Markets | NGI All News Access | NGI Data

Few Points In The Black During Weekly NatGas Shoulder-Season Trading

The $3 weekly pricing threshold proved a little more elusive as only a handful of points made it to the positive side of the trading ledger and most points outside the Northeast and Appalachia fell anywhere from a nickel to a dime.

The NGI National Spot Gas Average for the week ended Thursday down 6 cents to $2.84, and the location scoring the week’s greatest gain proved to be Iroquois Zone 1 with an advance of 5 cents to $3.09. The weakest point was gas destined for New York City on Transco Zone 6 with a drop of 32 cents to $2.67.

Regionally, Appalachia gave up the most, losing 18 cents to $2.53 and the Northeast made it to the top of the leader board at $3.00, unchanged.

California on average shed 9 cents to $2.90, the Southeast fell 8 cents to $2.97, East Texas lost 5 cents to $2.96 and the Rockies lost 7 cents $2.61.

South Louisiana lost 6 cents to $2.95, the Midcontinent fell 5 cents to $2.75, and South Texas posted a loss of a couple of pennies to $2.97.

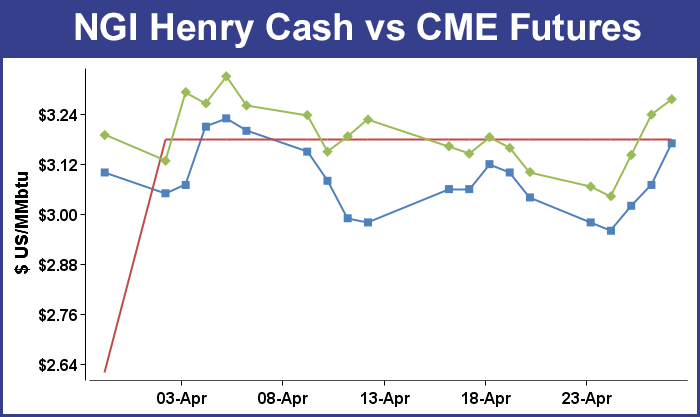

May futures expired Wednesday at $3.142, and for the short week the June contract eased 4.7 cents to $3.192.

As trading ended Thursday, gas for delivery Friday on average moved little in Thursday’s trading as most players elected to get their trades made ahead of the release of Energy Information Administration (EIA) storage figures.

Gains at South Louisiana, the Southeast, and California were able to offset weakness in the Northeast and Appalachia, and the NGI National Spot Gas Average was unchanged at $2.87.

The EIA reported a storage increase of 74 Bcf, just 2 Bcf greater than the industry consensus and the trading in futures was equally lackluster. At the close June futures had slipped 3.2 cents to $3.239 and July was down 3.0 cents to $3.320.

Prices curiously inched higher after EIA’s storage figure was released. Once the number had made it across trading desks June futures rose to $3.245, and at 10:45 a.m. June was trading at $3.263, down 8-tenths of a cent from Wednesday’s settlement. The day’s high at that point was $3.266 and low was $3.207.

Before the number was released, Citi Futures Perspective predicted a build of 63 Bcf and Tradition Energy was expecting a 77 Bcf increase. A Reuters survey of 18 traders and analysts revealed an average 72 Bcf injection with a range of 62-91 Bcf.

In the same week last year, 64 Bcf was injected and the five-year pace is for a 57 Bcf build.

“The market didn’t move much and failed to take out the day’s highs or lows when the number was released,” said a New York floor trader. “I think you have to look at $3.15 support and $3.35 on the upside. We just rolled from May to June, so we’ll have to see if we can hold these levels.”

Analysts saw the pattern of outsized builds continuing. “The build for last week was slightly more than the 72-73 Bcf consensus view, a minor miss that doesn’t really constitute a surprise,” said Tim Evans of Citi Futures Perspective. “However, this report does nonetheless confirm that the background supply/demand balance has weakened relative to late March and early April, a bearish development in terms of our model. We’ll be looking for somewhat more robust storage injections in the weeks ahead as a result.”

“We believe the storage report will be viewed as neutral,” said Randy Ollenberger of BMO Capital Markets. “Storage is trending below last year’s levels; however, rising associated gas production should keep U.S. storage levels at, or above, five-year averages, assuming normal weather.”

Inventories now stand at 2,189 Bcf and are 358 Bcf less than last year and 299 Bcf greater than the five-year average. In the East Region 25 Bcf was injected, and the Midwest Region saw inventories rise by 17 Bcf. Stocks in the Mountain Region were greater by 5 Bcf and the Pacific Region was up 5 Bcf. The South Central Region increased 22 Bcf.

Traders are favoring the short side of the market, but for now are on the sidelines. “The ability of the market to absorb a seemingly bearish storage figure in routine fashion suggests some further price consolidation mainly within this week’s trading range that could well persist through the first half of this month,” said Jim Ritterbusch of Ritterbusch and Associates in a morning report to clients. “But while we feel that a 300 Bcf storage surplus is more appropriate to nearby futures in the $3.05 area rather than $3.25 region, we will await a price advance prior to suggesting new short positions.

“The trade is likely to be a range bound affair across most of next month until the kickoff to the cooling season when the weather factor will return as primary driver of nearby futures prices. We are still viewing the mid-week expiration of the May contract as a bearish portent given its increased discount of almost 13 cents relative to June values. The expanded June price premiums combined with the supply overhang could prove sufficient to entice commercial concerns further into the short side especially as a hedge against future production amidst the unrelenting upswing in the oil and gas rig counts…”

Looking ahead to gas for Monday delivery, steady Monday power pricing along with increasing energy demand over the weekend prompted higher eastern quotes. Soft Midwest pricing was easily buoyed by gains in Appalachia, Texas, Louisiana, the Rockies and California. The NGI National Spot Gas Average added 6 cents to $2.88. Futures trading was something of a snoozer with total range on the June contract less than 7 cents. At the close June had added 3.7 cents to $3.276 and July was up 3.3 cents to $3.353. June crude oil gained 36 cents to $49.33/bbl.

The Marcellus proved to be the big gainer on the day as Monday power loads were forecast over Friday’s. The PJM Interconnection forecast Friday’s peak load of 34,368 MW would rise to 35,667 MW Monday. The New York ISO predicted Friday peak load of 17,704 MW would climb to 18,088 MW by Monday.

Gas on Dominion South rose 22 cents to $2.63 and gas on Tennessee Zone 4 Marcellus added 23 cents to $2.56. Deliveries to Transco-Leidy Line gained 21 cents to $2.62.

Monday on-peak power prices came in steady. Intercontinental Exchange reported on-peak Monday power at the New York ISO Zone G (eastern New York) delivery point rose $1.25 to $34.75/MWh and Monday peak power at the PJM West terminal slid 52 cents to $36.29/MWh.

Analysts see growing Permian volumes pressuring the basis and perhaps ultimately resulting in shut-ins. Tony Scott of BTU Analytics notes that “April cash prices averaged $0.30 below Henry Hub for Permian and Oklahoma producers while Rockies producers have averaged $0.37 below Henry Hub pricing this month, trading at parity with their Appalachia peers battling for Midwest markets on REX pipeline. Despite the weakness in pricing, producers do not yet appear concerned.

“There’s not another molecule of demand at the other end of the pipelines out of the Permian,” Scott told NGI. “You’ve got strong hydro runoff in the West, record solar and wind numbers and we are not in the heart of the summer yet. Production is still ramping up and we may see some tapering in the basis in June, July, and August, but as we go back into the shoulder season next year the impacts likely get worse.”

Futures opened a penny higher Friday at $3.25 as traders were mulling a mixed weather picture.

Overnight weather models showed a cool East and warming West. “The current 6-10 day period forecast is cooler than yesterday’s forecast across portions of the southern U.S. and East,” said WSI Corp. in its Friday morning report to clients. “The Rockies and north-central U.S. are a little warmer. CONUS GWHDDs are up 2.2 to 34.9. PWCDDs are 8.8.

“The details of a storm system over the East late in the period can cause the forecast to deviate. The East and West Coast have cooler risks, but the Rockies and central U.S. have some warmer potential by the end of the period.”

WSI forecasts that Monday’s high in Boston will reach 55, 7 degrees below normal, and Chicago is expected to see a max of 61, 5 degrees below normal.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |