E&P | NGI All News Access | NGI The Weekly Gas Market Report

Rig Gains Could Be Poised to Slow; Analysts See More NatGas in Q4

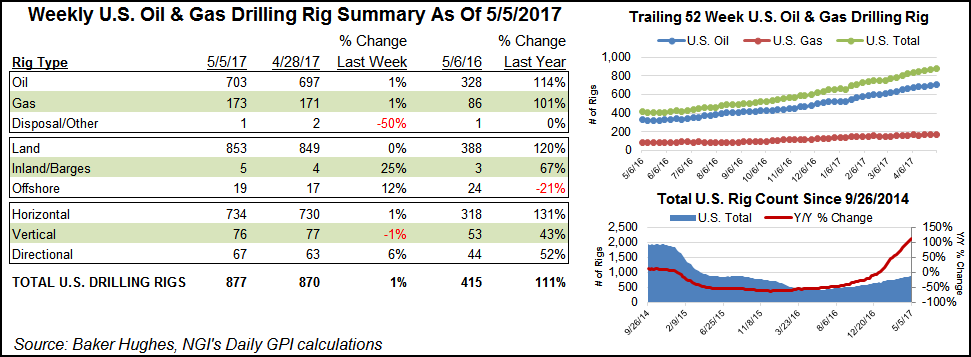

The U.S. land-based rig count posted a modest gain of four during the week just ended, according to Baker Hughes Inc. (BHI), and the pace of rig gains could slow in the months ahead, according to some. Meanwhile, analysts are awaiting the additional gas supply yet to come from rigs already added.

Several U.S. land drillers expect the pace of Lower 48 rig additions to slow in the coming months, for two reasons. Some customers will probably be cautious before a meeting of the Organization of the Petroleum Exporting Countries scheduled for later this month; and the rapid increase in active rigs seen during the last few quarters is seen as simply unsustainable.

“We again surveyed our largest Lower 48 customers earlier this month,” said Nabors Industries CEO Tony Petrello during a first quarter earnings conference call. “These clients represent over 30% of the total rig count. Of those, nearly 75% have plans to add rigs between now and the end of the year for an increase of over 15%. Only one customer indicated a possible reduction of just one rig. This feedback would imply an industry rig count approaching 1,000 rigs by the end of the year.”

The Lower 48 rig count has increased at an annualized trend-line rate of 136% per year since the cyclical bottom on May 27, 2016, from 399 rigs to 869 as of Friday, said NGI’s Patrick Rau, director of strategy and research. “The 1,000 rig end of 2017 rig count suggested by Nabors would imply an annualized growth rate of just 23% per year from now until late December. Still a good growth rate, but certainly well below that since the cyclical low,” Rau said.

More Gas to Come

Analysts at Wells Fargo Securities LLC have also been watching the rising rig count. “Since August, the U.S. natural gas rig count has increased by 90 rigs, or 111%, and now stands at 171,” they said in a note published Tuesday.

“Despite the increase in activity, overall natural gas production has remained relatively flat over the same time period,” the Wells Fargo analysts said. “Typically, there is a lag in production associated with pad drilling of as much as six to nine months, and the relatively flat production levels over the past seven months exemplify that trend. Our analysis indicates that most of the supply impact from the increase in activity will likely not be felt until 4Q17…”

Wells Fargo raised its 2017 U.S. production forecast to 73 Bcf/d, up 0.3 Bcf/d from the prior estimate. After incorporating Canadian imports, the firm’s total supply estimate is now 78.7 Bcf/d.

More Jobs in Sooner Country

More rigs running means more jobs in the energy patches of states like Oklahoma. The Oklahoma Energy Index (OEI) has been climbing, marking the eighth month in the last 10 that industry activity has increased, the producers of the index said Wednesday.

Another 2,100 oil and natural gas industry jobs were added across the state, according to the most recent index. Increased employment has been driven primarily by increased rig activity. More exploration for oil and natural gas has resulted in a 62% increase in the number of active Oklahoma drilling rigs compared to one year ago.

The OEI stood at 170.1 using data collected in March, a 1.9% increase from the previous month’s reading.

“The industry improvement shown in eight of the last 10 months is a sign for optimism. We see signs of this strengthening in our markets also,” said Chris Mostek, senior vice president of energy lending for Bank SNB. “At the risk of sounding redundant, the storage levels and price levels temper some of this enthusiasm. The industry should remain prudent on capex [capital expenditure] budgets, overhead expenses and risk management.”

The OEI is a project of the Oklahoma Independent Petroleum Association, Bank SNB and the Steven C. Agee Economic Research and Policy Institute.

April Monthly Rig Counts

BHI said on Friday the average U.S. rig count for April was 853, up 64 from 789 in March and up 416 from 437 in April 2016. The average Canadian rig count for April was 108, down 145 from 253 in March 2017 and up 67 from 41 in April 2016.

BHI’s international rig count for April was 956, up 13 from 943 in March and up 10 from 946 in April 2016. The international offshore rig count for April was 201, up four from 197 March and down 19 from 220 in April 2016. And the worldwide rig count for April was 1,917, down 68 from 1,985 counted in March and up 493 from 1,424 in April 2016.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |