E&P | NGI All News Access | NGI The Weekly Gas Market Report

BP Continuing Shift to NatGas While Eyeing Lower Carbon World, Dudley Says

BP plc shareholders at the annual meeting on Wednesday approved an $11.6 million pay package for CEO Bob Dudley, while management laid out its priorities to capture more natural gas and increase its lower carbon options.

Close to 98% of shareholders adopted the 2016 pay plan for Dudley and the new pay policy. Last year almost 60% of shareholders had opposed the pay policy.

“At our meeting last year, you, our shareholders, sent us a very clear message on how we approached paying our executive directors,” said Chairman Carl-Henric Svanberg at the meeting in London.

Shareholders at the 2016 annual meeting had staged a rare protest, roundly rejecting the board’s decision to increase Dudley’s 2015 compensation by 20%, despite massive job cuts and record losses. The 59.11% vote last year to oppose the pay raise was nonbinding, which meant Dudley still was eligible to receive the more generous compensation package, calculated at around $20 million total for 2015.

The pay policy changes approved Wednesday will apply for the coming three years, which include reducing Dudley’s maximum long-term payout to five times salary from seven times salary. Bonus payments are being reduced by about 25%.

In his speech before the votes were tallied on 23 resolutions, Dudley told the annual gathering that BP is preparing to launch projects that by 2020 will increase production by 800,000 boe/d. By 2020 BP should be producing as much oil and natural gas as it was before the tragic Macondo well disaster in 2010, which forced the operator to sell close to one-third of its global assets to cover litigation costs.

“We’ve continued to simplify the business with no let-up on our priority of safe and reliable operations,” Dudley said. “We’ve continued to be highly disciplined with how we spend our cash and capital — and highly strategic at the same time.”

BP in 2016 generated underlying profit of $2.6 billion and operating cash flow of $17.6 billion.

“Together these are good indicators that the business is operating strongly when seen in the context of the lowest oil prices for 12 years last year, and the lowest refining margins for six years,” he said. “Most important of all, safety performance has been good, with serious incidents down by 80% compared to 2011, and the injury rate down by 40% in the same period.”

Despite the challenging oil price environment, BP still started up six major projects in 2016, including the Thunder Horse South Expansion project in the Gulf of Mexico, which was completed 11 months ahead of schedule and $150 million under budget.

“We continued to develop a range of innovative new partnerships across the globe, including the creation of a new business in the Norwegian North Sea, called Aker BP, and a strategic joint venture with CNPC to explore for shale gas in China,” Dudley said. “And we have our distinctive partnership with Rosneft in Russia, which gives us a unique position in one of the world’s largest and lowest-cost hydrocarbon provinces.”

Oil and natural gas are expected to remain important for decades to come as the world transitions to a lower carbon economy.

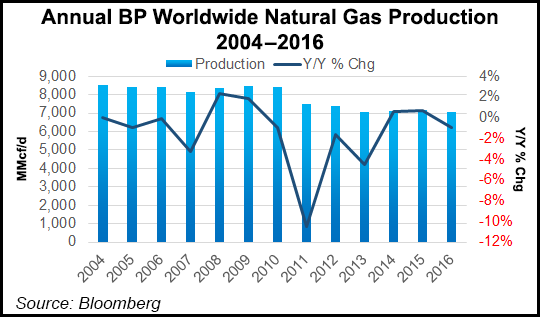

“The cleaner-burning properties of natural gas mean it is going to be increasingly important as an energy source, and we are already shifting our portfolio further toward gas,” Dudley said. “We recently agreed to expansions of major gas projects in Tangguh in Indonesia and Khazzan in Oman. We bought a share of the giant Zohr gas field in the Mediterranean, adding to our strong position in Egypt. And we formed a new partnership with Kosmos Energy to develop prolific gas discoveries off the coasts of Mauritania and Senegal in West Africa. Just last week we announced a huge new discovery in this province.”

This year is “proving to be another really important year for BP,” he said.

“We set out in 2017 with plans to deliver on seven major projects, six of which are gas projects, supporting that shift to gas in the portfolio,” he said. “We have two of these seven projects on line already, with two more imminent — including our big Quad 204 project in the UK — and we are right on track to deliver all seven by the end of the year.”

Global energy demand also “remains strong and growing, but abundant supplies of oil and gas are now a fact of life,” the CEO said. “As a result, the economics of the past are changing. At the same time, the energy mix is changing as we move to a lower carbon world.”

The major has a “vital contribution” to make as the world transitions to lower carbon.

“We already have a head start with a 20-year track record in renewables, having developed two great businesses in wind power and biofuels. We have about 6,000 employees in these businesses. We are building on that experience on a number of fronts.”

BP recently bought a U.S. plant to help commercialize the next generation of biofuels, and it secured a long-term supply of biojet — a sustainable aviation fuel — in a deal with Fulcrum BioEnergy.

“And our trading arm has secured a supply of bio-methane, which is renewable natural gas produced from waste,” Dudley said. “Alongside this, our venturing arm is investing in technology companies with the potential to advance both low-carbon energy and industrial efficiency, from biojet fuel to solar and desalination technologies. We will also keep working in partnership with others on industry-wide low carbon solutions, in particular through our part in the Oil and Gas Climate Initiative with nine other major companies.”

Another BP strategic “pillar” is to continue simplifying and modernizing operations from top to bottom.

“Just to give you one example,” Dudley said, “a BP engineer, anywhere in the world, can now get real-time alerts on wells based on processing almost a billion data points per second across our network, which has a very real impact on the speed, reliability and safety of what we can achieve every second, every day and quarter to quarter.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |