Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

North Dakota Maintains 1 Million b/d Production in March

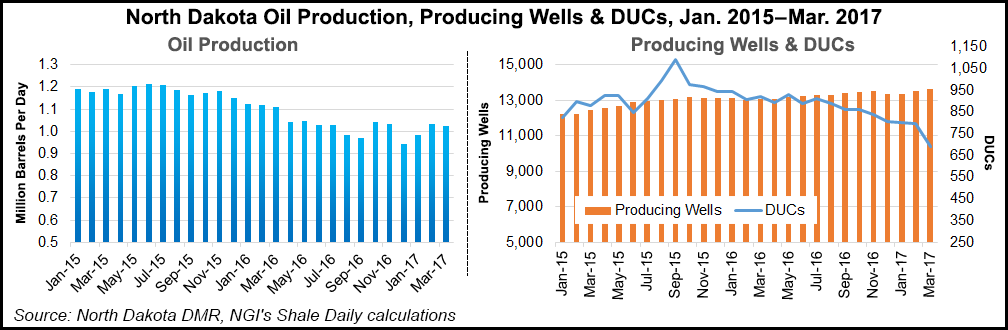

North Dakota’s latest production statistics released Friday show the state is maintaining its 1 million b/d rate for oil production, but state officials are concerned about developments at OPEC and in Washington, DC, that could adversely impact production levels.

Oil production was down slightly (1%) while natural gas went up a little (1.4%) in March, the most recent month for which there are complete statistics, said Lynn Helms, director of the state’s Department of Mineral Resources.

“We got an all-time high for the number of wells operating in the state (13,632) and a very large drop (110) in wells waiting for completion (to 689) in March, and that really stabilized things,” he said.

And adding to this thrust there was a surge in operators bringing back previously inactive wells for production, Helms said, adding that the drop in wells waiting for completion was the biggest in 18 months.

Oil production in March was 31.7 million bbl (1.02 million b/d), compared to 28.9 million bbl (1.03 million b/d) in February. Gas production in March was 53.5 Bcf (1.72 Bcf/d), compared to 47.7 Bcf (1.70 Bcf/d) in February.

“More than 300 wells that had gone inactive in December and January came back on production in March, and the last time we had less than 700 wells waiting on completion was in October 2014, so all of that is good news,” Helms said.

On a global basis, the state’s ability to keep production up is going to be affected by whether OPEC extends its current production restrictions at the end of this month, when they are set to expire, and if the Trump administration ultimately succeeds in retracting the Bureau of Land Management’s (BLM) flaring and methane emissions restrictions.

“OPEC has an enormous decision to make,” said Helms, adding that there are doubts about whether the cartel will extend the limitations in the face of the steep increases in the Permian Basin and Libya. “The Permian Basin is the newest shale play, and it is acting like it is 2012, adding 15 drilling rigs monthly for the past year.”

Permian production is up by nearly 450,000 b/d, which Helms thinks creates a “real concern” for OPEC ministers. “There is a real concern with North American shale plays acting like this, so we really need to be watching out for whether OPEC will decide that the United States needs to take another hit.”

With Congress’s failure to reverse BLM flaring rules, Helms said North Dakota faces the prospect of losing up to $10 million monthly in taxes and royalties starting next year from cutbacks in activity on the Fort Berthold Reservation lands. “Gas capture statistics are doing extremely well except for Fort Berthold; they’re down to 85% while the rest of the state is at 90% and 91%,” he said.

It could take the federal BLM rules six years to catch up with the North Dakota standards, Helms said. “Once we get to January 2018 and beyond, it looks like the state could take somewhere in the neighborhood of a $150 million annual hit in terms of royalties and decreased activities and shifting ownerships adding to a lot of pressure to go to more flaring,” he said. “And up until that time there is just a lot of uncertainty causing people to sell their federal properties.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |