Eagle Ford Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

SM Energy Lifts Production Guidance, Teases Howard County, TX, Well Results

Faster completions in the Eagle Ford Shale have prompted SM Energy Co. to raise production guidance by about 0.4 million boe, all thanks to activity during the second quarter.

The Eagle Ford completion pace was accelerated by 11 wells during the second quarter. SM Energy has completed 31 wells in its Eagle Ford program year-to-date, and the current full-year plan is to complete 39 wells. Production guidance was revised to 10.7-11.1 million boe for the second quarter and 43.2-46.2 million boe for the full year.

“Due to the favorable terms and performance under our pumping services agreement for the Eagle Ford, we are pleased to accelerate this activity, which we believe will result in higher cash flow and capital cost savings in 2017,” said CEO Jay Ottoson.

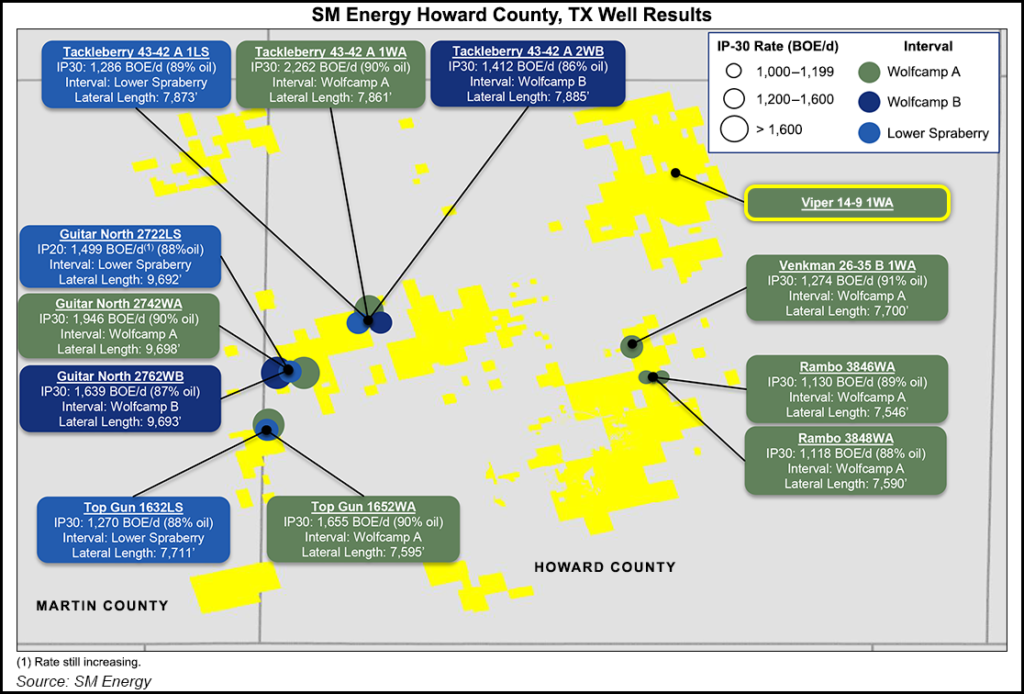

He also highlighted results in the Permian Basin’s Midland sub-basin in West Texas.

“I would also like to add that production from our highly anticipated Viper 14-9 1WA well in Howard County, TX, with an approximate 10,400-foot lateral drilled in the Wolfcamp A, has just passed 1,000 boe/d production at 92% oil during completion flowback with oil rates still increasing.

“It will be some time yet before we have a 30-day peak rate for this well, but this is clearly an encouraging early indication of productivity.”

Wells Fargo Securities LLC analyst David Tameron said the preliminary results are “encouraging” and help give “confidence around acreage quality in eastern Howard” County where SM Energy plans to acquire 3D seismic data.

Gabriele Sorbara, an analyst with The Williams Capital Group, said in a note Tuesday, “As the company grows its Midland Basin oil volumes over the next several quarters, improving visibility into 2018-2019, shares should witness multiple expansion, in our view.”

Earlier this year SM Energy closed on the sale of its nonoperated assets in the Eagle Ford, including an ownership interest in associated midstream infrastructure, to a unit of Venado Oil and Gas LLC, which is an affiliate of KKR.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |