Markets | NGI All News Access | NGI Data

Eastern Heat Wave Lifts New England, Mid-Atlantic Quotes; NatGas Futures Flounder

At first glance it might look like physical gas trading for Thursday delivery was a quiet affair as the NGI National Spot Gas Average slipped 2 cents to $3.00. That average, however, was comprised of large weather driven gains sending Northeast quotes up by double digits and broader losses of about a nickel strewn across Louisiana, Texas, the Southeast, and California.

Futures managed to open in positive territory but later succumbed to selling in spite of traders anticipating a lead government inventory report Thursday. The June contract fell 3.8 cents to $3.192 and July gave up 3.2 cents to $3.283. June crude oil gained 41 cents to $49.07/bbl.

High temperatures and high energy demand go hand in hand, and temperature forecasts along the Atlantic Seaboard close to 30 degrees above normal in some spots, combined with double digit gains in forecast power load, pushed natural gas prices higher.

AccuWeather.com forecast Boston’s Wednesday high of 91 degrees would reach a scorching 93 Thursday before dropping back down to 84 Friday, 17 degrees above normal. New York City’s 89 high Wednesday was expected to rise to 92 Thursday and fall to 88 Friday, 17 degrees above normal. Philadelphia was forecast to see its Wednesday high of 91 rise to 92 Thursday and ease to 90 by Friday, 16 degrees above normal.

The National Weather Service in southeast Massachusetts said, “Bermuda high pressure will bring unseasonably warm to hot conditions through Thursday with increasing humidity. Warm weather continues Friday as a cold front moves through ushering in more seasonable conditions for Saturday. Another cold front approaches Sunday night and moves through late Monday, with showers likely. Another system may approach by the middle of next week with unsettled conditions.”

Gas at the Algonquin Citygate rose 59 cents to $4.17. Gas on Iroquois Waddington fell 2 cents to $3.23 and deliveries to Tennessee Zone 6 200 L gained 34 cents to $3.67.

Gas on Tetco M-3 Delivery added 6 cents to $2.94 and gas bound for New York City on Transco Zone 6 rose 7 cents to $3.18.

Power demand was forecast to soar. ISO New England predicted Wednesday’s peak load of 16,620 would jump to 19,800 MW (+19.3%) Thursday before settling down to 17,300 MW Friday. The New York ISO calculated peak Wednesday load of 20,544 MW would climb to 22,910 MW Thursday (+11.5%) before falling to 21,314 MW Friday. The PJM Interconnection forecast peak Wednesday load of 40,400 MW would reach 47,154 MW Thursday (+16.7%) and decline to 43,587 MW Friday.

Gas at the Chicago Citygate fell a penny to $3.05 while deliveries to the Henry Hub skidded 7 cents to $3.16. Gas on Northern Natural Demarcation changed hands 5 cents lower at $2.87 and packages on El Paso Permian fell a nickel to $2.69.

Deliveries to Opal were quoted 3 cents lower at $2.78 and gas priced at the SoCal Citygate fell 6 cents to $3.17.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

Futures did manage to open 2 cents higher Wednesday morning at $3.25 as traders studied weather forecasts calling for concerted summer heat as well as Thursday’s anticipated lean inventory report.

Longer term forecasters are forming their summer outlook, and the early call is for a warmer than normal summer and increased demand for natural gas.

The major weather feature is the transition from a mild La Nina this past winter to neutral to weak El Nino conditions, and according to Natgasweather.com sea surface temperatures (SST) have warmed slightly, but “we don’t expect they will warm much more going into the core summer months, and thus, to our view, should have limited influences on summer weather patterns across the U.S.,” it said.

“We expect upper-level high pressure will become stronger than normal during the core summer months, resulting in occasional heatwaves, including at times, impacting the important southern and eastern U.S.

“Overall, our analysis suggests heatwaves have a higher statistical probability of occurring this year compared to normal, focused over the period July 11 to Aug. 11.

“If this were to prove true, and as long as the structurally tight background supply/demand environment continues, as we expect, this should result in most weekly storage builds being lighter than five-year averages, eventually flipping current surpluses of +275 Bcf to deficits of -160 to -240 Bcf by early November.”

Maybe $3.50 natural gas futures are not to be, at least in the short run.

“The natural gas market extended its recent decline on Tuesday as a somewhat cooler temperature forecast was seen undercutting power sector demand,” said Tim Evans of Citi Futures Perspective in closing comments Tuesday.

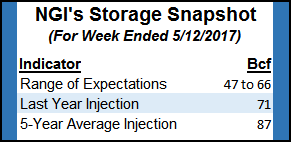

Thursday’s storage report is expected to show a continuation of the pattern of lean storage injections continuing. Last year 71 Bcf was injected and the five-year average is for a 87 Bcf increase. Citi Futures Perspective calculates a 59 Bcf increase and IAF Advisors is looking for a 64 Bcf build. A Reuters poll of 22 traders and analysts revealed an average 61 Bcf increase with a range of +47 Bcf to +66 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |