E&P | NGI All News Access | NGI The Weekly Gas Market Report

Number of NatGas Operators in Alberta, BC, Down 17% During Shale Gale, NEB Says

High technology and big investments required by shale drilling are cutting the number of Canadian companies capable of operating natural gas wells, according to an industry population count by the National Energy Board (NEB).

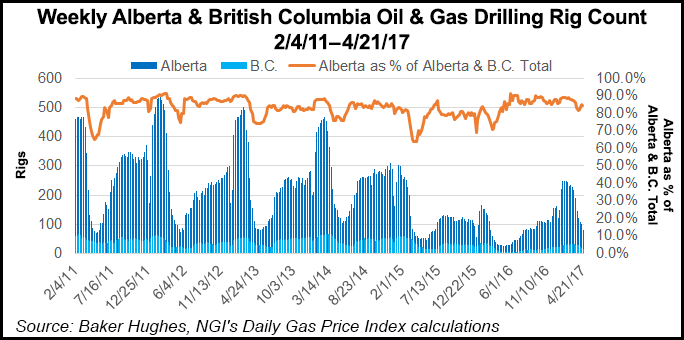

Since the shale gale of horizontal drilling and hydraulic fracturing spread to Canada eight years ago, the roster of gas operators in Alberta and British Columbia has shrunk by 17% to less than 500 from more than 600.

“Prior to 2009, the majority of companies in western Canada drilled relatively inexpensive vertical gas wells,” the NEB said. Production volume has barely changed in the Western Canada Sedimentary Basin, at a daily average 15.13 Bcf last year, compared to 15.17 Bcf in 2009.

Turning to shale deposits to replace vertical wells that petered out as conventional flowing reserves depleted is changing the industry structure by eliminating small firms or reducing their stature to minority investment partners.

“Modern gas wells are more expensive, since they are deeper, have long horizontal legs, and are stimulated with large applications of hydraulic fracturing. Because these new wells are more costly, smaller operators generally cannot afford to drill new wells,” said the NEB.

As in 2009, less than a dozen well operators account for half of western Canadian gas production. The concentration shows signs of increasing. Seven years ago, 95% of output belonged to 103 firms. As of last year, 81 operators controlled all but 5% of production.

“This suggests that shrinking production from both the largest and smallest operators has been offset by growing production from medium-sized operators,” said the NEB.

The board points out that the biggest Canadian firms have investment alternatives, led by the northern Alberta oilsands, where project costs dwarf even the biggest shale gas wells.

Canadian Natural Resources Ltd. (CNRL), for instance, led the top five gas well operators with 20% of production in 2009. CNRL remains the top gas operator, but the output share slid to 11% as the company concentrated on bitumen mining and upgrading.

The rest of the top five Canadian gas well operators in 2016 were Tourmaline Oil Corp. (6%), ConocoPhillips (5%), Peyto Exploration (5%) and Husky Oil (4%). Oilsands developer Cenovus Energy is signaling intentions in its takeover plans for ConocoPhillips to maintain and possibly expand the gas legacy, partly to cover fuel costs of thermal bitumen extraction.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |