Bakken Shale | E&P | NGI All News Access | Permian Basin

Keane’s Tie-Up With RockPile Grows U.S. Onshore Footprint, Adds Horsepower in Permian, Bakken

In a bid to expand its U.S. land services and build its pressure pumping capacity by one-quarter, Keane Group Inc. agreed to pay $284.5 million to acquire completion specialist RockPile Energy Services LLC.

The cash-and-stock transaction, set to be completed by the end of July, would increase Houston-based Keane’s U.S. hydraulic horsepower (hhp) capacity by 26% to 1.2 million hhp.

Keane now owns 944,000 hhp and 23 wireline trucks, with a geographic footprint spanning the Permian, Bakken, Marcellus/Utica shales and Oklahoma’s stacked reservoirs. Denver-RockPile owns 245,000 hhp, eight wireline trucks, 12 workover rigs and 10 cement units, with 30,000 hhp scheduled for delivery in the fourth quarter. Of its total capacity, RockPile has 215,000 hhp divided almost equally between the Permian and Bakken.

“Combined, our portfolio will include 315,000 active hp in the Bakken and 415,000 active hp in the Permian, strengthening our position as one of the top providers in these basins,” Keane CEO James Stewart said during a Friday morning conference call. “Once this transaction is completed, Keane’s expanded platform will include approximately 1.2 million hhp, 31 wireline trucks, as well as ancillary service capabilities in cementing, workover and coiled tubing.”

Keane’s emphasis, he said, “has been to identify opportunities that closely align with our strategy, culture and values. With RockPile, we’re acquiring a business very similar to ours in a transaction that is entirely consistent with the criteria we’ve previously discussed. The service, approach and geographic similarities make RockPile a great fit for Keane, and at the right time.”

Under terms of the transaction, Keane agreed to pay $135 million in cash, provide 8.7 million shares of common stock and pay $26.5 million for RockPile’s capital expenditures related to the 30,000 hhp scheduled for delivery late this year. The new horsepower is to be deployed to the Bakken under a dedicated agreement with an existing customer.

“Collectively, we are acquiring RockPile assets for approximately $1,000/hhp, after accounting for working capital and the value of ancillary assets, allowing us to participate in the continued growth we see in the market, but doing so at attractive economics in line with newbuild,” Keane CFO Greg Powell said.

“From a revenue perspective, RockPile has five active fleets with a current average annual revenue per fleet run-rate in-line with Keane’s performance in the mid-$60 million,” Powell said. “RockPile’s gross profit per fleet performance is also in line with Keane’s…We previously communicated our expectation of $10-11 million annualized gross profit per fleet by the end of the third quarter, with an improving leading edge in the range of 20%-plus.

“As far as other product lines, cementing and workover together represent a current revenue run rate of between $35-40 million per year at 10-15% gross margin. We intend to further evaluate these businesses with regards to opportunities for optimization and growth, including the potential to activate Keane’s idle assets.”

Coker Palmer Institutional analyst Trey Stolz said Friday the deal “brings a significant amount of additional horsepower at a time where easy fleet adds have evaporated in a rapidly tightening market.”

The transaction is viewed as accretive for Keane, but “consolidation is a positive for the entire industry,” Stolz said. “The entire industry benefits from one fewer player out in the field. With easy horsepower adds all but gone from the market, we believe that the merger/acquisition activity is just beginning to heat up as pumpers continue to seek ways to improve margins, leaving acquisitions as the primary pathway to better financial results.”

Tudor, Pickering, Holt & Co. (TPH) also see the combination as a “good thing” for the pressure pumping industry overall.

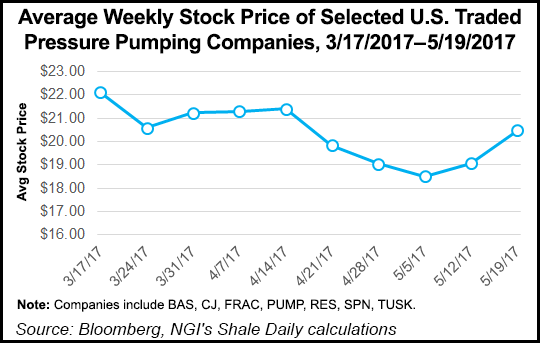

“After a downright pummeling over last few months, U.S. pressure pumper stocks are currently trading like this nascent industry recovery is already kaput,” thanks to a combination “wall of worry” regarding the oil macro price uneasiness and rampant fracture fleet reactivations in U.S. land.

The North American oilfield services (OFS) market has been “quietly” consolidating hydraulic fracturing services, noted TPH, which highlighted the Schlumberger Ltd./Weatherford International plc OneStim joint venture. Analysts also pointed to other consolidating in North American fracture services, including the merger of Patterson-UTI Energy Inc. and Seventy Seven Energy Inc. and the friendly tie-up between Western Canada’s biggest pressure Trican Well Service Ltd. and Canyon Services Group Inc.

The reaction to the recent mergers by investors, said TPH analysts, “seems to be falling on deaf ears, but this methodically improving industry structure is a decidedly constructive phenomenon, in our opinion.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |