E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

EOG Shatters Industry Records in Permian’s Delaware

EOG Resources Inc. struck oil gold in the Permian Basin during the first quarter, with four wells in the Whirling Wind field of New Mexico breaking industry records.

The Houston-based explorer issued its first quarter results late Monday and followed Tuesday with a conference call led by CEO Bill Thomas.

“We beat our production targets and are on track to grow oil production 18% this year,” he said, setting a company record for crude oil volumes of 315,700 b/d.

The Houston independent also returned to profits in the first quarter to earn $28.4 million (5 cents/share) from a year-ago net loss of $$471.8 million (minus 86 cents).

EOG is claiming strong returns production-wise for its shift to “premium” drilling, which Thomas defined as prospective well locations that will earn a minimum 30% direct after-tax rate of return at $40/bbl crude oil and $2.50/Mcf natural gas.

“Our shift to premium drilling is the reason we can deliver high-return, double-digit oil growth this year within cash flow including the dividend,” he said.

Just three months ago during the fourth quarter call Thomas had talked about delivering 2017 growth at $50/bbl oil. EOG will beat that forecast, he said.

“We now believe we can deliver 18% oil growth within cash flow at $47 oil, a record for the company. Our premium strategy clearly sets EOG apart as one of the most capital efficient and lowest-cost U.S. horizontal drillers. Our focus on growing low-cost premium production will continue to drive down breakeven costs and strengthen our bottom line over time.”

During 1Q2017, EOG increased its resource potential by 1.4 billion boe by converting 1,200 locations to “premium” for a new total of 6.5 billion boe and 7,200 locations.

“That’s a 27% increase in premium resource potential and 15 years of premium drilling at our current pace,” Thomas said.

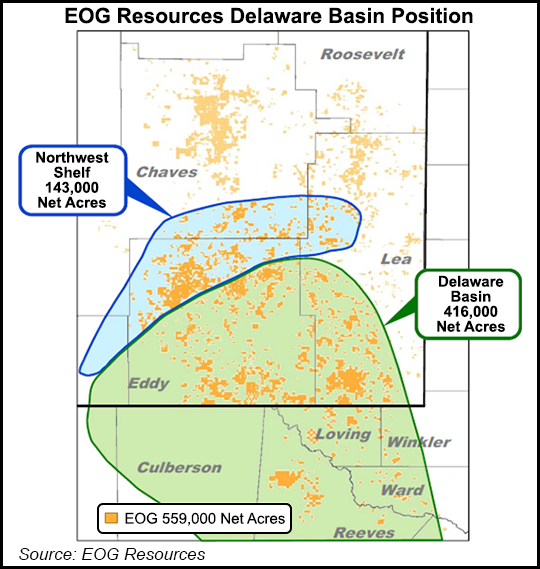

He then highlighted EOG’s record oil wells in the Permian’s Delaware sub-basin of southeastern New Mexico. In that play alone, net locations year/year rose by 700 to 4,150.

Within the Wolfcamp formation of the Delaware, 33 wells were completed in the first quarter, with average lateral lengths of 5,600 feet/well and 30-day initial production (IP) rates/well averaging 2,855 boe/d, including 1,850 b/d of oil, 450 b/d of natural gas liquids (NGL) and 3.3 MMcf/d of natural gas.

Thomas highlighted a four-well pattern in Lea County, NM, the Whirling Wind 14 Fed Com No. 701H and the Whirling Wind 11 Fed Com No. 702H-704H, which were completed with average laterals of 7,100 feet and average IPs of 5,060 boe/d, or 3,510 b/d of oil, 700 b/d of NGLs and 5.1 MMcf/d of natural gas.

Each well exceeded the previous all-time industry record for 30-day IPs from Permian horizontal oil wells, Thomas said.

“EOG’s Whirling Wind wells shattered industry records in the Permian Basin,” he said. “Our advanced technology and proprietary techniques are leading to breakthrough well performance across our diverse portfolio of premium plays.”

In the Bone Spring formation of the Delaware, three wells were completed using laterals of 8,800 feet average length and recording IPs of 3,255 boe/d, including 2,525 b/d of oil, 335 b/d of NGLs and 2.4 MMcf/d of natural gas. Another three wells were completed in the Leonard formation with average laterals of 3,800 feet and IPs averaging 840 boe/d, with 505 b/d of oil, 150 b/d of NGLs and 1.1 MMcf/d of gas.

Even with the record breakers in the Permian, the Eagle Ford Shale in South Texas continued to be the most active area for the Houston operator early this year. EOG expanded its net locations by 500 to more than 2,400 locations, enabled in part by a shift to longer lateral drilling units. Seven wells that began production in 1Q2017 had lateral lengths of more than 10,000 feet.

EOG completed 65 wells in the Eagle Ford during 1Q2017 with average laterals of 6,500 feet and average 30-day IPs of 1,390 boe/d, or 1,130 b/d of oil, 130 b/d of NGLs and 0.8 MMcf/d of gas.

Tests also continued in the Austin Chalk formation of South Texas, where EOG completed five wells in Karnes County with an average laterals of 5,700 feet and IPs averaging 2,605 boe/d, or 1,895 b/d of oil, 360 b/d of NGLs and 2.1 MMcf/d of gas.

Beyond Texas and New Mexico, EOG is developing the Powder River Basin (PRB) position and reducing its inventory of drilled uncompleted wells in North Dakota’s Bakken Shale.

In the PRB, EOG completed five wells with average lateral lengths of 4,900 feet/well and average IPs of 1,160 boe/d, or 950 b/d of oil, 75 b/d of NGLs and 0.8 MMcf/d of gas.

Twenty-seven wells were completed in North Dakota during 1Q2017 with average laterals of 8,500 feet and IPs that averaged 715 boe/d, or 640 b/d of oil, 40 b/d of NGLs and 0.2 MMcf/d of gas.

Bakken completions included 24 wells that were drilled before 2016, including three of the first ones drilled in EOG’s Bakken Lite area using high-density fractures. The three wells had average laterals of 7,700 feet with average IPs of 955 boe/d, or 795 b/d of oil, 85 b/d of NGLs and 0.5 MMcf/d of gas.

Completed well costs in the first quarter fell 6% from full-year 2016 averages in the Eagle Ford, Delaware and Bakken using normalized lateral lengths, Thomas said.

“For all three plays, the overall cost reductions were achieved in spite of service and equipment price inflation in certain areas, which were more than offset by continued advances in drilling and completion tools and techniques, benefits from extended lateral lengths, and new contracts at lower prices.”

Between January and March, lease and well expenses on a per-unit basis increased 4% from a year ago while per-unit transportation costs fell 8%. Total general and administrative expenses were down 3%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |