E&P | Eagle Ford Shale | NGI All News Access

EVEP Activity in Eagle Ford, Austin Chalk Escalating

Four wells drilled and completed (D&C) in a newly acquired area in the Eagle Ford Shale of South Texas averaged a combined 6,000 boe/d over 60 days, 84% weighted to oil, EV Energy Partners LP (EVEP) said.

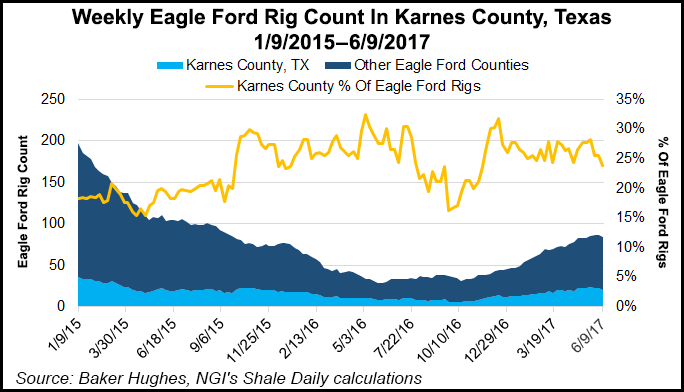

The Houston-based partnership, which owns a 5.8% working interest (WI) in the recently acquired properties in Karnes County, expects to D&C another 24 wells on four pads in June and July. Sixteen wells are scheduled for the Eagle Ford, all in South Texas, with another eight scheduled in the Austin Chalk formation; initial output is expected during the third quarter. Average D&C costs for the new wells, also with an average 5.8% WI, are estimated at $4.5-5.7 million.

“Our initial drilling results have met expectations,” and the company is optimistic about increasing drilling activity this year, CEO Michael Mercer said. “Given current commodity pricing and our previously provided guidance, we expect to fully fund our $30-45 million 2017 capital budget out of cash flow from operations.”

All of EVEP’s activity today is centered in Texas, with one rig working in the Barnett Shale and one running in the Austin Chalk. In the Barnett, eight wells are to be finished on two pad sites, while one previously drilled well is scheduled for completion. The Barnett wells, with 31% WI, are averaging around $4 million/well to drill and should begin production during the third quarter, the operator said.

In the Austin Chalk, three-to-five wells are scheduled to be completed and ramped up between July and September. Average D&C costs/well are $5.5-6 million; average WI is 16-25%. Also in Ochiltree County, EVEP participated in a nonoperated well with a 30-day production rate of 900 boe/d gross, 70% weighted to oil. D&C costs, net to the partnership’s 32% stake, were less than $1 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |