Regulatory | LNG | NGI All News Access | NGI The Weekly Gas Market Report

Agreement Calls For Long-Term LNG Contracts Between China, U.S. Suppliers

An agreement announced Thursday between the United States and China to advance economic cooperation could have implications for liquefied natural gas (LNG) trade between the two countries.

No. 4 of the 10 provisions in a “100-day action plan” is one that says the United States “welcomes China, as well as any of our trading partners, to receive imports of LNG from the United States.”

China, a non-free trade agreement nation (FTA) is treated “no less favorably than other non-FTA partners with regard to LNG export authorizations,” the announcement from the U.S. Commerce Department said.

“Companies from China may proceed at any time to negotiate all types of contractual arrangement with U.S. LNG exporters, including long-term contracts, subject to the commercial considerations of the parties,” it said.

The plan could alter LNG trade, according to Wood Mackenzie’s Massimo Di-Odoardo, head of global gas and LNG research. “Until now, Chinese buyers have not bought long-term LNG supply from the U.S. directly. This ensures U.S. LNG entering the Chinese market will be politically palatable,” he said.

“The agreement connects the U.S., the fastest-growing LNG supplier, with China, the largest LNG growth market. By 2030, we expect Chinese LNG demand to reach 75 million tonnes per annum, triple 2016 imports. This is equivalent to $26 billion a year at today’s prices ($7/MMBtu), and the U.S. is keen for a slice of the pie.”

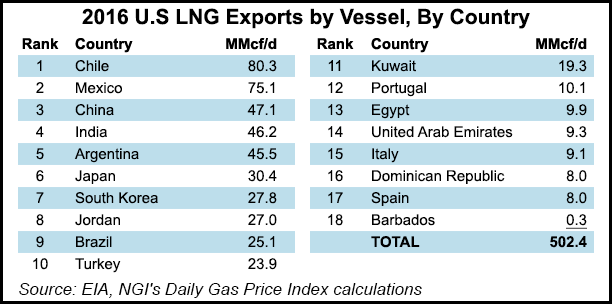

U.S. LNG has been delivered to China already, but not under long-term contracts. Last March, U.S. LNG accounted for 7% of China’s LNG imports, Di-Odoardo said. China’s total LNG demand in 2016 amounted to 26 million tonnes, according to Wood Mackenzie.

Demand for LNG in Asia was strong during the first quarter as winter needs, especially in China, South Korea and Taiwan pulled cargos from the Atlantic Basin, LNG terminal developer Cheniere Energy Inc.’s Anatol Feygin, said earlier this month.

“In the longer term, the deal paves the way for a second wave of investment in U.S. LNG, Di-Odoardo said. “Developers will now be able to target Chinese buyers directly, potentially supporting project financing. It could also support direct Chinese investment into liquefaction and upstream developments on U.S. soil.”

The agreement could also increase pressure on competing supplies of natural gas to serve China, he said. These include LNG from Australia, East Africa and Canada, as well as pipeline gas and LNG from Russia. “It also undermines the niche that portfolio players, such as Shell, BP and Total, have found playing the middleman between U.S. LNG exports and Chinese imports,” Di-Odoardo said.

“But ultimately, whether Chinese buyers line up for a second wave of U.S. LNG will depend on its competitiveness versus other global alternatives and Chinese buyer appetite for exposure to U.S. gas prices.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |