Regulatory | Infrastructure | Mexico | NGI All News Access | NGI Mexico GPI | NGI The Weekly Gas Market Report

Mexico Pipeline Open Season Draws Diverse International Crowd

Twenty-four companies representing a wide range of industries and national origin gained access Monday to Mexico’s natural gas pipelines that had been under the control of state-run oil company Petroleos Mexicanos (Pemex) for almost eight decades.

Such Mexican industrial flagships as Industrias Peñoles, the world’s leading silver producer, and glass-maker Vitro were granted capacity by Sistrangas, the system of natural gas storage and transportation run by Cenagas, the autonomous operator.

The results, showed that the open season proved to be a “great success,” Cenagas Director David Madero told NGI. “This has been a big day, not only for natural gas in Mexico, but also for the nation’s industrial base and its need for greater efficiency.”

Before the open season, Pemex Transformación Industrial (PTI) was allocated 1.3 Bcf/d under the terms of what is known as the EPE (state enterprises) round, similar to the “Round Zero” that provided Pemex the first bite of the cherry before the Round One upstream auctions that followed the 2014 energy reform.

And just as Pemex may form alliances with the fields allotted for Round Zero, so too will PTI be free to join up with other companies and contractors from its EPE allocation. PTI, which is the recently created downstream subsidiary, includes both refining and petrochemicals.

The previous round of the capacity open season concluded last month.

The principal winners of the open season were France-based Engie, with 159 MMcf/d, Royal Dutch Shell plcm 140 MMcf/d, Mexico’s Grupo Alpha, which manufactures restaurant equipment, 104 MMcf/d, and Macquarie Energym 64 MMcf/d.

The most sought-after take-up point for the system was Los Ramones, the pipeline system that runs from the Texas shale fields to central Mexico. Sixteen companies reserved capacity there including Macquarie Energy, Shell, BP plc and steelmaker ArcelorMittal.

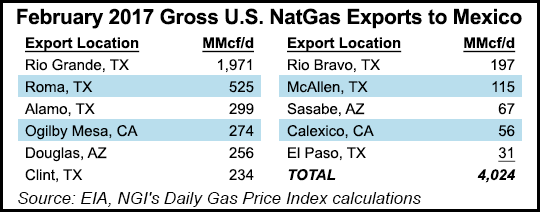

In general, there was more interest in natural gas produced in the United States. Fifteen lots of available capacity involving the Mexican product found no takers. By contrast, nine lots of imported gas received 37 bids.

The contracts are to be signed by mid-June and come into force in July.

Sistrangas was the Pemex pipeline system that was transferred to Cenagas after the energy reform. Its total capacity is 6.1 Bcf/d of which the EPE round and the open season took up 36%.

Cenagas reported that of the 2.6 Bcf/d available during the open season, 2.2 Bcf/d was assigned. Requests for capacity totaled 3.2 Bcf/d.

For a better understanding of the developing situation in Mexico, check out NGI’s 2017 Map of Emerging Mexico Natural Gas Pipeline Infrastructure, which includes the latest updates on the 15 operational and 19 prospective natural gas pipeline projects in the country.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |