Markets | NGI All News Access | NGI Data

NatGas Futures Drifting Lower Following Plump Storage Build

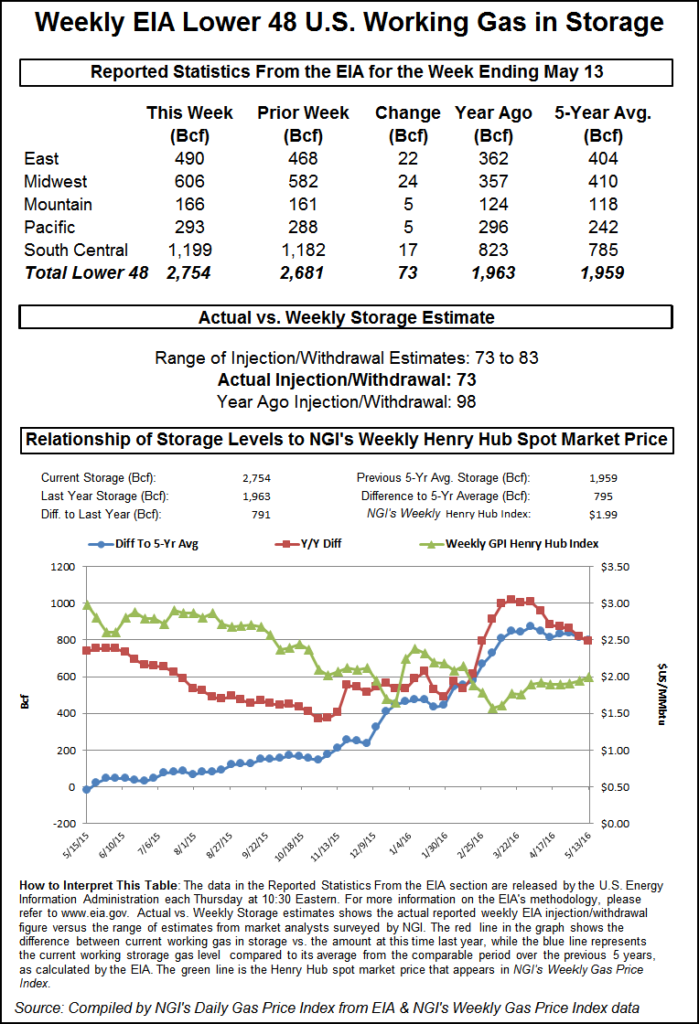

June futures slipped lower on Thursday morning after the Energy Information Administration (EIA) reported a storage injection for the week ended May 19 that was slightly greater than what traders were expecting. The EIA reported a storage injection of 75 Bcf, about 4 Bcf above consensus estimates, and prices fell after the number was released.

Once traders had time to digest the figures, June futures dropped to $3.165, and at 10:45 a.m. June was trading at $3.182, down 2.7 cents from Wednesday’s settlement.

Prior to the report traders were looking for a storage build not far from the actual figures.

Last year 71 Bcf was injected and the five-year average stands at a stout 90 Bcf. ICAP Energy calculated a 74 Bcf injection and IAF Advisors was looking for a 69 Bcf increase. A Reuters survey of 22 traders and analysts showed a sample mean of 71 Bcf with a range of +65 Bcf to +82 Bcf.

“We had heard a 71 Bcf number before the report, so this was no big deal,” a New York floor trader told NGI. “If you really think about it you are in a $3.50 to $3.00 trading range and closer to the $3.00 to $3.25 right now. As long as we don’t get under $3.00 I think we are in good shape, but what’s keeping it above $3.00, I don’t know.”

Market technicians raise the specter of a market peak heading into a seasonal decline.

“Again we ask, are we witnessing the onset of a summer to fall seasonal decline?” asked Brian Larose of United ICAP in closing comments Wednesday. His calculations showed that such a decline would take prices into low $2.00 territory.

Inventories now stand at 2,444 Bcf and are 371 Bcf less than last year and 241 Bcf above the five-year average.

In the East Region, 23 Bcf was injected, and the Midwest Region saw inventories rise by 22 Bcf. Stocks in the Mountain Region were greater by 5 Bcf, and the Pacific Region was up 6 Bcf. The South Central Region increased 19 Bcf.

Salt storage rose by 1 Bcf to 332 and nonsalt increased 18 Bcf to 738 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |