OFS In-Depth Part 2: Pressure Pumping, Sand Demand Growth Tempered by Uncertain NatGas Price Forecast

Part two of a two-part NGI report. (Part One)

As drilling activity runs rampant in lucrative plays such as the Permian Basin, oilfield service (OFS) costs are expected to rise to levels that could take producers by surprise, leaving future production on a choppy path toward growth, some analysts say.

High-tech, so-called “super-spec” rigs are sold out, and the availability of completion crews is starting to concern some producers about meeting the 2018 targets they set out for investors. But given the availability in bringing online idled rigs and major service companies’ confidence in staffing, there is some wiggle room when it comes to future growth.

As such, few exploration customers are seeking to lock in rigs long-term, and drilling companies don’t think current economics justify building new rigs, according to NGI’s Patrick Rau, director of commodity research.

Top-end land rig day rates continue to be at either side of $20,000/day, up about 15% from the cyclical low, but no real change from 4Q2016. National Oilwell Varco Inc., whose forte is North American land rigs, expects newbuild demand for onshore rigs to increase once dayrates reach the “mid-$20,000 range,” but Precision Drilling Corp. said it doesn’t expect that to happen until crude oil price reach the upper $50s/bbl.

New York Mercantile Exchange crude oil futures settled at around $50/bbl on May 19.

In the end, producers are going to have to pay if they want to meet the outlooks they’ve provided to investors, even if it means that higher OFS costs come along with that growth, according to Kathryn Miller, a partner at BTU Analytics.

“When push comes to shove, producers are likely to accept more cost inflation in order to get the services necessary to meet their targets. We estimate that service costs need to rise 20-30% off the low to bring service companies back to historical operating margins, and it’s likely the majority of this inflation is felt in 2017,” Miller said.

Pressure Pumping, Sand Demand Showing No Signs of Slowing

Aside from rigs, equipment and labor, there are several other moving parts that get worked into what OFS operators charge producers, key components that could lead to even more uplift in overall service costs.

Demand for pressure pumping and proppant sand are directly tied to rig counts, for example, and both are experiencing significantly higher costs than the cyclical lows seen in 3Q2016. Analysts at Coker Palmer Institutional expect Basic Energy Services Inc., which reported a 17% increase in revenue in the first quarter, to meet or exceed its second quarter expectations, including a sequential increase in fracture (frack) pricing of 30%.

Mammoth Energy Services Inc., meanwhile, said that current pressure pumping pricing has climbed 25-30% above its low. CEO Arty Straehla said on the 1Q2017 earnings call that “some industry analysts are projecting a rig count of between 1,000 to 1,100 rigs operated by the end of 2018. This would equate to the need for up to 18 million hp by late 2018. If this comes to bear, there could be a significant shortage of horsepower in the market.”

Meanwhile, there is no question that the short-term supply situation for sand remains tight, with demand for finer-grade sands leading the way, according to commentary by leading proppant providers during the first quarter conference calls.

“40/70 sand is going for $40-45/ton at the mine gate, and at least two sand providers indicated they have been able to get up to $60 per ton for those in desperate need of finer grade sand,” said NGI’s Rau.

Demand for coarser grades continues to edge higher as well, if for no other reason than finer grade sands like 40/70 and 100 mesh are largely sold out. Overall, Hi-Crush Partners LP noted that the average mine gate prices were in the low $20s/ton in January, but exited the quarter closer to the lower $30s. Practically everyone expects prices to tick higher throughout 2017. Fairmount Santrol Holdings Inc. guided raw sand prices to rise by $7-9/ton in the 2Q2017, and Emerge Energy Services LP is seeing $5-7/ton increases quarter/quarter, Rau said.

U.S. Silica Holdings Inc. CEO Bryan Shinn during the first quarter call noted that some customers are beginning to experiment with crushed sand that produces 200-400 mesh. “The idea is this gets pumped in first, followed by regular proppant. Fairmount Santrol indicated this is all pretty new, and they are ”watching it,’” Rau said.

Meanwhile, Genscape Inc.’s Ben Chu, manager of equity products, said locally mined brown Texas sand is being offered as a substitute for the traditional Wisconsin-sourced Northern White Sands. Encana Corp., a big Permian player, indicated last fall that it was not seeing any degradation from using brown sand in its fracking operations.

Aside from the sand types that are driving costs, the shut-in sand mines that are coming back online now tend to be higher cost, so from a marginal supply standpoint, sand prices have to be higher to justify that, Rau said.

Current projections by some analysts indicate industry demand will be 70 million tons in 2017, rising to a “consensus” of 100 million tons in 2018, based on a land rig count of 1,000 or so, according to Rau. But any new sand capacity growth is an ongoing battle between Wall Street investors and the sand providers over what impact sand capacity growth will have on pricing going forward.

Sand providers are making the argument that nameplate capacity is in fact higher than effective capacity, for a number of reasons, including that some of the nameplate capacity is for coarser-grade sands that aren’t in as high demand.

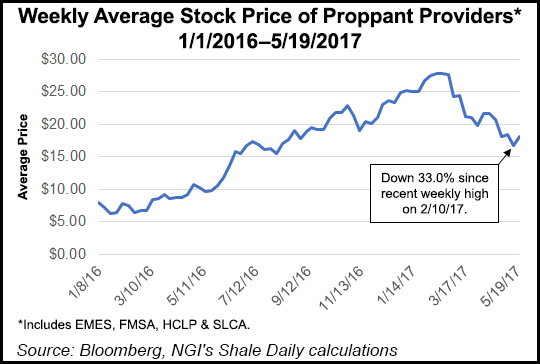

“U.S. Silica, Hi-Crush Partners, and Emerge Energy Services all had intriguing arguments as to why this is the case and argue that further capacity increases are needed to support this demand,” Rau said. “However, Wall Street investors believe the capacity growth will be too much, and that has been hammering the stock prices of the sand folks.”

Indeed, Black Mountain Sand recently filed an air permit in Winkler County, TX, bringing total potential capacity additions by Black Mountain to 8 million metric tons/year in 2018. This potential incremental supply of wind blown sand, and the idea that additional parties including U.S. Silica, Fairmount Santrol and others are being linked to potential further development, has and could continue to cause significant damage to the frack sand supply storyline, Coker Palmer analysts said. The investment group, however, expects continued strong supply/demand fundamentals for frack sand through year-end 2018.

Gas Production Growth Unclear on Unattractive 2018 Prices

While oil production continues to grow in spite of higher OFS costs, the story for natural gas, despite its necessity, isn’t so certain. The main reason: prices aren’t high enough to attract producers. As of May 19, gas prices averaged $3.40/MMBtu June-December, but Calendar (Cal) 2018 prices averaged just $3.11/MMBtu. In fact, the crux of Cal 18 trading remains under the $3/MMBtu threshold.

It’s important to note that 2016 was the weakest natural gas price year of the past decade, and the $3/MMBtu-plus prices seen through 1Q2018 are mostly tied to tightened underlying fundamentals, said Societe Generale (SG) analyst Breanne Dougherty.

“SG does not view the 12-month trailing or current price environment, the combination of cash and Nymex curve, as being supportive to strong growth,” she said.

Part of the backwardation in the futures curve stems from market concerns that strong price support will provide incentive to producers and trigger strong production growth. While the market has years of production outperformance to create concern over providing too much price support to producers, the problem is that the market is looking at more than a period of isolated seasonal tightening; it is looking at a sustained fundamental structural tightening underpinned by rising demand and stalled production, she said.

Production growth is clearly a necessity to avoid untenable balance tightening in 2018, Dougherty said, and the market is seemingly looking to trigger production growth with only a short-term price incentive, not extending the supportive message into 2018 and 2019.

SG’s base-case expectation is for gas production to reach a 72 Bcf/d average by this July, 73 Bcf/d by October, over 74 Bcf/d by 2017 exit and extending to 78 Bcf/d by 4Q2018.

“Either the Cal 18/19 curve has to start rising to help producers confidently accelerate growth programs very soon, or the market should be prepared for the return to strong volume growth to take a little longer, leaving a good portion of Cal 18 exposed to upside price volatility,” the SG analyst said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |