Markets | NGI All News Access | NGI The Weekly Gas Market Report

Barclays Raises Henry Hub Gas Price Forecast, Sees Hot Summer Ahead

With futures already reflecting warmer-than-normal temperatures, Henry Hub natural gas prices could reach $3.57/MMBtu this summer, Barclays said Wednesday.

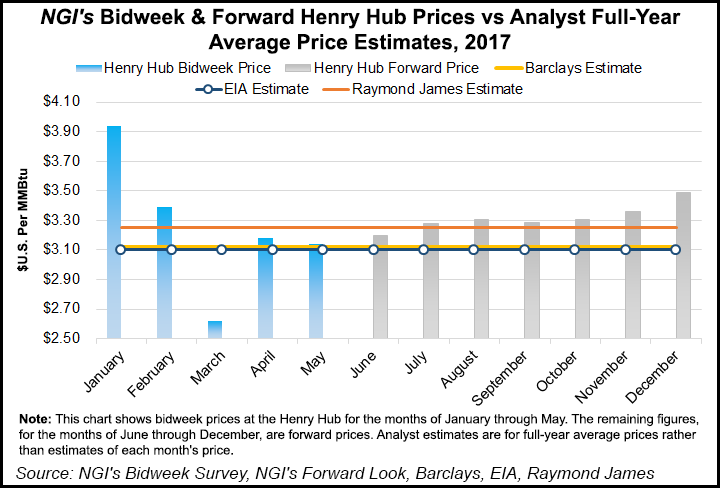

Analyst Nicholas Potter, with an assist from Amarpreet Singh, said the investment firm is raising its 2017 gas price forecast to $3.12/MMBtu from $3.02 on the back of stronger cash prices in the second quarter, supported by “heavy production maintenance and nuclear outages…We also increase our 2018 forecast from $3.11/MMBtu to $3.17/MMBtu (curve at $3.08/MMBtu).”

Barclays 2017 forecast is close to one issued last month by the Energy Information Administration (EIA), which forecast Henry Hub would average $3.10/MMBtu in 2017; it foresees an average gas price of $3.45 in 2018. In a Summer Fuels Outlookissued last month, EIA said it expected relatively mild summer temperatures to keep gas-fired power generation about 9.1% lower than last summer. Raymond James & Associates Inc. in April turned bearish on gas prices, maintaining a 2017 forecast of $3.25/Bcf, but the 2018 estimate has been slashed to $2.75 from $3.50.

Futures already appear to reflect a 5% warmer-than-normal summer, analysts said.

“Assuming normal weather this summer, we believe 2017 U.S. natural gas prices (Henry Hub) are currently overvalued by around 6% relative to the curve, while 2018 prices look undervalued by around 3%,” said Potter. With normal temperatures this summer, “we see value in selling 2017 and buying 2018 natural gas…but a hot summer could present a clear bull case for prices in 2017 and 2018.”

In any case, summer temperatures are likely going to drive volatility in prices.

“We estimate a 10% warmer-than-normal summer would result in 2017 gas prices of $3.45/MMBtu, while a 10% cooler-than-normal summer would result in prices averaging $2.91/MMBtu,” Potter said. “We think the market is currently factoring in an 5% warmer-than normal summer, slightly above meteorologists’ current estimates. For this reason, we see risks as skewed to the downside.”

The summer is going to feed into 2018 balances.

“At current levels, we continue to see 2018 gas as attractive, despite the risks we see of around 5 Bcf/d of supply growth next year,” Potter said. “We estimate a 10% warmer summer this year would result in 2018 prices at close to $3.80/MMBtu and would have further upside if winter 2017-18 is colder than normal.”

However, don’t close the door to the bears, he cautioned. Mild temperatures this summer could reduce gas prices to $2.92/MMBtu

“Although summers have trended warmer than normal in recent years, we believe a mild summer could send 2017 and 2018 prices back well below $3.00/MMBtu.”

As the second quarter progresses, gas prices should experience headwinds as heating demand dissipates before summer cooling season kicks in completely. This year, however, “cash prices have been supported by a busy spring season of production and nuclear maintenance work,” Potter said.

“Once shoulder season ends, things are likely to continue to tighten, with days of forward demand cover expected to fall below the five-year average in the second half of the year. As storage levels normalize, we anticipate this tightness will slip into the first half of 2018, supporting prices.”

The market appears hesitant to bid up 2018 prices even though 2017 is moving higher. In April gas prices averaged a 27 cent/MMBtu premium over 2018, likely driven by an expectation for a large production response next year as the next Northeast infrastructure comes online and associated gas volumes move higher, Potter said.

“However, despite these bearish factors, we see below-average storage levels as a counterweight, which would help prices move higher than the current 2018 futures.”

Given current 2017 prices, the market may be getting ahead of itself.

“Good news for U.S. natural gas prices has been hard to come by over the last five years or so,” he said. “However, with more bullish data (lower production levels and new demand), sentiment seems to be shifting away from the perma-bear years of the past.”

The managed money net length in gas as reported by the Commodity Futures Trade Commission has moved higher in recent weeks.

“At current levels, net long positions are the most bullish they have been in the last three years and increased for nine consecutive weeks since Feb. 21,” Potter said. A “small decline” was registered in net length on April 25, “possibly evidence of some profit-taking.” Data have improved, but bearish factors remain in the market, “and we think there may be some measure of irrational exuberance that has bid prices too high too soon.”

Not including power burn, gas supply/demand balances should be about 2.1 Bcf/d tighter this summer versus a year ago, according to Barclays data. Higher prices would mean 3Q2017 power burn is down 1.8 Bcf/d year/year (y/y), lowering the overall y/y tightness to 300 MMcf/d.

For the curve to be priced “correctly,” Barclays analysis suggests that, at current prices, the United States would need to experience a warmer-than-normal summer, said Potter.

Meteorologists overall are forecasting cooling degree days (CDD) from June through August will be inline with the five-year average and about 3% warmer than the 10-year average.

“However, if forecasts are correct, temperatures this summer would be around 6% milder than last summer, which was one of the warmest on record,” Potter said. “Forecasts do not show any significant changes in the historical distribution of this year’s CDDs. July is forecast to be the hottest month, accounting for 26% of the April-October CDD levels, with August and June following at 24% and 18% respectively.”

Those assuming a warmer-than-normal summer have history on their side, said the analyst. Except for the summer of 2014, which was about 1% cooler than normal, the average temperatures for the last six summers have been above normal, Potter noted.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |