Natgas Cash And Futures Both Take A Modest Hit In Weekly Trading

Weekly natural gas quotes couldn’t quite hold the $3 threshold reached the previous week as the NGI Weekly National Spot Gas Average dropped a nickel to $2.95.

Improving prices in California, the Rockies and Midcontinent couldn’t withstand cascading quotes in Appalachia and the Northeast. Of the actively traded points the Tolar Hub in East Texas proved to be the week’s strongest point adding 11 cents to average $3.02 and Algonquin Citygate dropped the most losing 69 cents to $2.85.

Regionally the Rocky Mountains and California proved to be the week’s strongest with gains of a nickel each to $2.78 and $3.08, respectively, and the Northeast lost the most dropping 37 cents to average $2.84.

Appalachia shed 14 cents to average $2.66, the Southeast was off 9 cents to $3.11, and South Louisiana averaged $3.05, down 7 cents.

South Texas was down 2 cents to $3.07, but both East Texas and the Midwest managed to come out unchanged at $3.11 and $3.05, respectively. The Midcontinent crept into the black rising 3 cents to average $2.88.

June futures expired Friday at $3.236, down 2 cents on the week.

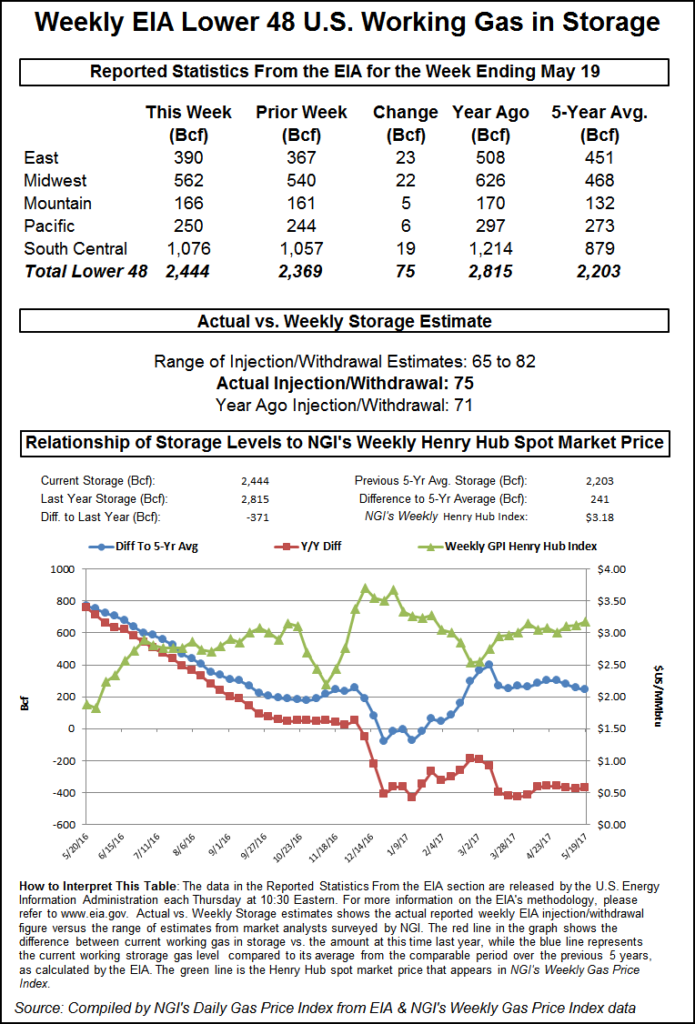

Thursday’s activity saw futures respond to an Energy Information Administration (EIA) storage report showing a 75 Bcf injection for the week ending May 19, about 4 Bcf greater than expectations, by dropping a couple of pennies. At the close on Thursday June had retreated 2.5 cents to $3.184 and July had shed 2.5 cents as well to $3.275. July crude oil plunged $2.46 to $48.90/bbl following an announcement from OPEC that it would continue to cut supply as U.S. shale production remains robust.

Once traders had time to digest the figures, June futures dropped to $3.165, and at 10:45 a.m. June was trading at $3.182, down 2.7 cents from Wednesday’s settlement.

Prior to the report traders were looking for a storage build not far from the actual figures.

Last year 71 Bcf was injected and the five-year average stands at a stout 90 Bcf. ICAP Energy calculated a 74 Bcf injection and IAF Advisors was looking for a 69 Bcf increase. A Reuters survey of 22 traders and analysts showed a sample mean of 71 Bcf with a range of +65 Bcf to +82 Bcf.

“We had heard a 71 Bcf number before the report, so this was no big deal,” a New York floor trader told NGI. “If you really think about it you are in a $3.50 to $3.00 trading range and closer to the $3.00 to $3.25 right now. As long as we don’t get under $3.00 I think we are in good shape, but what’s keeping it above $3.00, I don’t know.”

The Wells Fargo analytical team in Denver saw the report as bearish, but noted the market remains undersupplied. “The reported figure was 6 Bcf above consensus, 4 Bcf above last year and 16 Bcf below the 5-yr average of 91 Bcf. Based on our storage model this data point indicates that the natural gas markets are still running about 2 Bcf/d undersupplied, and our analysis shows that this state of undersupply will persist throughout the summer.

Market technicians raise the specter of a market peak heading into a seasonal decline.

“Again we ask, are we witnessing the onset of a summer to fall seasonal decline?” asked Brian Larose of United ICAP in closing comments Wednesday. His calculations showed that such a decline would take prices into low $2.00 territory.

Inventories now stand at 2,444 Bcf and are 371 Bcf less than last year and 241 Bcf above the five-year average.

In the East Region, 23 Bcf was injected, and the Midwest Region saw inventories rise by 22 Bcf. Stocks in the Mountain Region were greater by 5 Bcf, and the Pacific Region was up 6 Bcf. The South Central Region increased 19 Bcf.

Friday it looked like physical buyers of natural gas had left town ahead of the holiday weekend as prices plunged.

There was little interest in pursuing four-day deals with a well-supplied market. Firm quotes in Texas and Louisiana couldn’t match the free-falling prices of Appalachia, the Northeast, Rockies, and California, and the NGI National Spot Gas Average slipped 6 cents to $2.86.

Futures held their ground and then some, although the expiring June contract was limited to a 7-cent range. At settlement June had added 5.2 cents to $3.236 and July had risen 3.5 cents to $3.310. July crude oil recovered somewhat from the ashes of Thursday’s steep decline and added 90 cents to $49.80/bbl.

Mother Nature had something to say about the steep physical declines as temperatures were not only expected close to seasonal norms, but close to the 65-degree threshold from which both heating and cooling loads are driven.

Weatherunderground.com forecast that the high in New York City Friday of 74 degrees would ease to 69 Saturday and rise to 72 by Tuesday, 2 degrees below normal. Chicago’s 67 high on Friday was expected to reach 76 Saturday before easing to 70 Tuesday, 3 degrees below normal.

Weather systems over the weekend were expected to have only modest impact. The National Weather Service in New York City talked of “low pressure tracks off the New England coast [Friday]. Weak high pressure builds in tonight and Saturday, then retreats to the northeast as a weak wave of low pressure passes near the region Sunday into Monday. A cold front approaches from the west on Tuesday, then crosses the area Tuesday night. A series of weak waves of low pressure will result in unsettled weather for the middle of next week.”

Futures bears can’t seem to find any traction. The expiring June natural gas contract opened a penny higher Friday morning at $3.19 as traders noted little downside to an oversupplied market.

Analysts don’t see much in the way of market room lower unless some events can materially affect the trend of a diminishing long-term supply surplus.

“Although the initial response to yesterday’s moderately bearish weekly storage report appeared appropriate, downside price follow-through remains elusive, and key support levels managed to hold once again,” said Jim Ritterbusch of Ritterbusch and Associates in a morning report to clients. “June futures are going into today’s expiration virtually unchanged from a month ago, and July futures may not be posting much alteration at about this time next month.

“Although a supply surplus is likely to remain intact well into the summer period, the market is currently being supported by a reduction in this surplus that will continue to restrict selling until temperatures and some of the non-weather factors facilitate a reversal in this recent trend. In other words, this market may need some indication of a significant increase in the storage overhang if yesterday’s lows are to see violation.”

That diminishing long term supply surplus may eventually take a turn as the roster of drilling rigs keeps growing.

Overall, seven U.S. rigs came back, all of them land-based, according to Baker Hughes International in its weekly rig survey. Canada added eight rigs to bring the North American tally to 1,001. It stood at only 447 one year ago. Five U.S. natural gas rigs came back along with two oil rigs. The Canadians redeployed four of each.

For a change, Texas and the Permian were mostly quiet during the week while Colorado and its Denver Julesburg-Niobrara play posted the strongest gains, adding five rigs and four rigs, respectively.

Giving the Permian its due, not everything was static there. While the basin overall only added one rig during the week, five rigs entered the Delaware sub-basin while four left the Midland, so there was something going on.

As far as longer-term weather patterns, NOAA forecasters said Thursday they expect 11-17 named storms to form in the Atlantic Basin this year, with five to nine of them becoming hurricanes, including two to four major hurricanes (Category 3 or higher).

Offshore Gulf of Mexico production has diminished in importance over the years. Energy Information Administration figures peg current output at 3.4 Bcf/d, down from five years ago when it was 4.5 Bcf/d.

Traders have a range of forecasts to choose from. The NOAA numbers are higher than earlier predictions by two other prominent weather forecasters. In an extended-range forecast released in April, scientists at Colorado State University said they expected slightly below-average activity in the Atlantic Basin this year, with 11 named storms, of which four are expected to become hurricanes, including two major hurricanes. AccuWeather meteorologists have said they expect 10 named storms in the Atlantic this year, of which five could become hurricanes, including three major hurricanes.

Gas buyers for weekend supplies for electric power generation across the MISO footprint will have their hands full. “An active, stormy and changeable pattern is expected,” said WSI Corp. in its morning report to clients. “Variably cloudy and warm conditions are expected [Friday], though a weak frontal system will likely touch off a few showers or thunderstorms across the Midwest.

“Temps will rebound into the 70s and 80s. A vigorous storm system will dig into the power pool during the weekend with a risk for scattered heavy showers and thunderstorms. Severe weather is a risk across the lower Midwest and Mississippi Valley.

“Light wind generation is expected during the next one to two days. Output will bottom out around 1-3 GW. A west-northwest wind associated with the weekend storm will likely bolster wind generation output during Saturday night through early next week. Total output is forecast to peak 8-10 GW.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |