E&P | NGI All News Access | NGI The Weekly Gas Market Report

Proved Oil Reserves Fall Sharply Again on Oilsands Writedowns, Fewer Extensions, Discoveries

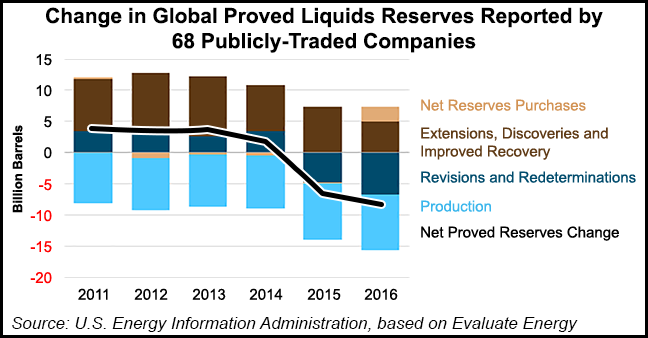

The proved oil reserves for 68 publicly traded global producers that trade on U.S. stock exchanges declined in 2016 for the second consecutive year, dinged by writedowns mostly for the value of Canadian oilsands projects and fewer extensions and discoveries, according to an analysis by the Energy Information Administration.

The examination of 2016 annual reports was done for producers listed on U.S. stock exchanges, which are required to report proved reserves every year to the Securities and Exchange Commission (SEC). The review, led by principal contributor Jeff Barron, also concluded that finding costs, which are exploration and development expenditures per bbl of proved reserves added, remained near their historical average.

“For the companies included in this analysis, global crude oil and other liquids production averaged 24 million b/d during 2016,” said researchers.

Proved reserves are defined as estimated quantities of oil and natural gas that, based on an analysis of geologic and engineering data, demonstrates with reasonable certainty are recoverable under existing economic and operating conditions. Price changes may have a significant effect on the economic viability of oil projects, and some companies specifically cited low prices in 2016 as a reason to revise their proved reserves base downward.

Three companies contributed the most to the group’s combined downward revisions of 6.7 billion bbl, each making downward reserves revisions associated with Canadian oilsands and bitumen projects. Collectively the revisions “represented the largest reduction in proved reserves among companies whose 2016 reports were reviewed for any region globally,” researchers said.

Together, ExxonMobil Corp. and ConocoPhillips wrote down a combined 4.65 billion bbl of proved reserves for 2016 — nearly all from oilsands losses.

ExxonMobilrecorded a 19.3% reduction in its proved reserves for 2016, its steepest reduction ever, erasing almost 3.3 billion boe. The writedown of the entire 3.5 billion bbl of proved undeveloped reserves, or PUDs, at the Kearl oilsands development in Western Canada was responsible for nearly all of last year’s reserves losses. ConocoPhillips in March followed Marathon Oil Corp. and Royal Dutch Shell plc in trading some of Canada’s vast oilsands for assets elsewhere.

Meanwhile, extensions at existing fields and discoveries at new fields totaled 4.9 billion bbl across the 68 companies in 2016, according to EIA.

“Following the crude oil price decline beginning in mid-2014, companies significantly reduced capital expenditures, especially in their exploration and development budgets. Instead, they focused on extracting additional oil from reserves developed in previous years.”

Additions from extensions and discoveries, along with net purchases of reserves from companies not included in the EIA analysis, were offset by large negative revisions to company assessments of existing reserves. Reserves also declined as these companies collectively extracted 8.9 billion bbl of liquids in 2016.

“The combined effect of these changes and other factors was a net reduction of 8.2 billion bbl in proved reserves,” said researchers.

EIA later this year plans to issue an annual report that focuses exclusively on U.S. proved reserves by all domestic operators, whether or not they are publicly traded. However, the relatively small change in the U.S. reserves component of global total reserves for the 68 companies whose reports were reviewed “suggests that EIA’s 2016 proved reserves report for the United States will show only modest changes from the 2015 report,” researchers said.

Before 2015, U.S. crude oil reserves had risen for six consecutive years. Domestic crude oil/condensate proved reserves in 2015 fell 4.7 billion bbl (11.8%) from 2014. Proved reserves of U.S. natural gas also set record highs in 2013 and 2014. However, EIA reported in December that U.S. natural gas proved reserves fell 64.5 Tcf in 2015, a 16.6% decline from 2014’s historic high.

To date in 2017, capital expenditures (capex) remain lower than for the same period in 2016, EIA researchers said. Generally, larger operators with more production are reducing spending, while relatively smaller companies are increasing their capex.

Forty-five of the operators in the new analysis produced less than 250,000 b/d in 1Q2017, and 28 of the 45 increased their capex year/year. In aggregate, the 45 companies increased their capex by $2.6 billion. In contrast, 17 of the 22 companies producing more than 250,000 b/d in the analysis reduced spending. Those 22 companies, in aggregate, lowered their capex by $10.8 billion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |