Markets | NGI All News Access | NGI Data

NatGas Futures Fall Further on Lack of Weather Inspiration; Cash Follows

Mild weather brought the bears out to play Wednesday as July natural gas futures reaffirmed Tuesday’s 14-cent dive by plunging another 7 cents, settling at $3.071. The day-ahead market followed the futures down, as most regions gave up a nickel to a dime, and NGI’s National Spot Gas Average dropped 8 cents to finish at $2.73/MMBtu.

In its first two days as the front month, July hasn’t gotten off to the best start, setting a new 30-day low Wednesday. The winter curve fared about the same, with most months giving up about 7 cents on the day.

Traders seemed to be disappointed with recent bearish changes in the weather models showing a lack of cooling demand.

Speculators with net long positions and “unfulfilled expectations of higher prices” likely accounted for much of the selling Tuesday and Wednesday, Tom Saal, vice president of FCStone Latin America LLC in Miami, told NGI.

The market is transitioning from the shoulder season to higher summer demand, but the anticipated hotter weather hasn’t shown up yet, Saal said.

“Speculators are coming off some very high, record level net long positions, so they’re getting disappointed because they bought the contract anticipating higher prices, and those aren’t materializing, so it looks like they’re the ones selling right now,” he said.

Powerhouse’s David Thompson, executive vice president of the Washington, DC-based energy brokerage firm, told NGI that traders are reacting to “a lot of the weather models being revised cooler, taking away some of that threat of a hot start to the early cooling season. If we’re stuck in this cooler-than-expected pattern for a while, I would stay on the bearish side of things. I would probably expect to see it test $2.88-2.90.”

Thompson noted a lack of takers looking to buy the discount Tuesday after July “smashed through” a $3.20 support level that had held up since April. “So that breaks, and then [Wednesday] follows through. Again, there were no discount buyers stepping in to buy on the dip.

“That tells me the bears are firmly in control of the market at the current time. We’re probably seeing tests down into $3.02-2.98 as the next area of support that’s fairly close by.”

For his part, Saal said natural gas tends to be “sticky around whole numbers” and predicted “pretty good psychological support at $3.”

The cash market couldn’t find much to contradict the downward move in futures Wednesday, with natural gas for Thursday delivery showing declines in most regions for the second day in a row.

The National Weather Service’s latest six-to-10 day outlook predicted below average temperatures across much of the Northeast, Mid-Atlantic, Midwest and Southeast, with above average temperatures in the West and South Florida.

In addition, the National Oceanic and Atmospheric Administration’s Climate Prediction Center expects 13 fewer cooling degree days (CDD) for the week ending June 3 than in the year-ago period. The Mid-Atlantic is expected to see 40 fewer CDDs than in the year-ago period, with the East North Central region forecast to experience 35 fewer CDDs year/year and the New England and East South Central regions are each expected to see 18 fewer CDDs than last year.

“The natural gas markets have become quite disappointed hot weather patterns can’t seem to gain traction, highlighted by next week through the following weekend where yet another late season cool shot is expected to sweep across large stretches of the central, southern and eastern U.S.,” NatGasWeather.com said in a Wednesday note.

“It’s not so much the impact from the cool conditions on heating demand as it’s the loss of cooling demand over the southern half of the period. The markets seem to have priced in this cooler period…the focus is now on whether hot temperatures can finally gain ground over the east-central U.S. June 13-16” as much of the weather data suggests.

The Midcontinent led declines in gas traded for Thursday delivery. Gas at Northern Natural Demarcation plunged 14 cents to finish at $2.64, while NGPL Midcontinent gave up 6 cents to close at $2.67.

Packages for delivery at Chicago Citygate dropped 12 cents to $2.78.

Changes were more mixed in the Northeast, as Algonquin Citygate gave up a couple pennies to finish at $2.40, while Iroquois Waddington added a dime to reach $2.47. Packages at Transco Zone 6 NY traded down 2 cents at $2.58.

In Appalachia, Dominion South fell 8 cents to $2.23, while Texas Eastern M2 gave up a nickel to finish at $2.18.

Out west, Kern River closed down 5 cents at $2.67, and SoCal Citygate also fell 6 cents to $3.09.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

Recent production estimates suggest the supply/demand balance may be loosening somewhat. Natural gas analytics firm Genscape Inc. estimated weekend production exceeding 72 Bcf/d, only the second time production has surpassed that threshold since early March.

Last Friday (May 26) “estimated production for the Northeast set a new record high at 23.14 Bcf/d, and regional volumes stayed above 23 Bcf/d through the weekend,” Genscape said in a note to clients. “Production has been on the rise in each of the Northeast subregions, but West Virginia’s volumes on May 26 were at a record high. Gulf region production hit a 70-day high with gains offshore and in North Louisiana.

“Maintenance season is still very much in effect…so the daily production numbers will continue to be volatile.”

For Wednesday Genscape reported a 0.2 Bcf/d drop in production coinciding with a 0.6 Bcf/d uptick in demand driven by power burns and restoration of flows to Cheniere Energy Inc.’s Sabine Pass liquefied natural gas terminal.

With the market still trying to work its way out of the shoulder season, analysts weren’t expecting anything too dramatic from Thursday’s storage injection report, set for a 10:30 a.m. release by the Energy Information Administration.

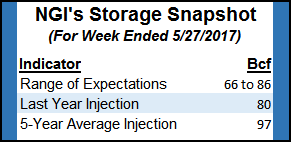

A Bloomberg survey predicted an injection ranging from 66-78 Bcf with a median build of 69 Bcf for the week ended May 26. IAF Advisors called for a 73 Bcf injection, while Stephen Smith Energy Associates revised up its weekly gas outlook estimate to call for a 79 Bcf build. A Reuters survey called for an injection ranging from 73-86 Bcf. Last year’s injection was 80 Bcf, while the five-year average stands at 97 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |