Markets | Mexico | NGI All News Access | NGI Mexico GPI | NGI The Weekly Gas Market Report | Regulatory

Mexico’s CRE Abolishes First-Hand NatGas Price, Opens Market to Competition

Natural gas prices have been freed throughout Mexico, the nation’s energy regulator Comision Reguladora de Energia (CRE) declared in a decree published Friday in the Diario Oficial, the equivalent of the U.S. Federal Register.

The measure was presaged by 2013 energy reforms, but its implementation had not been expected for some time.

According to the decree, the maximum price for natural gas, known as the first-hand price, or VPM, was abolished.

“This is a very pleasant surprise,” said consultant George Baker, president of Houston-based Mexico Energy Intelligence.

For more than two decades, Mexico has not resolved the role of natural gas in energy, environment and urban policy, Baker said. But the CRE’s recently announced gas release program orders state-owned oil and natural gas operator Petroleos Mexicanos, or Pemex, to reduce its customer portfolio by 70%.

If that happens, Baker said, new doors would open for gas resellers, and the promise of the energy reform would be realized, for natural gas at least.

CRE on Friday spelled out the result of the day’s action. “That means that economic agents other than Pemex can offer supply options,” it said.

CRE said two markets in Mexico have been the main factors in determining the VPM. One is Reynosa, near the U.S.-Texas border, and the other at Ciudad Pemex in the southern state of Tabasco, where most of the gas produced in Mexico is processed.

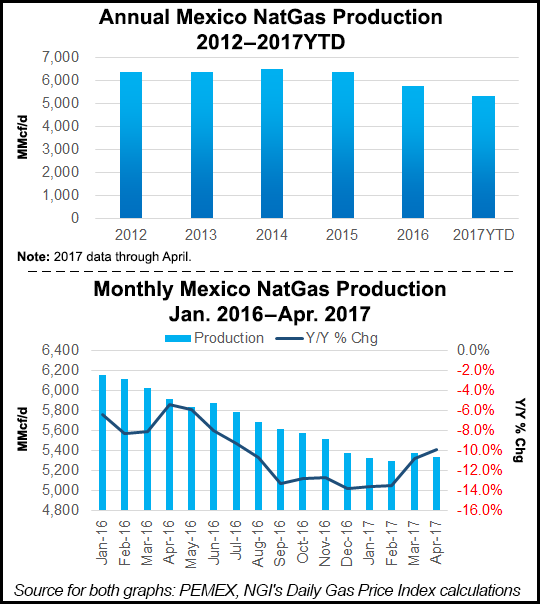

With a range of prices on offer, Pemex gas production should be boosted, which should reduce the nation’s natural gas deficit, particularly in southern and southeastern Mexico.

The 16 producers other than Pemex, nine of which are in southern Mexico, would have incentives to produce more, the La Comision Nacional de Hidrocarburos (CNH) said. The 16 were declared winners in the upstream auctions of Round One of the energy reform. So far, however, the 16 are only marginal producers.

Auction round 2.1, for shallow water drilling, is scheduled to open Monday (June 19), with rounds 2.2 and 2.3, for offshore and conventional onshore properties, to follow on July 12. The start of round 2.4 (deepwater and unconventional onshore) has yet to be determined but should take place before the end of 2017.

The CNH pointed out that a free market also would be an incentive for companies that have the capacity to import and transport through the Sistrangas pipeline system of the natural gas regulator, Centro Nacional de Control del Gas Natural (Cenagas).

And the CNH expects that the free market would, in the medium-term, generate more projects in areas such as transportation, storage, regasification and compression.

However, eliminating the price ceiling “does not imply the total deregulation of the VPM system,” the CRE added. It would continue to regulate the terms and conditions of the VPM and of Pemex contracts. The aim is to provide safeguards in terms of fair conditions for those that trade in the markets and of the nation’s consumers.

On July 1 Mexico plans to launch the pipeline capacity reservation contract model as the next step on its way to a fully competitive natural gas market.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |