E&P | Eagle Ford Shale | NGI All News Access | Permian Basin

Pioneer Growing Spraberry/Wolfcamp Production, Resuming Eagle Ford Activity

Pioneer Natural Resources Co. continues to work its Spraberry/Wolfcamp acreage in the Permian Basin with its latest — and most successful so far — well completion design. Meanwhile, company activity is returning to the Eagle Ford Shale.

As the company and others continue to increase drilling, Pioneer CEO Tim Dove told analysts during an earnings conference call Thursday that cost inflation is a fact of life in the patch, but not necessarily for Pioneer.

“We still see some cost inflation. In some areas it’s up to 10-15%. We see other areas that are single digits. We’re assuming about a 5% net cost inflation to our operations,” he said. “I think I’m pretty confident at this point to say that what we’re doing in terms of both vertical integration and improvements in productivity will offset that 5%. I don’t expect to be impacted by any significant amount of inflation in 2017 at the bottom line.”

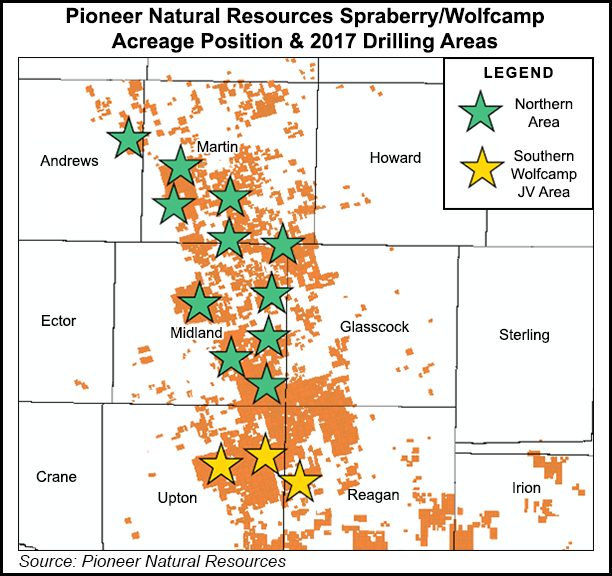

Pioneer is the largest acreage holder in the Spraberry/Wolfcamp with about 600,000 gross acres in the northern portion of the play and about 200,000 gross acres in the southern Wolfcamp joint venture area.

The company has been testing the third iteration of its completion design, version 3.0, and has deemed it to be the current standard. It includes larger proppant concentrations of up to 1,700 pounds per foot, larger fluid concentrations up to 50 barrels per foot, tighter cluster spacing down to 15 feet and shorter stage spacing down to 100 feet.

Pioneer placed 38 horizontal wells on production in the Spraberry/Wolfcamp during the first quarter. All 38 used the version 3.0 completion design. Pioneer has now placed 154 version 3.0 wells on production since early 2016 (80 Wolfcamp B wells, 57 Wolfcamp A wells and 17 Lower Spraberry Shale wells). Results are outperforming version 2.0 completions at an incremental capital cost of $500,000 to $1 million per well, which is paid out in less than a year at current commodity prices, Pioneer said.

Plans are to place about 260 gross horizontal wells on production in the Spraberry/Wolfcamp this year. About 220 will be in the northern area and 40 will be in the southern Wolfcamp joint venture area.

Pioneer is also planning a limited appraisal program for the Clearfork, Jo Mill and Wolfcamp D intervals during the year. The company has been tracking the performance of five Jo Mill wells that were placed on production over the past two years in the Spraberry/Wolfcamp.

“The performance of these wells has been encouraging, with an average estimated ultimate recovery (EUR) of 900,000 boe for a 6,800-feet average lateral length,” the company said. Six additional Jo Mill wells are planned to be placed on production during 2017 at a cost of about $6 million each with an average lateral length of 10,000 feet.

Pioneer said it expects EURs for the wells planned this year to average 1.5 million boe for Wolfcamp B wells, 1.2 million boe for Wolfcamp A wells and 1.0 million boe for Lower Spraberry wells.

The forecasted 2017 production growth rate for the Spraberry/Wolfcamp ranges from 30% to 34%, with oil production increasing 33-37%.

In the Eagle Ford Shale, Pioneer has begun limited horizontal drilling and completions in the liquids-rich area. The company is focusing on Karnes, DeWitt and Live Oak counties in Texas. This year’s program includes plans to complete nine wells that were drilled in late 2015/early 2016 and drilling and completing 11 new wells. Pioneer is running two horizontal rigs and one third-party fracture stimulation fleet in the play.

“The objective of this drilling and completion program is to test longer laterals with wider spacing and higher-intensity completions in the new wells,” the company said of the Eagle Ford program. “Lateral lengths are being extended to 7,500 feet from the previous design of 5,200 feet, with cluster spacing reduced from 50 feet to 30 feet. Proppant concentrations are being increased from 1,200 pounds per foot to 2,000 pounds per foot.”

These wells are expected to cost $8.5 million each with EURs averaging 1.3 million boe for the new wells. The 2017 Eagle Ford program is expected to moderate the production decline Pioneer has experienced in the field since it stopped drilling operations in early 2016. “While the year-over-year decline is still forecasted to be approximately 40%, the decline from the fourth quarter of 2016 to the fourth quarter of 2017 is expected to be shallower at 20% since the production from the 2017 program is heavily weighted to the second half of the year,” the company said.

Wunderlich Securities Inc. analyst Irene Haas has a “buy” rating on Pioneer and was enthusiastic about first quarter results in a note published Friday. “Total production averaged at about 249,000 boe/d, above high end of guidance despite fewer wells being tied in (38) than planned (45), mostly [because of] timing issues,” she wrote. The third generation completions are “much stronger,” and this helped, she said, adding that natural gas liquids and gas production as well as pricing were also “much stronger” than expected.

This year’s capital budget is still $2.8 billion and includes $2.5 billion for drilling and completion activities, including tank batteries/saltwater disposal facilities and gas processing facilities, and $275 million for water infrastructure, vertical integration and field facilities.

For the second quarter overall production is projected to be 254,000-259,000 boe/d.

Pioneer reported a net loss of $42 million (minus 25 cents/share) compared with a net loss of $267 million (minus $1.65/share) in the year-ago quarter.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |