Markets | NGI All News Access | NGI Data

July NatGas Surges Past $3 On Bullish EIA Stats, But Can It Hold?

June futures managed a healthy gain Thursday once the Energy Information Administration (EIA) reported a natural gas storage injection that was somewhat less than what traders were expecting.

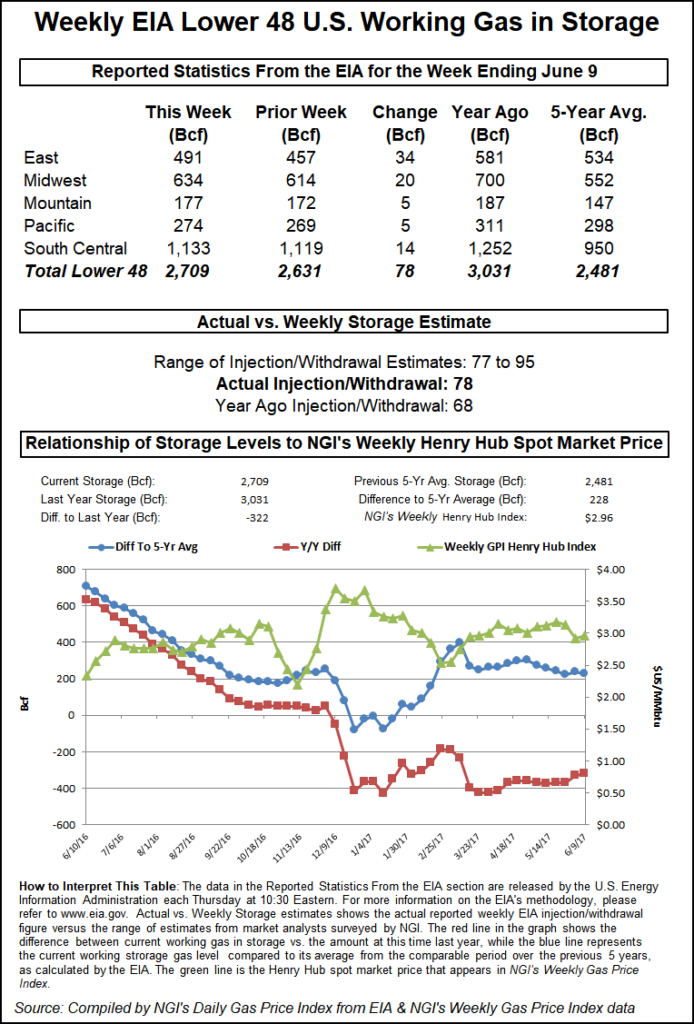

The EIA reported a storage injection of 78 Bcf, about 8 Bcf less than consensus estimates. Prices jumped after the number was released.

Once traders had time to digest the figures, June futures vaulted $3.034, and at 10:45 a.m. June was trading at $3.025, up 9.2 cents from Wednesday’s settlement.

Prior to the report traders were looking for a storage build greater than the actual figures. Last year 68 Bcf was injected and the five-year average stands at 87 Bcf. Citi Futures Perspective calculated a 91 Bcf injection and ION Energy was looking for an 86 Bcf increase. A Reuters survey of 28 traders and analysts showed a sample mean of 86 Bcf with a range of plus 77-94 Bcf.

The market needs to hold $2.99 to $3.01, a New York Floor trader told NGI. “If if starts to touch the $2.99 area, I think it slips back down. Although the market bounced back, I don’t think it’s a rebound. The whole complex feels heavy.”

“The 78-Bcf net injection for last week was smaller than expected and below the 87 Bcf five-year average for the date with no reclassifications or other asterisks, a clear bullish surprise,” said Tim Evans of Citi Futures Perspective. “With warmer than normal temperatures this week and next also limiting the rate of injections, the market may be set up for a short-covering rally back above the $3.00 level, with potential to move back up to $3.20-3.25 in our view.”

The Wells Fargo Securities analyst team lead by David Tameron said the smaller than expected build backs up their long-held projection of an undersupplied natural gas market. “This week’s figure marked a reversal of a four-week trend in which the storage injection was higher than forecasted by 6 Bcf on average each week,” the team wrote in a post-storage Thursday morning note. “Additionally, this data point provides further confirmation that the natural gas markets are at least 2 Bcf/d undersupplied.”

Looking at current weather forecasts, the Wells Fargo model indicated a 102 Bcf cumulative injection over the next two weeks, which would bring the storage surplus (versus the five-year average) down to just 182 Bcf. “As a reminder, our forecast for end-of-injection season storage is 3.88 Tcf, which is in-line with the five-year average and incorporates 3 Bcf/d of lost power generation demand due to gas-to-coal switching driven by higher summer natural gas prices.”

Inventories now stand at 2,709 Bcf and are 322 Bcf less than last year and 228 Bcf above the five-year average.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |