Markets | NGI All News Access | NGI Data

NatGas Cash Follows Expiring May Futures Higher; May Settles At $3.14

Physical gas for delivery Thursday bounded higher in Wednesday’s trading as a strong screen and New England maintenance combined to send prices about a nickel to a dime higher at most locations.

The only significant setback was at a couple of Mid-Atlantic points where weather-driven softening of demand was noted. The NGI National Spot Gas Average rose 8 cents to $2.87. Over in the futures arena the expiring May contract experienced a short -covering rally and at the close May had risen 9.9 cents to $3.142 and June was higher by 10.6 cents to $3.271. June crude oil added 33 cents to $49.56/bbl.

A few eastern points saw prices slump as most market points charged higher. “Flows from the south [on Algonquin] were derated and they had to price to attract flows of more expensive gas, but in terms of Transco Zone 6 declining you saw loads declining, ” said Stefan Baden, an associate with EnergyGPS in Portland, OR.

Cleaning tool runs between Algonquin Gas Transmission’s Stony Point and Cromwell Compressor stations scheduled for Thursday and Saturday appeared to put upward pressure on New England price points east of the station.

The maintenance is expected to cap capacity through Stony Point at 800 MMcf/d, down from an average 1.5 Bcf/d over the past week, according to natural gas analytics firm Genscape.

Day-ahead Northeast prices showed signs of supply pooling west of the Stony Point restriction. Gas at the Algonquin Citygate jumped 44 cents to $3.16 and deliveries to Iroquois Waddington added 35 cents to $3.18. Packages on Tenn Zone 6 200L rose 35 cents to $3.18.

In the Mid-Atlantic gas on Texas Eastern M-3, Delivery shed 3 cents to $2.53 and gas on Transco Zone 6 into New York fell 7 cents to $2.56.

Mild Mid-Atlantic temperature forecasts were not exactly a positive for next-day gas. AccuWeather.com forecast that New York City’s 59 high Wednesday would rise to a pleasant 68 Thursday and reach 80 on Friday, 15 degrees above normal. Philadelphia’s 66 high Wednesday was seen rising to 79 Thursday and 83 by Friday, also 15 degrees above normal.

The National Weather Service in New York City reported that with an “inversion on Thursday and the development of a weak return southeast flow, low clouds are likely to persist through the day.

“Overnight lows [Wednesday] will be mild in the lower to mid 50s, with highs a bit warmer on Thursday, in the 60s to around 70. The warmest readings will be across the interior Thursday.”

Major market centers were mostly higher. Gas at the Chicago Citygate added 11 cents to $2.93 and packages on Dominion South eased a penny to $2.47. At the Henry Hub deliveries added 6 cents to $3.02.

Gas on Panhandle Eastern changed hands 8 cents higher at $2.73, and gas on Transwestern San Juan added 6 cents to $2.64. Gas priced at the SoCal Border Avg. Average rose 5 cents to $2.75.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

Futures opened 3 cents higher Wednesday morning at $3.07 even though traders are factoring in not only weak forecast load figures, but also a deteriorating technical picture. Overnight oil markets fell.

Forecasters see a slight cooler bias going forward. “As we move into the final month of meteorological spring, it seems like the consensus among the models is for a cooler lean overall, with special focus toward the middle third of the U.S,” said Matt Rogers, president of Commodity Weather Group, in a morning report to clients.

“[Wednesday’s] outlook shifts marginally cooler again in the 1-10 day for the Midwest and South, but more complications emerge from a cool wedge affecting the East Coast this weekend into early next week. We still see Mid-Atlantic 80s this Thu-Fri and also next Monday ahead of the bigger cold front. The West is generally on the drier side for the 6-10 day except for some wetness into southwest Canada.”

Marginally cooler notwithstanding, total heating and cooling load in major U.S. markets remains below normal near term. The National Weather Service (NWS) forecasts that for the week ending April 29, New England will see combined degree day (DD) load of 64, or 46 fewer than normal. The Mid-Atlantic should experience 52 DDs or 38 fewer than normal, and the greater Midwest from Ohio to Wisconsin is expected to have 54 DDs, or 41 fewer than its normal tally.

Technical traders are calculating whether a seasonal top is in place. “If $3.347 marked an early seasonal top the downside risk from here is a loss of 36%. From $3.347 a loss of 36% would target the $2.142 level,” said Brian LaRose, a technical analyst at United ICAP. “So the question we need to answer, is a seasonal top in place?

“While the short-term trend does appear to be down, bears have not done enough to confirm the seasonal trend is down as well. To do that bears need to force June below $3.048-3.032 and $2.946-2.935-2.928.”

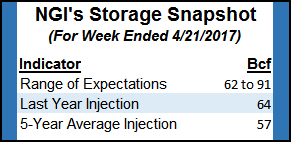

Thursday’s storage report will give traders an idea if the termination-day exuberance is likely to continue. Expectations are for a 70+ Bcf build, ahead of last year at 64 Bcf and the five-year pace of 57 Bcf.

Analysts at Citi Futures Perspective calculate a 63 Bcf increase and Tradition Energy is looking for an injection of 77 Bcf. A Reuters survey of 18 traders and analysts revealed a sample mean of 72 Bcf with a range of +50 Bcf to +80 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |