Markets | Mexico | NGI All News Access | NGI Mexico GPI | NGI The Weekly Gas Market Report

Mexico Streamlining Upstream Auctions, Pursuing Natural Gas Storage

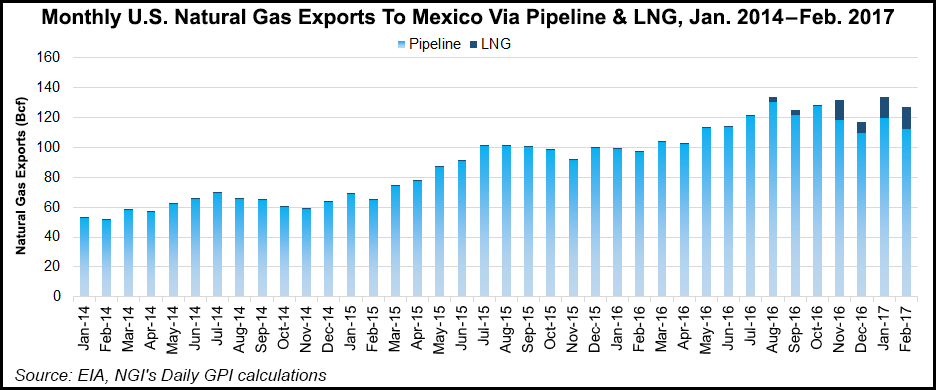

As Mexico proceeds with upstream and midstream natural gas reform, demand for gas continues growing and domestic supply can’t keep up. The market opening is a work in progress.

Having learned from early upstream bidding rounds, the country is tweaking the process to be more streamlined and transparent. Natural gas transport capacity has been assigned in a competitive process, but more is to come. The Mexico pipeline buildout is ongoing while engineers and others are examining opportunities to create natural gas storage in the country, which has none.

In the meantime, liquefied natural gas (LNG) imports from the United States have been helping to fill the natural gas supply gap.

“Last year the natural gas supply dynamics changed and we became net importers…” said Daniela Flores Ramirez, deputy general director of planning with the Energy Secretariat (Sener). LNG has been “a buffer,” she said. LNG is cheaper than fuel oil in Mexico and a bit costlier than pipeline gas.

The Comision Federal de Electricidad has used LNG on a regular basis, and other industrial sectors should take greater advantage of the fuel, too, she said. “LNG is highly competitive and we feel like we should use it more.”

More natural gas — whether by pipeline, LNG, or from Mexico’s own Burgos Basin, in about a decade, perhaps — is not enough to ensure supply security in a competitive market; gas storage is also needed, Flores Ramirez said. Sener is working on a program for gas storage development, with details to come later this year, she said.

A public policy for natural gas storage levels, obligation of market participants and mechanisms to promote storage development needs to be developed. “LNG is not enough…Please stay tuned; in the following months we will be announcing this policy.”

Storage development is being considered in underground caves and in depleted reservoirs, Roberto Ortega Ramirez, director of engineering services for Instituto Mexicano de Petroleo, told the audience at the Third Mexico Gas Summit in San Antonio Wednesday.

Turning to the upstream, Hector Moreira Rodriguez, a commissioner with Mexico’s Hydrocarbons Commission (CNH), told the conference audience that much was learned in Mexico’s Rounds Zero and One for upstream concessions. CNH needs to improve its processes for upcoming rounds, and procedures need to be simplified with communication improved. There needs to be and will be more coordination among regulators, and industry participants will be listened to more attentively, he said.

“We expect Round Two to be much bigger than Round One,” Moreira Rodriguez said. “The whole point of Round One was to show the world that there are opportunities in Mexico and that these opportunities are real and fair. We are sure that more companies will participate in future biddings. The energy reform is fulfilling expectations.”

Pipeline capacity is being doled out, too.

Last February BP EnergÃa México, Industria del Ãlcali, and Fábrica de Envases de Vidrio del Potosà were assigned 220,741 MMBtu/d from a total of 753,722 MMBtu/d of import pipeline capacity offered by system operator Cenagas. Theauction was considered a success, even though a sizeable amount of capacity went without bids, according toresults.

Cenagas has awarded of 97% of its capacity through open seasons, allowing for 24 firms to use the natural gas system. There were 722 contracts awarded for a total of 2.32 Bcf/d.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |