throttle back slightly across the southwestern United States but will still remain at dangerous levels into the weekend,” said AccuWeather.com meteorologist Renee Duff. “Hot air started cranking up to full force on Monday and Tuesday, with record highs shattered, flights canceled and energy consumption pushed to high demand.

“Temperatures at Sky Harbor International Airport in Phoenix soared to 119 degrees Fahrenheit on Tuesday, a level which has not been achieved since June 29, 2013. Las Vegas soared to 117 F which tied their all-time record high for any date. Beyond Wednesday, temperatures will remain at life-threatening and record-challenging levels, despite conditions turning slightly less extreme,” she said.

Other market points fluctuated within a few pennies of unchanged. Gas at the Algonquin Citygate added 10 cents to $2.85 and deliveries to Dominion South dropped 2 cents to $1.83. Gas at the Chicago Citygate added 3 cents to $2.80 and packages at the Henry Hub were quoted a penny higher at $2.88.

El Paso Permian traded flat at $2.76 and gas at Northern Natural Demarcation fell a penny to $2.69. Deliveries to Opal changed hands a penny higher at $2.66.

Traders are looking at natural gas as being pressured by the free-falling crude and products. “Natural gas is being dragged down by the whole complex,” said a New York floor trader.

“Natgas is only down a penny and a half. If the complex is going the other way, you would get another 5 to 6 cents out of natural gas.”

July futures opened 2 cents higher Wednesday morning at $2.93 as changes to the weather outlook were in the moderately cooler direction, but models showed considerable variability.

“The forecast sees a small change in the cooler direction in the Eastern Half where below normal temperatures are widespread in coverage,” said MDA Weather Services in its morning six- to 10-day forecast. “The coolest conditions are forecast in the early half as high pressure passes through, but some moderation is expected late out ahead of a shortwave low coming out of western Canada.

“There remains a bit of disagreement among the models with this feature and its impact on the Eastern Half trough from mid to late period, a factor which keeps confidence to the lower side of usual. Warmer changes were generally limited to the West, where aboves are favored.”

MDA also reported that Tropical Storm Cindy, currently situated south southwest of Morgan City, LA, will continue its movement to the northwest and likely make landfall at the Texas-Louisiana border Thursday morning. Maximum winds were 57 mph, and it was moving to the northwest at 7 mph.

“Cindy will bring tropical storm conditions to the key production areas starting [Wednesday] and continuing through Thursday, ” the forecaster said.

“Based on satellite imagery, Cindy does not appear like a tropical cyclone. There is no convection in the vicinity of the center with convection well removed to the northeast.”

Market technicians see the market needing to make a substantial rally in order for the bulls to reclaim any semblance of upward price movement. “Only hint of bottoming is some minor divergence on the 720 minute charts,” said Brian LaRose, market analyst with United ICAP after Tuesday’s close. His figures show that spot futures would have to climb back above $3 “in order to make a case for a recovery of some kind here.

“As long as NatGas can remain” below $3 “we will continue to favor a more substantial test of” the low $2.80s. If that doesn’t hold, “the door will be open” for a decline to the mid $2.60s to low $2.70s.

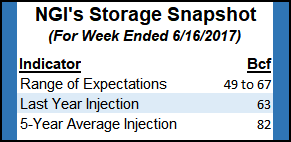

Futures may have a chance at reaching above $3 with the release of Thursday storage figures by the Energy Information Administration. Last year 63 Bcf were injected and the five-year pace stands at 82 Bcf. This week’s estimates are far less than the 5-year average.

Citi Futures Perspective is looking for a build of 51 Bcf and Ritterbusch and Associates calculates a 67 Bcf injection. A Reuters survey of 22 traders and analysts revealed an average 58 Bcf with a range of +50 Bcf to +67 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |