E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Devon Talks Growth in Permian, STACK, Puts $1B of Noncore Assets on Auction Block

Devon Energy Corp. expects to ramp up to 20 rigs by the end of 2017 as it focuses on oilier opportunities in the Permian Basin and Oklahoma’s STACK (aka, the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties).

Meanwhile, the Oklahoma City-based super independent’s resource expansion in Oklahoma and West Texas has management planning to divest $1 billion in non-core assets over the next year and a half, including portions of its Barnett Shale acreage in North Texas and other properties primarily within its U.S. portfolio.

“By the end of this month, we will have 15 operated rigs running in the U.S., focused primarily within our top two franchise assets” in the STACK and the Permian’s Delaware sub-basin, CEO Dave Hager said in a conference call Wednesday to discuss 1Q2017 results. “As we progress through 2017, we are on pace to steadily ramp up drilling activity to as many as 20 rigs by year-end, resulting in a $2-2.3 billion upstream capital program for the year.”

Hager said the company sees “significant upside” to its risked inventory in the STACK and the Delaware, with more appraisal work planned later this year.

“We look at this divestiture program as a first step,” he said. “We think it’s an appropriate first step, because obviously commodity prices have softened somewhat in the past few months. We are confident that we have a program planned for 2018 that’s well beyond the 20 rigs that we will have in 2017.”

The divestment program “gives us increased certainty that we can deliver on the growth results even if commodity prices soften, because these wells are still generating incredible rates of return even at somewhat lower prices.”

As if on cue, on Thursday Denver-based Meritage Midstream Services II LLC and subsidiary Thunder Creek Gas Services LLC announced an agreement to purchase substantially all of Devon’s midstream assets in Wyoming’s Powder River Basin. The assets include 115 miles of natural gas gathering lines and associated equipment. Also part of the deal, Devon will make a long-term dedication of 250,000 acres in the basin.

During Wednesday’s call Hager also touched on Devon’s hedging program and its efforts to work through its supply chain to limit service cost inflation.

Over 50% of estimated 2017 oil and gas production is locked in at prices above market levels, the company said.

As for service costs, Hager said Devon will be able to limit about 75% of cost inflation from 4Q2016 to 4Q2017 “with just some good planning and good operational efficiency…we are already working out into 2018 and 2019. Planning our work there allows us to go to providers, give them certainty about the long-term plans…that’s helping us in a big way. We like to have control over our destiny, as a lot of companies do. We find that when we have good plans in place, good partners and control over the project schedule, we can excel there.”

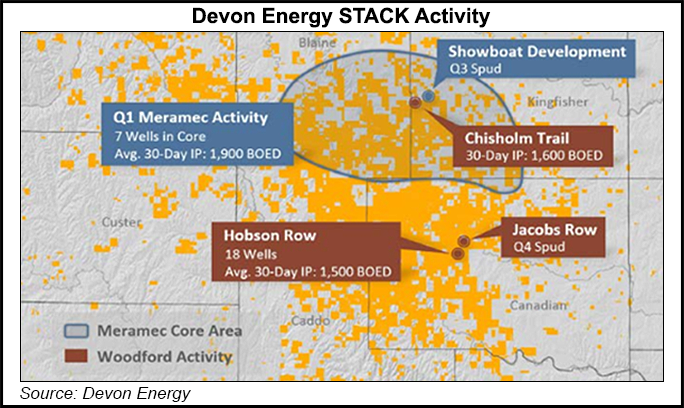

As for recent well results, Devon highlighted its Hobson Row project in Canadian County, OK, located in the eastern core of the Woodford play. Devon has completed 90% of the project’s 39 wells, with 18 of these wells averaging 30-day initial production (IP) rates of 1,500 boe/d, 25% weighted to oil. The company said per-well recoveries from Hobson Row are trending above its 1.6 million boe type curve.

North of Hobson Row, Devon is planning to develop its Jacobs Row project later this year using 10,000-foot laterals. Devon said it plans to begin drilling at Jacobs Row in the fourth quarter, potentially ramping up to 10 gross rigs on the development by early 2018.

Total production for the quarter averaged 563,000 boe/d, including 261,000 b/d of oil and bitumen, 98,000 b/d of natural gas liquids (NGL) and 1,228 MMcf/d of natural gas. Production in the year-ago quarter, not including divested assets, averaged 611,000 boe/d, including 268,000 b/d of oil, 115,000 b/d of NGLs and 1,581 MMcf/d of gas. Devon is guiding for 539,000-561,000 boe/d of production for full-year 2017.

Realized prices for the quarter averaged $25.97/boe, a significant improvement over $13.53/boe averaged in the year-ago quarter. In 1Q2017, realized prices averaged $37.83/bbl for oil, $15.46/bbl for NGLs and $2.65/Mcf for natural gas. That’s compared with year-ago prices of $20.06/bbl, $6.84/bbl and $1.66/Mcf, respectively.

Devon said it has now lowered annualized operating and general and administrative expenses by $1 billion compared with the 2014 peak. First quarter lease operating expenses totaled $386 million ($7.62/boe), $58 million below 1Q2016 levels.

Devon reported a quarterly net income of $579 million ($1.08/share) versus a net loss of $3.1 billion (minus $6.44/share) in the year-ago quarter.

Enlink Midstream Partners LP, a master limited partnership in which Devon owns interest in both the limited and general partner, reported a net income of $13.3 million (minus 3 cents/unit) for the quarter, compared with a net loss of $563 million (minus $1.74/unit) in 1Q2016.

Enlink reported distributable cash flow of $153 million for the quarter versus $155 million in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |