Markets | NGI All News Access | NGI Data

NatGas Bulls Stirring Following Thin Storage Stats

June futures bounded higher Thursday once the Energy Information Administration (EIA) reported a natural gas storage injection that was far less than what traders were expecting.

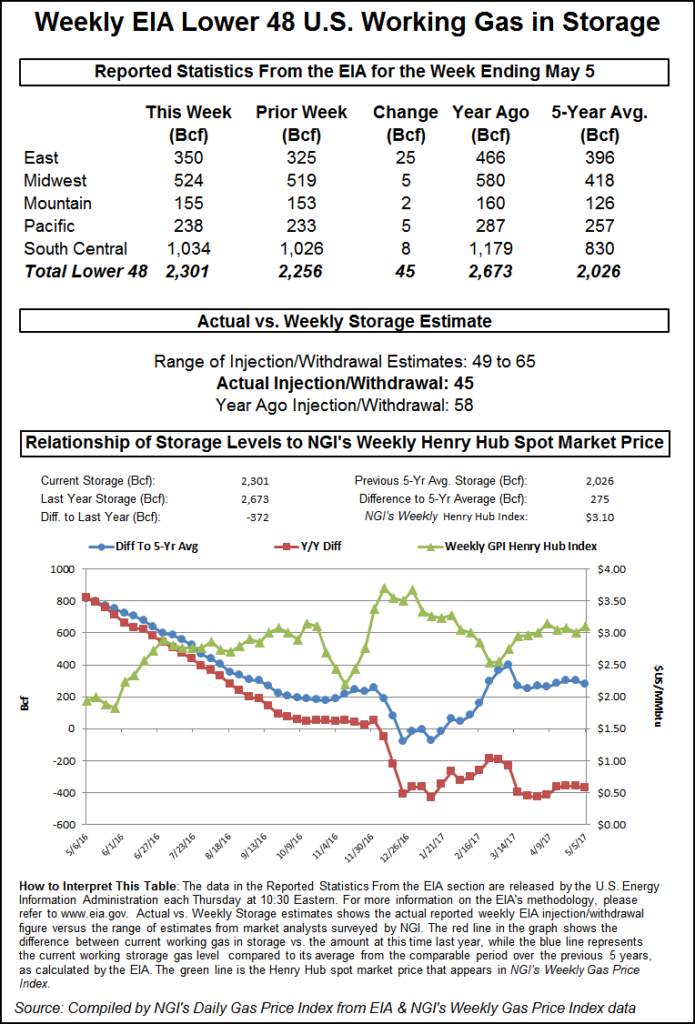

EIA reported a storage injection of 45 Bcf, about 8 Bcf less than consensus estimates, and prices jumped after the number was released. Once the number had rattled across trading desks, June futures rose to $3.387, and at 10:45 a.m. EDT June was trading at $3.372, up 8.0 cents from Wednesday’s settlement.

Prior to the report, traders were looking for a storage build well below historical norms, but the 45 Bcf figure was beyond expectations. Last year 58 Bcf was injected and the five-year average stands at a stout 73 Bcf.

Tradition Energy was looking for a 55 Bcf increase. A Reuters survey of 23 traders and analysts showed a sample mean of 53 Bcf with a range of +49 to +65 Bcf.

“We were looking for a number in the mid-50 Bcf range,” said a New York floor trader. “Initial technical resistance was $3.35 so it broke through that, and if it settles above $3.35, that would be a good indication.

“The 45 Bcf build for last week was below the consensus expectation for 53-54 Bcf and also below the 73 Bcf five-year average for the date, a clear bullish surprise,” said Tim Evans of Citi Futures Perspective. “The data implies some tightening of the market and the end of a mini-run of bearish surprises.”

Inventories now stand at 2,301 Bcf and are 372 Bcf less than last year and 275 Bcf greater than the five-year average. In the East Region 25 Bcf was injected, and the Midwest Region saw inventories rise by 5 Bcf. Stocks in the Mountain Region were increased by 2 Bcf and the Pacific Region was up 5 Bcf. The South Central Region increased by 8 Bcf.

Salt cavern storage rose by 2 Bcf to 331 and non-salt increased 5 Bcf to 702 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |