Infrastructure | LNG | NGI All News Access | NGI The Weekly Gas Market Report

LNG, Oil Make Analyzing North American NatGas A Global Undertaking, Say BP, Macquarie

Shaped by both liquefied natural gas (LNG) exports and crude oil production, the North American natural gas market is becoming increasingly globally interconnected — and more complex as a result.

That’s according to two keynote presentations delivered at the recent LDC Gas Forums conference in Boston.

BP Energy Co. North American Gas and Power COO Michael Thomas told attendees that the growth of natural gas-fired power generation has made it harder to understand weather-driven changes in the market over the last few years.

“But I think it’s getting way more complex. If you’re on a bumper car and you see someone, and you’re barrelling at them, and all of the sudden you get side-swiped and taken out, I think that’s what’s going to be happening in the natural gas space due to the global connectivity,” Thomas said.

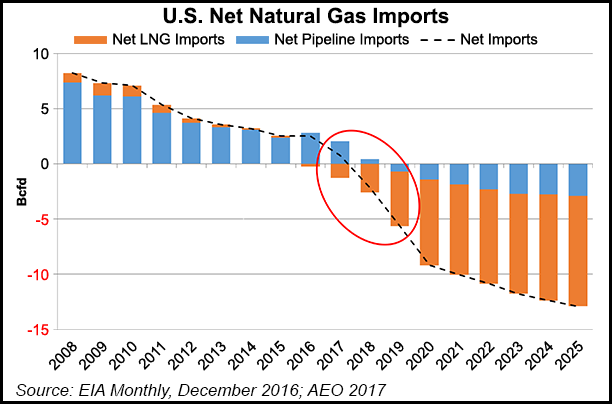

With the United States emerging as a global exporter, LNG and crude oil — a historical influence on LNG pricing — will factor more heavily into North American natural gas prices.

“So you really need to understand what the global analytics are to understand what’s going on in North America,” Thomas said. BP previously had separate analytics groups in Europe and North America but “recognizing this connectivity, we formed a single analytics group across BP so we’d be able to understand what’s going on. So when we have a bumper car our head’s going to be on a swivel trying to understand all the different factors that are going to play into the North American natural gas market.”

In a separate presentation in Boston, Macquarie Global Oil & Gas Strategist Vikas Dwivedi also keyed in on the significance of the crude oil markets — and the potential associated gas production from the U.S. onshore — for natural gas.

Dwivedi said his firm’s modeling shows “U.S. oil production’s just going to boom. It’s just going to keep growing and dragging associated gas production up with it.”

As breakevens for oil fall, “you start getting a little bit more hedged to oil prices naturally. You don’t need $60/bbl to get good growth. In some cases $40/bbl works” with prices in the high-$40s/bbl to low-$50s/bbl the “sweet spot for our projections. But we can still grow below that. That’s the key, and with that comes a lot of associated gas.

“…That type of growth, it will overwhelm most demand scenarios, so if you’re watching, thinking about gas, you almost have to start with oil, or at least keep oil pretty close in terms of priority and how you’re thinking about and analyzing the U.S. natural gas market.”

Dwivedi noted that, with an estimated 2.5-3 Bcf/d hitting the market with every 1 million b/d of oil production, associated gas has accounted for “the lion’s share of total growth” in U.S. natural gas output over the last several years. “Now you can say it’s a little bit of a sleight of hand, because the non-associated gas is the sum of big growth in some areas, like the Appalachians, and declines in other areas, but on a national level, it’s accurate, and we think it’s very meaningful for the national supply/demand balance.”

As for LNG, Dwivedi said Macquarie expects U.S. exports to reach around 10 Bcf/d by the end of 2020. Thomas, citing BP’s outlook to 2035, said the energy giant expects U.S. LNG output to grow to 22 Bcf/d by 2035.

So “even though it feels like we’re oversupplied, there are price signals that we feel are going to be in the early 2020s, mid-2020s, that we feel are going to call for additional LNG facilities to come online…Europe’s going to be importing, Asia’s going to be importing a massive amount of LNG, and then North America and Australia are going to be the dominant players,” Thomas said.

Dwivedi said the energy demand growth in China and India could have a big impact on the global market.

“They’re both still growing their coal generation quite a bit, but they’re also growing gas and LNG, so it’s kind of all-of-the-above in both countries,” he said. “…The direct impact to U.S. gas might be limited, but the indirect impact could be big, meaning if they’re getting LNG from elsewhere, it’s still tightening the market…everything will go as those guys go, and we’re still expecting big growth from both.”

Thomas said growth in LNG introduces more potential for volatility moving forward, envisioning a scenario where demand peaks in multiple countries simultaneously. He pointed to historical data showing that a number of membership countries in the Organization for Economic Cooperation and Development (OECD) experience similar seasonal demand cycles.

“You can see that” countries such as the United Kingdom, Germany, France and the United States “really peak at the same time. So if you’re having extremely cold weather across the Northern Hemisphere, all the sudden you have a significant amount of natural gas demand in North America at the same time that you have in other OECD countries, and how do you manage that?” Thomas said.

“What we’re trying to figure out is what is the value of storage longer-term, the summer/winter spreads? As well as, even in the shorter-term, understanding the flexibility that you’re going to have. If you have these massive LNG facilities concentrated in the Gulf Coast, facilities that shut down, or they’re not baseload, and we’re trying to manage them coming on and off, what type of flexibility are you going to need in North America to be able to handle that?”

Dwivedi said the lack of new storage in a growing North American natural gas market is a main ingredient in a recipe for volatility.

Looking at demand from LNG, “what we think is interesting about this is the volatility of that demand, so I think the need for high-turn storage will just keep rising…if you’re a buyer of natural gas needing to manage upside price risks, weaving this into your planning is going to be important, because what this will create in our view is upward skews. The average may not be a lot higher, but there could be blowouts, a chance to visit $5/MMBtu and $6/MMBtu more frequently than in the past, where we visited $2/MMBtu and sub-$2/MMBtu a lot. Now it may be a little bit more symmetrical around the middle with just as many upside trips on price.”

Cyclical-type demand continues to grow as storage capacity has remained at about the same level for years, he said.

“We’ve gotten away with it, because it hasn’t really been tested in a big way — a couple mild winters, even last summer when the demand was good, we still had decent production,” Dwivedi said. “We think we’re entering an era where it’s going to be tested. What is the test? The test is I need a ton of gas quickly to demand centers, in a much bigger scale market.

“The storage has been about the same since the market was in the low 60s Bcf/d. Now it’s 72-73 Bcf/d. It’s going to be 85 Bcf/d in the blink of an eye as far as these things are concerned. We’re not going to have a lot more storage. Think about that. You’ve got a much bigger market with more cycling and high-volatility demand, and about the same storage.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |