Bakken Shale | E&P | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin | Utica Shale

U.S. Onshore Permitting Off to ‘Roaring Start,’ With More Activity in Fringe Plays, Says Evercore

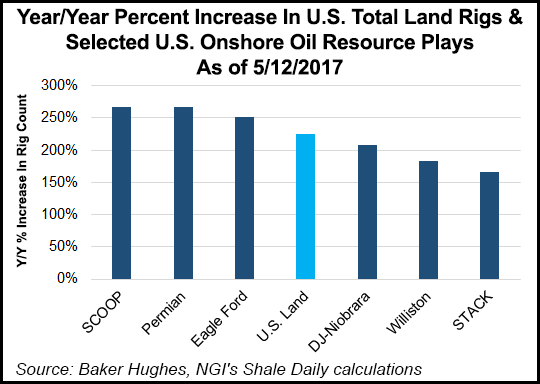

Oil and natural gas permits to drill on U.S. land have risen “at least” 49% in every major oil producing state from a year ago, with activity also rising in the fringe areas of major shale plays, Evercore ISI said Tuesday.

Overall, U.S. land permitting slowed in April from March, and the rig count likely will moderate until summer drilling and completion activity hits its stride, according to analysts. The domestic land permit tally was 2,706 in April, down 31% from the last 12 month (LTM) high of 3,945 in March, said James C. West, senior managing director.

“March had notched the highest monthly permit total since October 2015, and April totals were still 29% above year-ago levels,” he said. Year-to-date, “2017 is off to a roaring start,” up 61% from the same period of 2016, with permit totals in every major oil producing state “up at least 49%” from a year ago.

Through May 5, U.S. land permitting stood at 867, with the four-week rolling average of 725, “within striking distance of the LTM high of 849 (from mid-March). The usual suspects (Texas, Oklahoma, Wyoming and Louisiana) are off to extremely hot starts to the month, with Texas on pace to break the 1,500 permit level for the first time since 2014.”

May traditionally is a strong month for permits in an upcycle, with month/month (m/m) increases in 2012 through 2015; May 2014 was the second highest permit month in the past eight years, West noted.

“Clearly, the U.S. industry is gearing up for a busy summer period,” as commodity prices stabilize and better capital expenditure visibility by U.S. exploration and production companies. The gains “could contribute to continued upward permitting momentum in order to lock in incremental production at better economics.”

In a continuation of a trend that began in January, natural gas and oil production from the nation’s seventh most prolific unconventional plays is expected to increase again in June, while the number of drilled but uncompleted wells in the plays also should increase, according to the latest Drilling Productivity Report by the Energy Information Administration.

Broader drilling prospects beyond sweet spot acreage also could be ready to break out, boosting permitting outside major oil and gas producing states, according to Evercore. More permits filed for “peripheral shales and fringe acreage” have begun to yield activity improvements beyond the Permian Basin, West said.

For example, he again pointed to California, which has exhibited “by far the greatest sequential and year/year improvement of states outside of the Permian” as operators gang up in the San Joaquin Basin. “This could contribute heavily to ‘conventional’ oilfield development while the rest of the market is myopically focused on shales.”

Compared to March, April showed relatively strong permit numbers in Mississippi, up 20%, in Alaska, 9% higher, and in Pennsylvania, which was 5% higher. The gains more than offset permitting declines in Colorado, off 54% from March, and in Oklahoma, down 34% m/m.

“Texas permitting exhibited a 22% sequential decrease, (but was up a whopping 40% y/y), which was perhaps a function of higher-than-average permit momentum in 1Q2017,” West said. “With nearly half of the working U.S. oil rigs, Texas continues to be the single-most important state in terms of evaluating the magnitude and direction of U.S. permitting trends, although we expect states located in the peripheral shale oil basins (Niobrara, Woodford and Bakken) to continue their positive trajectory as oil prices improve and ‘fringe’ acreage becomes economical.”

Meanwhile, the Gulf of Mexico is finally seeing some consistency in permitting, according to Evercore.

“The April total of 14 new permits fell just 18% from eight in March, and was down 13% from permitting in April 2016,” West said.

Shallow water permitting fell by one to three permits in May, with two sidetracks and one new well approved. Seven new midwater permits were filed in April, flat m/m. Deepwater permitting fell by two to three, with three bypass permits approved. Ultra-Deepwater permitting had a single new well permit in April — and for the third month in a row.

“The sharpest decline from the 2014 peak (ex-ultra-deepwater) has come from shallow water permitting, down 87% in 2017 from year-to-date 2014,” according to Evercore. “We believe that offshore drilling (and jackup utilization) is starting to turn the corner, but continued attrition/consolidation will be critical in supporting slowly improving permit and drilling activity…Overall, we remain cautious in allocating optimism to the offshore space, but permitting trends have certainly shown upward momentum over the first quarter of 2017.”

Evercore’s monthly tally uses data gleaned from the major producing states and the Department of Interior’s Bureau of Ocean Energy Management (BOEM). Most land permits are submitted through individual state regulatory boards, while offshore/Alaska permits are reviewed and approved by BOEM’s twin agency, the Bureau of Safety and Environmental Enforcement. Most onshore permits are issued several months before drilling begins, while offshore permits often are secured even more in advance.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |