Markets | NGI All News Access | NGI Data

Futures Rebound Following Plump NatGas Storage Figures

Natural gas futures fell hard initially Thursday morning after the Energy Information Administration (EIA) reported a storage injection for the week ending June 2 that was much greater than expectations.

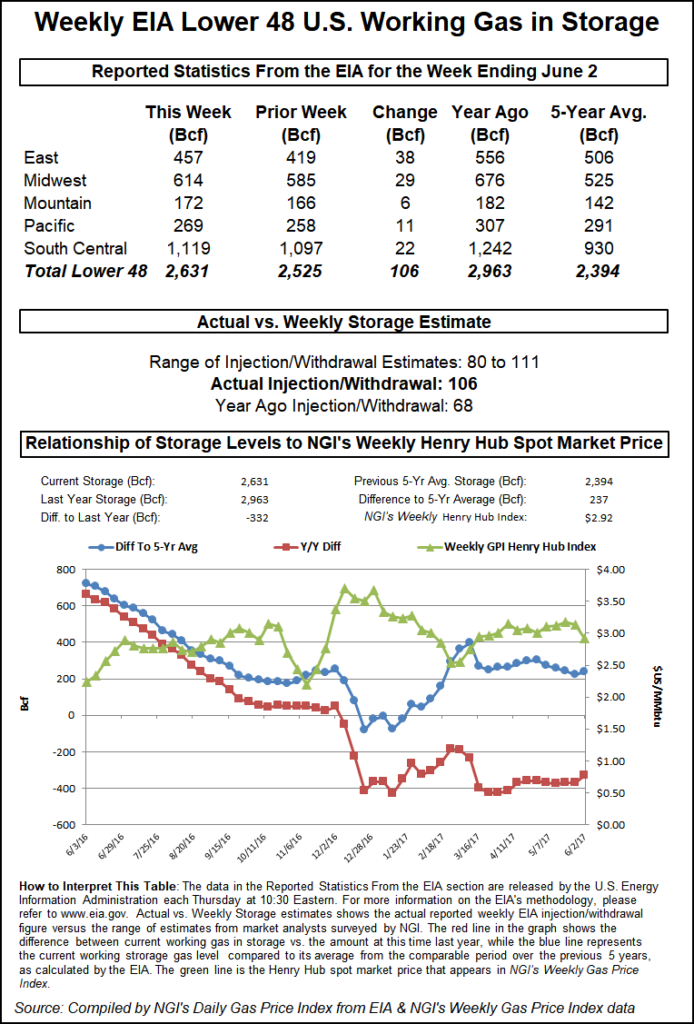

EIA reported a 106 Bcf injection in its 10:30 a.m. EDT release. The build put inventories at 2,631 Bcf and July futures fell to a low of $2.978, but by 10:45 a.m. EDT July was trading at $3.05, up 3.0 cents from Wednesday’s settlement.

Prior to the release of the data, analysts’ estimates were in the high-90 Bcf withdrawal area. Ritterbusch and Associates was looking for a build of 90 Bcf, and a Reuters poll of 25 traders and analysts showed a range from +80 Bcf to +111 Bcf, with an average of 98 Bcf.

“We were expecting a build of 96 Bcf to 98 Bcf, and when the number came out it made a new low, but the subsequent bounce over $3 tells me that there are a lot of buyers out there looking to get long under $3,” a New York floor trader told NGI.

“The 106 Bcf net injection into U.S. natural gas storage for last week was at the top end of the range of expectations and more than the 94 Bcf average, a bearish surprise,” said Tim Evans of Citi Futures Perspective. “The build also suggests some weakening of the underlying supply/demand balance, although we note the reporting period did span the Memorial Day holiday, which may have had a one-time effect in suppressing commercial and industrial demand.”

Inventories now stand at 2,631 Bcf and are 332 Bcf less than last year and 237 Bcf more than the five-year average.

In the East Region 38 Bcf was injected, and the Midwest Region saw inventories grow by 29 Bcf. Stocks in the Mountain Region increased by 6 Bcf and the Pacific region was up 11 Bcf. The South Central Region added 22 Bcf.

Salt cavern storage was up 3 Bcf at 345 Bcf, while the non-salt cavern figure rose 19 Bcf to 774 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |