Markets | NGI All News Access | NGI The Weekly Gas Market Report

Plenty of Optimism Despite Declines in Reported Volumes, Says NGI Expert

The number of natural gas transactions disclosed to NGI and other price reporting agencies (PRA) has been in an overall decline since the financial crisis of 2008, but there are reasons to believe volumes are stabilizing and problems will be prevented before they reach a critical level, according to NGI’s Patrick Rau, director of Strategy & Research.

In a presentation at the recent LDC Gas Forums Northeast conference in Boston, Rau identified several factors that have contributed to the declines in FERC 552 volumes for day-ahead and bidweek transactions since 2008. The rate of decline in reported deals actually has stabilized somewhat since 2014, he said.

“The concern is if these declines continue at the same pace, perhaps they reach a critical level where we’re no longer able to calculate indexes in the way that we always have. That would be bad,” Rau said. “The good news is that we think this rate of decline has actually been slowing. It’s been stabilizing the past few years, and what we’re hopeful of is that there’s always going to be a base level of reportable transactions that will get reported to the PRAs that we can use to calculate our indexes.”

If the hypothesis is correct, the rate of decline observed over the last few years would “continue to get smaller and smaller and smaller over time. We think that’s what we’re seeing in the day-ahead market. In the bidweek market, there’s still a little bit of work to do. We’re not quite there yet, but there are other reasons why we’re hopeful and optimistic things will be improving there as well.”

Reported volumes for next-day and bidweek deals saw modest year/year gains in 2015, but the number of estimated deals in 2016 reportedly declined 1.5% year/year for day-ahead and 7.1% for bidweek, according to Federal Energy Regulatory Commission 552 data and NGI estimates and calculations.

“I don’t like that [bidweek] number. Nobody should like that number,” Rau said.

One factor in the estimated declines last year is that “we haven’t received all of the 2016 data. Most companies have reported, but there are still a few who have yet to do so.”

Gas Production Fell in 2016

Another factor could be the drop in U.S. natural gas production for the year, the first such falloff in more than a decade, according to Rau. Producers as a whole tend to report to PRAs, so a drop in produced volumes would put downward pressure on reported volumes, he said.

“If you take the production decline out, if we had more of a pro forma-type of number,” the 2016 changes “would look much better and again support our thesis of smaller year-over-year percentage declines,” Rau said.

Looking at the bigger picture, several factors have contributed to the declines in transactions reported to PRAs, according to Rau.

For example, the number of companies reporting has decreased.

“The shale revolution has had a big impact on reported volumes to PRAs. We have seen a huge increase, obviously, in the trendline rate of natural gas production growth in the last decade…that’s been largely led by independent producers that as a group don’t tend to report to PRAs,” Rau said. Integrated producers tend to report to PRAs, but the independents do not, he explained.

Looking at the 20 largest publicly traded natural gas producers in 2016, only six reported to PRAs, Rau said. Of those six, only one experienced growth from 2013 to 2016.

Another factor is the regulatory concerns that emerged after the Dodd-Frank Wall Street Reform and Consumer Protection Act was passed in 2008. That led some investment banks and trading shops to pare back or get out of the business altogether, he said. The House voted earlier this month to revamp most of act, but whether the Senate will follow remains in question.

Declining Price Swings

Then there’s the overall decrease in price volatility.

“We believe that any sort of fear about running out of supply has been priced out of the market, which has decreased volatility, and you can see that,” Rau said. “The good news though is that volatility has picked up a little bit over the past few years. We expect that will continue to increase,” particularly as liquefied natural gas (LNG) export facilities “come online, because that’s going to connect us more with worldwide markets.

“Now if there’s a price spike in Asia or Europe, we’re in a much better position to take advantage of that. That should lead to more volatility, more trading and more reported volumes to PRAs.”

Changes also have been made in how gas processing companies do business, which has led to “fewer equity volumes to contribute to the PRAs,” Rau said, something he believes is “probably a structural, permanent thing, but it is what it is.”

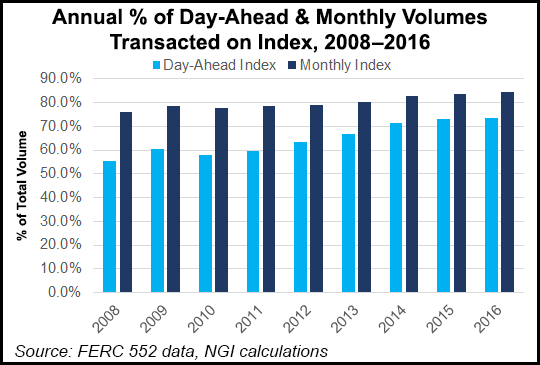

However, the biggest reason for declines in reported transactions is that the share of total transactions tied to indexes has increased — at the expense of fewer fixed-price and physical basis transactions that help determine these very indexes.

“That’s a problem for us, because we cannot calculate indexes using indexed deals,” Rau said. “Now, it’s flattering this is happening. We provide these indexes, we’re glad the industry is using them more, but if we use them too much, we run into the risk of running out of deals to actually calculate our indexes.”

The overall growth in the U.S. natural gas market — driven in part by LNG, industrial and petrochemical demand, and growing exports to Mexico — is a major reason for PRAs such as NGI to remain optimistic going forward, Rau said.

Price Assessments Not Wanted

But if the number of reported volumes continues to decline, it could reach a level where NGI would have to provide price assessments, and “that’s not anything we want do,” he said. NGI would be prepared if it were to reach that point — or if FERC were to step in and require companies to report.

“Now, we realize the decision to report to PRAs is very much a cost-benefit decision. And we understand the costs. Believe me, we understand those costs,” Rau said. “But what I’m asking is, when you make that decision whether to report, please don’t just do it at the company level. Do it at the industry level, because ultimately if the current system of voluntary reporting were to fail, either we need to do assessments, or the FERC could step in and require mandatory reporting to PRAs.

“That’s not anything we want. I don’t think you want it. I know the FERC probably doesn’t want it. It’s best to leave the government out and have this be voluntary.”

On the bidweek side, Rau raised the possibility of using “synthetic indexing” to help bolster reported volumes.

“The concept is this: We believe it’s possible to replicate published bidweek indexes by doing a series of basis trades that are priced to forward contracts during bidweek,” he said. “All that has to do with the rules of financial arbitrage and convergence.” He explained that the Henry Hub bidweek index comes in about where the New York Mercantile Exchange contract settles.

“By the same financial theory, so too should basis trades be priced around the same prices where forward curves are trading during bidweek.”

NGI has done the math and concluded that “it is indeed possible to replicate indexes this way. And the cool thing about it is, physical basis trades are already reportable to the PRAs, so this could be one way to really help boost the reported volumes to bidweek, which has been the bigger of the two issues.”

Rau said it would be business as usual for NGI following a deal between S&P Global Platts and the Intercontinental Exchange (ICE), wherein ICE agreed to share transactional data.

NGI entered into a data sharing agreement with ICE in 2008, and that agreement is continuing with no end in sight.

“It doesn’t really affect us. That’s the short answer,” Rau said. “Our agreement with ICE is going to continue in perpetuity.” The other ICE deal “does not impact us at all. I know there were some concerns that there was an exclusivity arrangement between Platts and ICE. That is not the case. We will continue to receive those data from ICE, which, along with the data we receive directly from the trading companies, constitutes the data from which NGI price indexes are determined. If anything, if Platts is using the same data we are…it should be closer to our indexes, which just makes NGI all the more either a complement — or a viable alternative” — to Platts.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |