E&P | NGI All News Access | NGI The Weekly Gas Market Report

‘Persistent’ Growth Seen in U.S. Onshore Oil, NatGas as Completions Catch Up, Says Rystad

U.S. onshore unconventional growth began to exhibit “material and persistent” monthly output growth in the first quarter after bottoming out in mid-2016, a trend likely to continue through 2017, according to an analysis by Rystad Energy.

Using “sufficient fact-based visibility” compiled from state data of the first three months, onshore U.S. oil production growth was evident and “considerable growth” in natural gas could be restored by the second half of the year (2H2017).

“With a strong start to 2017, shale is set for steady growth throughout the remainder of 2017, due to indications of significant recovery in completion activity,” Rystad analysts said.

A rising U.S. rig count has led to more drilling activity since mid-2016 for both oil and natural gas. However, completion activity naturally had lagged, exhibiting relatively flat development for drilled-but-uncompleted (DUC) wells through 2H2016. That resulted in a surplus inventory of DUCs.

However, between January and March, completion activity finally began to catch up with drilling growth, driven primarily by completions in the Permian Basin and in the Eagle Ford Shale of South Texas.

“Along with the significant build-up of new inventory of high-quality DUCs observed in 2H2016 and 1Q2017, this positions completion activity for a prolonged expansion throughout the rest of 2017 as more pressure pumping equipment gets reactivated,” said analysts.

Even with a rising rig count, however, “growth in drilling activity is stabilizing” because of “degrading drilling efficiencies in all major plays.”

The first quarter, and notably February, proved particularly strong for unconventional U.S. plays in terms of monthly net additions in oil production, according to Rystad. February oil output reached an all-time high of 190,000 b/d from “overlapping completion rounds in several major basins and reactivated, inactive wells in the Bakken Shale after a winter shock in December,” analysts said.

While the rate of oil output growth in February is considered “unsustainable” through 2017, U.S. horizontal shale oil monthly production should increase every month to the end of the year by an average 100,000 b/d because of the implied rate of current DUC completions, Rystad said.

Unsurprisingly, the largest completions growth is expected in the Permian. Rising onshore gas volume growth also is expected this year.

Rich gas production from U.S. shale plays had exhibited flat development since early 2016, analysts noted. “However, robust drilling in January-April 2017 shows signs of recovery and is expected to turn into new completions from mid-2017.”

Rystad said “considerable growth in gas volumes can be restored from 2H2017, “driven by expansion in the Appalachian Basin, Haynesville Shale and recovery in associated volumes from liquid plays…”

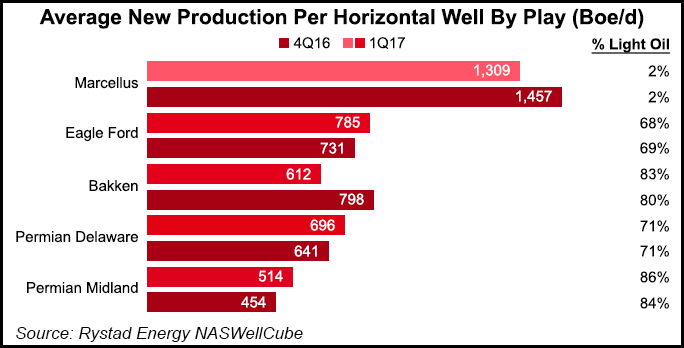

Rystad also compared how productive wells were in 1Q2017 versus 4Q2016.

The Eagle Ford, along with the Permian’s Delaware and Midland sub-basins, exhibited “further productivity improvements, despite some offsetting effects such as a stronger contribution from minor players and expansion of activity in noncore areas.”

The Eagle Ford led among the major liquids plays sequentially in terms of new production per well, with an average of 785 boe/d of new volumes per well brought into the market in 1Q2017, followed by the Delaware, with 696 boe/d of new production per well.

“Overall, strong first quarter results suggest that shale is on track to grow further throughout the remainder of 2017,” said the Rystad team. “While exceptional oil output additions observed in February are unsustainable through the rest of the year, 100, 000 b/d average month/month oil production growth in 2017 is in line with trends in completion activity.”

The Energy Information Administration (EIA) in its Drilling Productivity Report issued in mid-May also said it expected gas and oil production from the nation’s seven most prolific unconventional plays to increase again in June, but it is forecasting the number of DUCs to rise as well.

The Bakken, Eagle Ford, Haynesville, Marcellus, Niobrara, Permian and Utica plays are forecast by EIA to produce an estimated total of 51.3 Bcf/d of natural gas in June from 50.8 Bcf/d in May. Gas production from the seven plays, which had been on a downward trend for more than a year, returned to the upside in January and has been on the upswing ever since, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |