Storage Rattles NatGas Forwards But Damage Already Done; Heat Crucial to Ongoing Strength

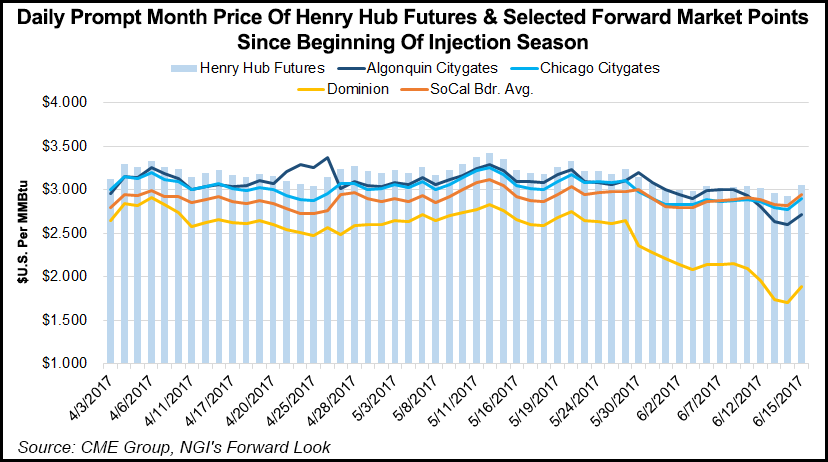

Natural gas forward prices for July fell an average 2.8 cents between June 9 and 15 as a late-week rally failed to overcome earlier market weakness. Still, Thursday’s more than 12-cent surge offered a glimmer of hope to the market that had, up until this point, had little reason to believe $3 gas was all but in the rearview mirror, according to NGI’s Forward Look.

The Nymex futures strip set the tone for the week, which was mostly characterized by weakness brought on by an exiting heat wave that somewhat disappointed the market as power demand came in less than many had anticipated the prior week.

Adding salt to the wound were forecasts calling for a weather system and associated cool shot that were expected to track into the central United States over the weekend, then across the Great Lakes and Mid-Atlantic early in the week for a return to comfortable conditions and light natural gas demand, according to NatGasWeather.

Hot conditions are expected to remain over the central and southern United States, as well as the West, with widespread highs of upper 80s to 100s, to drive regionally strong demand. Late in the week and into the June 24-25 weekend, slightly cool conditions are forecast over the northern United States because of weak weather systems tracking across, although the southern part of the country is expected to remain quite warm, the forecaster said.

However, while weather failed to spark any fires in natural gas futures/forwards early in the week, Thursday’s storage report from the U.S. Energy Information Administration (EIA) sent shock waves through the market and sent the Nymex July futures contract catapulting more than 12 cents to $3.056.

The EIA reported a 78 Bcf injection into storage inventories for the week ending June 9, far below market estimates in the mid-80s Bcf range and below the five-year average of 87 Bcf. At 2,709 Bcf, inventories were 322 Bcf less than last year at this time and 228 Bcf above the five-year average of 2,481 Bcf.

Wells Fargo Securities LLC analysts said the smaller-than-expected build backed up their long-held projection of an undersupplied natural gas market. “This week’s figure marked a reversal of a four-week trend in which the storage injection was higher than forecasted by 6 Bcf on average each week,” the analyst team said following the EIA report’s release. “Additionally, this data point provides further confirmation that the natural gas markets are at least 2 Bcf/d undersupplied.”

Wells Fargo is projecting a 102 Bcf cumulative injection over the next two weeks based on current weather forecasts, which would bring the storage surplus versus the five-year average down to just 182 Bcf. The bank’s end-of-injection season storage projection is 3.88 Tcf, which is in line with the five-year average and incorporates 3 Bcf/d of lost power generation demand because of to gas-to-coal switching driven by higher summer natural gas prices.

Still, if markets bulls are to continue the upswing that began with Thursday’s surprise storage report, Mother Nature is going to have to add some fuel to the fire as prices have yet to break through the 100- and 200-day averages, according to NGI’s Patrick Rau, director of strategy and research.

“While the Nymex July contract is technically oversold — with slow stochastics showing a very low reading of about 17 or so, easily below the 20-25 level traders consider to be the oversold threshold — $3 is also serving as a pretty strong support level right now,” Rau said. “But all that support is being countered by what appears to be pretty good resistance by the moving 100- and 200-day averages, both of which have been hovering at either side of $3.10. The spot month has tested but failed to break above those averages for 13 consecutive trading sessions.”

The tide appears to be turning on the weather front. NatGasWeather said a strong upper-level high pressure is expected to cover the southern two-thirds of the country with the hottest temperatures so far this year around June 25-26.

The latest weather data maintains this very warm to hot pattern, with temperatures in the 90s to 100s over locally affected areas. Temperatures aren’t expected to be as aggressive far north as the upper ridge advances, the forecaster said. Still, NatGasWeather forecasters said Thursday’s rally was the market finally pricing in the hot weather risk, as prices failed to sell off after the market had time to digest the storage number.

“To our view, if the markets didn’t see weather patterns as hot enough, they would have sold off after the spike off [Thursday’s] EIA report,” NatGasWeather said. “But with prices holding, we interpret it as the markets being coy the past couple days about the potential for hotter temperatures, or wanting more convincing evidence of it, and are now finally pricing in the risk.”

Rau, however, isn’t as convinced. Trading volume has been lower in recent days, but that’s not atypical for the middle of the month, as volume tends to spike closer to the prompt month expiration, he said.

“However, I do think the lack of activity in recent days reflects a lack of conviction as to how the summer is shaping up. Thursday’s storage report was bullish, but weather still hasn’t really kicked in, and daily production volumes are starting to show year-over-year increases for the first time in several quarters,” he said.

Tom Saal, senior vice president of energy trading at FCStone Latin America LLC, agreed the market was in “from Missouri, the ”Show-Me State.’ If the hot weather can remain through next week, July ’17 natural prices should show support at $3.00. Wind power and solar power also are contributing factors in natural gas oscillations.”

Meanwhile, production soared above 72 Bcf/d on June 10, reaching a month- and year-to-date high. Maintenance issues led to softer production to start the week, but data and analytics company Genscape Inc.’s Spring Rock Pipe Flow estimate showed production back above 71 Bcf/d by Thursday, still lagging the previous week’s high by more than 1 Bcf/d.

Analysts with Tudor, Pickering, Holt & Co. (TPH) said while recent production is off recent highs, volatility is likely caused by seasonal infrastructure outages rather than changes in underlying production. “The medium-term risk to price remains linked to likely meaningful supply growth,” TPH said in a Friday note.

Meanwhile, the slight easing of bullish risk in the latest weather models may help cancel out some of the tightening the market has seen in EIA estimates over the next few weeks, as new adjusted data shows stockpiles growing far slower and gradually approaching the five-year average over the next month, the weather team at Bespoke Weather Services said. The market will need to see bullish weather risk verify in order for balancing to occur, it said.

In addition, the New York-based weather forecaster cautioned there may be a more bearish revision in the next storage report following the bullish miss for the week ending June 9, but said the market is clearly a bit tighter than previously expected, which explained the large jump in prices Thursday.

“The July natural gas contract rallied by over 4%…following a bullish miss in EIA data…that conï¬rmed that production increases are being canceled out by increased near-term cooling demand,” Bespoke said late Thursday.

Analysts at Houston-based Mobius Risk Group agreed, noting the recent price collapse shifted the fuel mix in the power stack and as a result, power burn levels may become notably bullish in the near-term. “Also adding support and providing an upside catalyst is substantial reduction in speculative net length over the past couple of weeks,” analysts said.

Meanwhile, weather models overall are becoming more convinced that hot weather is here to stay. Global weather models favor slightly to moderately above-average demand to end the month, while Canadian models continue to favor widespread heat, Bespoke said.

Louisville, KY-based Genscape also sees heat continuing to keep demand well supported in the coming weeks. Power burns are expected to climb daily through Wednesday, reaching a season-to-date high of 34.8 Bcf/d.

“If actuals materialize near the forecast, the June burn will average around 29.4 Bcf/d. While notable in the context of this June, it is worth noting burns still trail last summer and June-to-date levels. Last June averaged 32.1 Bcf/d with a peak at 37.1 Bcf/d,” said Genscape analysts.

Some of the hottest weather in the near-term is forecast in the West, where the Genscape power team is expecting the highest load numbers of the season over the week. They were projecting peak load within the California ISO to exceed 40 GW over the next five days, with similar spikes in other markets within the Western Electricity Coordinating Council.

Meanwhile, Bonneville Power Administration hydro generation is entering its seasonal decline, and the California ISO market will remain without generation from PG&E’s Diablo Canyon nuclear unit, which is not expected to return to service until June 22 (Thursday).

The heat and reduced supply from nuclear and hydro have Genscape projecting gas demand during the third full week of June averaging 6.342 Bcf/d, up from the previous seven-day average of 4.46 Bcf/d. The last week of the month is expected to see demand average 5.98 Bcf/d.

Forward markets in California reflect the stronger demand as gains for the week were slightly stronger than the benchmark Henry Hub.

Nymex July futures climbed 1.5 cents from June 9 to 15 to reach $3.056, August rose 1 cent to $3.08 and the balance of summer (August-October) picked up 1 cent to $3.08. The winter 2017-2018 strip, meanwhile, fell 1 cent to $3.29, while packages further out the curve also ended marginally in the red or stayed flat on the week.

At Southern California Border, July forward prices edged up 2.5 cents from June 9-15 to reach $2.94, August rose 1 cent to $2.994 and the balance of summer (August-October) picked up 1 cent to hit $2.92, Forward Look data shows. The rest of the curve followed the Nymex lower.

Meanwhile, Appalachian forward prices got hammered this week as demand was expected to plunge from a weekly high of 10.68 Bcf/d set June 12 to an average 8.76 Bcf/d for the June 19-23 businessweek as temperatures may retreat to the 60s and 70s. The last full week of June could see demand average 8.84 Bcf/d, according to Genscape.

Double-digit declines were the norm across the region and were seen throughout the remainder of summer. At Dominion, July forward prices tumbled 20.7 cents from June 9-15 to reach $1.884, August forwards dropped 23 cents to $1.908 and the balance of summer (August-October) fell 18 cents to $1.99, according to Forward Look.

In New York, Transco Zone 6-New York July forward prices plummeted 14.2 cents from June 9-15 to reach $2.595, August forward prices fell 13 cents to $2.613 and the balance of summer (August-October) dropped 14 cents to $2.51.

The dramatic declines in the Appalachia/Northeast region come on the heels of retreating cash prices, where Transco Zone 6-NY prices peaked at $3.09 in trading for Tuesday’s gas day but then plunged 90 cents the very next day. That weakness was also evident in forward basis trading, where July basis prices at New York and across Appalachia and the Northeast dropped more than 10 cents the same day, while July basis prices at most other market hubs barely budged.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |