Markets | NGI All News Access | NGI Data

NatGas Cash Posts Solid Gains; July Futures Punch Through $3

Both the physical natural gas and futures markets erased the memories of Wednesday’s down day and returned to the win column in Thursday’s trading. Modest weakness of a few points in the Midwest, Southeast, and Northeast was countered by gains of a few pennies upwards to a dime at most market points. The NGI National Spot Gas Average 2 cents to $2.65.

Futures bulls got a boost with the 10:30 a.m. EDT release of storage figures from the Energy Information Administration (EIA) that were significantly less than what the market was expecting. At the close July had added 12.3 cents to $3.056, and August had tacked on 12.5 cents to $3.078. July crude oil continued its trek lower falling 27 cents to $44.46/bbl.

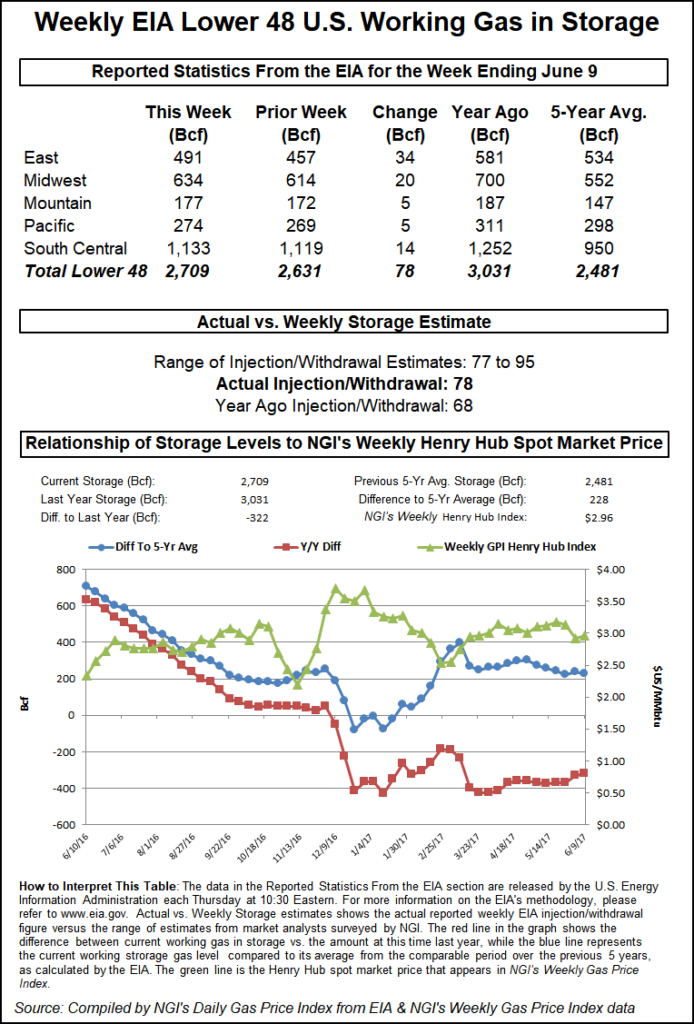

The EIA reported a storage injection of 78 Bcf, about 8 Bcf less than consensus estimates, and prices wasted no time moving higher after the number was released.

Prior to the report traders were looking for a storage build greater than the actual figures. Last year 68 Bcf was injected and the five-year average stands at 87 Bcf. Citi Futures Perspective calculated a 91 Bcf injection and ION Energy was looking for an 86 Bcf increase. A Reuters survey of 28 traders and analysts showed a sample mean of 86 Bcf with a range of plus 77-94 Bcf.

Once traders had time to digest the figures, July futures vaulted to $3.034, and at 10:45 a.m. July was trading at $3.025, up 9.2 cents from Wednesday’s settlement.

The market needs to hold $2.99 to $3.01, a New York Floor trader told NGI. “If it starts to touch the $2.99 area, I think it slips back down. Although the market bounced back, I don’t think it’s a rebound. The whole complex feels heavy.”

“The 78-Bcf net injection for last week was smaller than expected and below the 87 Bcf five-year average for the date with no reclassifications or other asterisks, a clear bullish surprise,” said Tim Evans of Citi Futures Perspective. “With warmer than normal temperatures this week and next also limiting the rate of injections, the market may be set up for a short-covering rally back above the $3.00 level, with potential to move back up to $3.20-3.25 in our view.”

The Wells Fargo Securities analyst team lead by David Tameron said the smaller than expected build backs up their long-held projection of an undersupplied natural gas market. “This week’s figure marked a reversal of a four-week trend in which the storage injection was higher than forecasted by 6 Bcf on average each week,” the team wrote in a post-storage Thursday morning note. “Additionally, this data point provides further confirmation that the natural gas markets are at least 2 Bcf/d undersupplied.”

Looking at current weather forecasts, the Wells Fargo model indicated a 102 Bcf cumulative injection over the next two weeks, which would bring the storage surplus (versus the five-year average) down to just 182 Bcf. “As a reminder, our forecast for end-of-injection season storage is 3.88 Tcf, which is in-line with the five-year average and incorporates 3 Bcf/d of lost power generation demand due to gas-to-coal switching driven by higher summer natural gas prices.”

Inventories now stand at 2,709 Bcf and are 322 Bcf less than last year and 228 Bcf above the five-year average.

Futures traders also had longer term weather forecasts working for them as well as more deferred weather models continue to hold to a pattern of above normal temperatures. “The themes of the forecast remain consistent with previous expectations as above normal temperatures take focus in the Central United States,” said MDA Weather Services in its morning 11- to 15-day outlook. “This is supported by the background” Madden Julian Oscillation “in phases 1 and 2, phases which also promote pattern variability along the East Coast.

“The forecast averages the period near normal in the East, but with opportunity for aboves to spill into the region in the mid-period. While recent weakening in” Atmospheric Angular Momentum, a measure of how fast the atmosphere is spinning relative to the Earth’s rotation, “is also supportive of these warmer forecast themes, confidence remains low in the details given poor model skill and differing model solutions as it relates to the progression of the pattern.”

In the physical markets forecasts of increased power load in California continued to bear down on the spot market with all major market centers followed by NGI falling solidly in the black. CAISO forecast that Thursday’s peak load of 35,273 MW would jump more than 12% to 39,767 MW Friday. The peak load ever recorded by CAISO is 50,270 MW reached during a heat storm in July 2006.

Gas at Malin added 3 cents to $2.68 and deliveries to the PG&E Citygate rose 2 cents to $3.08. Gas at the SoCal Citygate gained 8 cents to $3.14 and gas priced at the SoCal Border Average was quoted 9 cents higher at $2.79.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

The National Weather Service in Los Angeles reported that “a ridge of high pressure will continue to build across the southwest U.S. through early next week with additional warming expected during this time. The well above normal temperatures will likely continue for much of next week. Stronger onshore winds this upcoming weekend may delay warming for coastal areas.”

Other market centers were mostly higher. Although gas at the Algonquin Citygate eased 1 cent to $2.11, deliveries to Transco Zone 6 New York gained a dime to $2.21. Gas at the Chicago Citygate was quoted 4 cents higher at $2.79 and packages at the Henry Hub changed hands 2 cents higher at $2.92.

El Paso Permian rose 4 cents to $2.66 and gas priced at the NGPL Midcontinent Pool added 6 cents to $2.68. Kern River receipts jumped 9 cents to $2.69.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |